GOLD PRICE UP

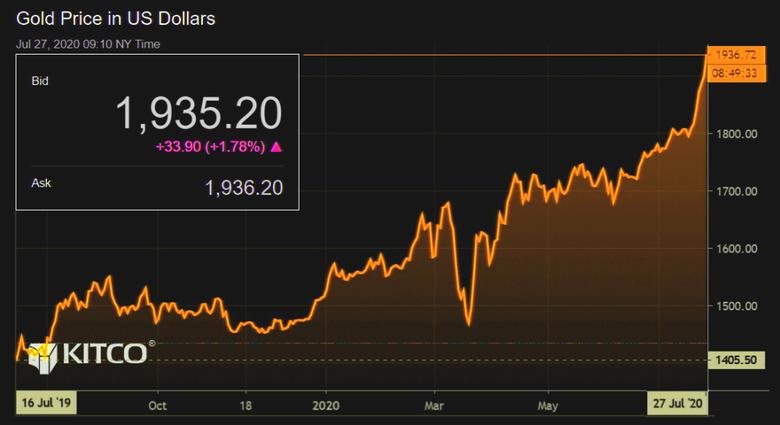

REUTERS - JULY 27, 2020 - Gold soared to an all-time high on worsening ties between the United States and China, a sinking dollar and ultra-low interest rates on Monday, while stock markets faltered before a deluge of corporate earnings.

Europe's main stock markets were still hurting after their first weekly drop in four and as the euro's fastest gains since early 2016 took past $1.17 [/FRX], but it was weakening dollar and precious metals surge that dominated.

Gold made a 1.6% jump to surpass its 2011 highs and put $2,000 per ounce in its sights. Silver climbed another 7.5%, to take its July streak past 30%, which would be its best month on record.

A lot of factors were in play for markets, said Shafali Sachdev, the head of FX Asia at BNP Paribas Wealth Management in Singapore, from U.S.-China tensions to a second wave of coronavirus outbreaks.

"If you look at the fact that the dollar's been higher yielding than many other currencies for quite a while, and with some of the benefits of that being eroded ... and also the continued demand for a safe haven, it all plays into gold's strengthening," she said.

"And at this point there doesn't seem any obvious factor that could help the trend to draw to a close."

European stocks cut some early losses after data from Germany showed an improvement in business morale, but they continued to struggle.

Travel and leisure stocks were down nearly 2.5%, with airlines and tour operators such as TUI AG,, Easyjet, British Airways owner IAG falling between 7.5% and 12% after Britain imposed a 14-day quarantine on travellers returning from Spain, where coronavirus cases are rising again.

Asia was also choppy. A 10% rally in Taiwanese chipmaker TSMC helped the tech sector, after U.S. rival Intel saw its shares plunge more than 16% on Friday.

Elsewhere, mainland Chinese shares gave up most of their early gains, with the CSI300 index closing up just 0.2%, after steep losses on Friday too.

Japan's Nikkei fell 0.2%, though S&P 500 futures steadied and were last up 0.5% in Europe.

Global shares had lost steam late last week after Washington ordered China's consulate in Houston to close, prompting Beijing to close the U.S. consulate in Chengdu.

U.S. Secretary of State Mike Pompeo said Washington and its allies must use "more creative and assertive ways" to press the Chinese Communist Party to change its ways.

"U.S. President (Donald) Trump used to say China's President Xi Jinping is a great leader. But now Pompeo's wording is becoming so aggressive that markets are starting to worry about further escalation," said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

MORE STIMULUS

Key for markets this week will be the U.S. Federal Reserve's latest meeting, U.S. gross domestic product figures and earnings releases from the world's main tech companies, including Facebook on Wednesday and Amazon, Apple and Google on Thursday.

Hopes for a quick U.S. economic recovery are fading as coronavirus infections showed few signs of slowing.

That means the economy could capitulate without fresh support from the government, with some of the earlier steps such as enhanced jobless benefits due to expire this month.

Investors hope U.S. Congress will agree on a deal before its summer recess. U.S. Treasury Secretary Steve Mnuchin said the package will contain extended unemployment benefits with 70% "wage replacement" — but there are some sticking points.

Democrats, who control the House of Representatives, want enhanced unemployment benefits of $600 per week to be extended and are looking for a much bigger stimulus compared with the Republicans' $1 trillion plan.

Concerns about the U.S. economic outlook have also started to weigh on the dollar. The dollar index dropped 0.5% to its lowest in nearly two years.

The euro gained 0.5% to a 22-month high of $1.1725, continuing a winning streak since last week's agreement on a 750 billion-euro post-pandemic EU recovery fund.

Against the yen, the dollar slipped 0.7% to 105.355 yen, a four-month low. The British pound hit a four-and-a-month high of $1.2868 and benchmark Bunds and Treasuries gained ground in the bond markets.

Oil prices were capped on worries about the worsening Sino-U.S. relations and both new and returning waves of the coronavirus around the world, which have now infected more than 16 million people and killed nearly 650,000.

Brent futures were at $43.40 per barrel and U.S. crude futures at $41.44.

-----

Earlier: