INDONESIA'S BOND $40 BLN

REUTERS - JULY 6, 2020 - Indonesia unveiled a nearly $40 billion financing scheme for its fiscal deficit on Monday, with the central bank set to buy some 397.6 trillion rupiah ($28 billion) directly without receiving interest, to help fund the economic recovery, Finance Minister Sri Mulyani Indrawati said.

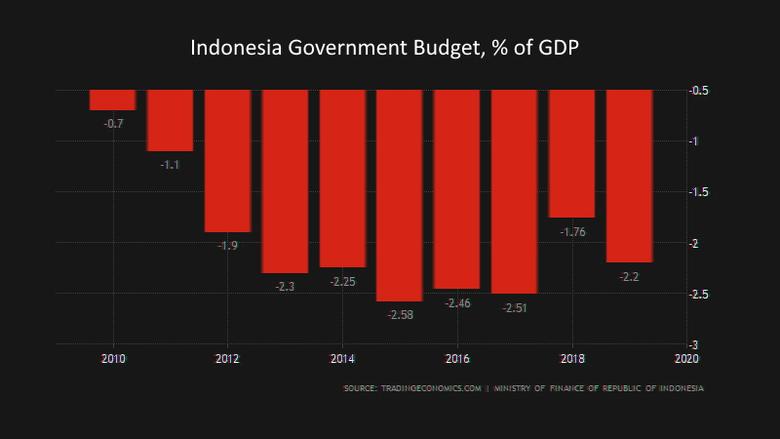

The bond-buying programme will help finance the 2020 fiscal deficit, which is forecast to reach 6.34% of GDP this year, as the government steps up spending to fight the virus outbreak while revenue drops.

Bank Indonesia (BI) will also be a standby buyer and help pay some interest rate expenses for 177 trillion rupiah worth of bonds that the government will sell in auctions to fund recovery schemes for some businesses, she said. BI is set to pay the spread between market rates and its 3-month reverse repurchase rate minus one percentage point, she added.

"This policy is aimed at invoking confidence in our economic recovery, healthcare response and to create more certainty," Indrawati said.

The bond scheme for public interest programmes is a one-off policy, the debt will have long maturities and be tradeable, which will allow BI to utilise them for its monetary operation, she added.

BI Governor Perry Warjiyo said the scheme will have a small impact this year on inflation, which hit a 20-year low in June due to weak demand, while BI will continue to assess the impact on future inflation and rupiah exchange rate.

Warjiyo added that the scheme will not have any implication to monetary policy.

"Our capital is strong and it will not affect how BI conducts our monetary policy according to the framework that we have established for years," he said.

BI has intensified its "quantitative easing" operations in recent months to help cushion the economic slowdown and cut its main policy rate three times this year to support GDP, on top of four cuts in 2019.

Warjiyo at BI's last policy review had flagged the potential for more cuts.

The government expects Indonesia's GDP to come in between a 0.1% contraction and a 1% expansion this year, compared with 5% growth in 2019.

The deal implied some bond supply risk as BI is unlikely to unload the bonds in the market in 2021 or 2020, an analyst said.

"In our view, a pre-condition for unwinding would be if portfolio inflows are large enough relative to both the balance of payments and the fiscal year's financing needs, such that any potential yield volatility could be managed," Citi said in a note.

-----