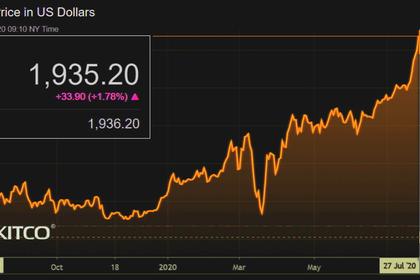

GOLD PRICE UP AGAIN

REUTERS - JULY 31, 2020 - Gold rose on Friday en route to its best month in nearly 4-1/2 years as the dollar slid further after dismal U.S. data added to doubts about a swift recovery from the pandemic-induced economic slump, driving investors towards the safe-haven metal.

Spot gold was up 0.4% at $1,967.53 per ounce by 0458 GMT after snapping a nine-session winning streak on Thursday. U.S. gold futures rose 1% to $1,961.30.

The U.S. dollar fell to a two-year low and was on course for its worst month in a decade, making bullion cheaper for investors holding other currencies.

Apart from U.S. data showing the deepest economic contraction in at least 73 years in the second quarter, and a rise in unemployment benefits, the dollar was also hurt as President Donald Trump raised the idea of delaying the Nov. 3 presidential election.

"The weak Q2 GDP also underscores the point of a weak economy, and investors seeking refuge in gold," said National Australia Bank economist John Sharma.

A deterioration in the coronavirus situation, escalation in geopolitical tensions and further declines in the dollar could push gold above the $2,000 level, he added.

Gold has risen more than 10% so far this month, its biggest monthly percentage gain since February 2016, having soared to an all-time high of $1,980.57 on Tuesday.

The jump took gains for the year to nearly 30%, driven by a worsening pandemic and low interest rates globally amid widespread stimulus from central banks since the metal is considered a refuge against inflation and currency debasement.

"However, further gains are reliant on investor demand, with consumer demand showing no signs of recovery," ANZ analysts said in a note. Among other metals, silver climbed 0.3% to $23.62 an ounce, on course for its best month on record -- up 30%, with additional support coming from hopes for a revival in industrial activity.

Platinum rose 0.1% to $903.87 and palladium gained 0.3% to $2,090.01.

-----

Earlier: