OIL DEMAND IS BETTER

PLATTS - 12 Jul 2020 - With oil prices and global demand rebounding, the OPEC+ alliance will stick to its timeline of paring back its landmark production cuts at the end of July, sources familiar with the deliberations told S&P Global Platts.

The 23-country OPEC+ coalition — which together controls about half of the world's oil production — instituted an unprecedented 9.7 million b/d cut accord in May during the depths of the COVID-19 crisis, but expects to downsize the cuts to 7.6 million b/d starting in August, as scheduled, instead of extending them, the sources said.

The key Joint Ministerial Monitoring Committee, co-chaired by Saudi Arabia and Russia, the two largest members of the coalition, will convene online July 15 and make a final recommendation.

August term volumes for major crude exporting countries have already been set, making it impractical for the coalition to make changes to the deal for the month.

"We are satisfied with what is going on" in the market, one Gulf OPEC+ source said.

Another Gulf delegate said he expects a smooth JMMC meeting, with major economies showing signs of recovery and no significant shutdowns occurring. Disputes over quota compliance have largely been resolved, the source added, asking not to be named due to the sensitivity of the discussions.

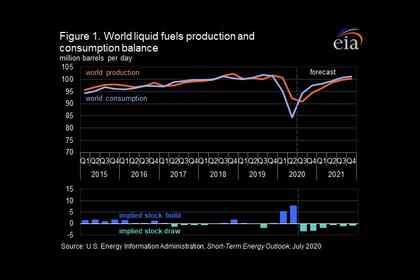

The International Energy Agency on July 10 said the worst of the pandemic's impact had been weathered and the market was set to tighten significantly and flip into deficit in the second half of the year. But it also warned that a resurgence of the infection, particularly in North and South America, was "casting a shadow over the outlook."

A sustained second wave of COVID-19 cases could undo the economic gains forged over the last few months.

"As OPEC+ plays its part in rebalancing the oil market, economic growth will nonetheless hold the key to allowing oil prices to rise," Harry Tchilinguirian, a senior oil economist at BNP Paribas, said.

On the supply side, war-torn Libya remains a wildcard, as forces grapple for control of ports and key oil infrastructure, and the OPEC+ coalition must also guard against members' temptation to overpump their quotas as prices rise.

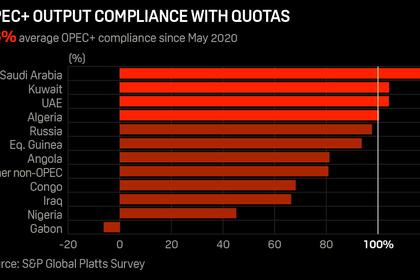

107% compliance

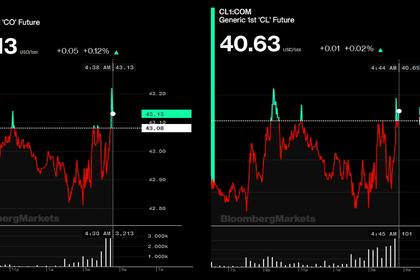

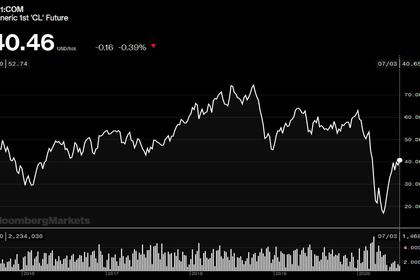

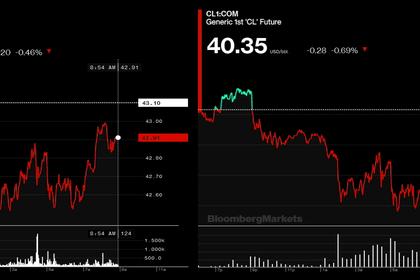

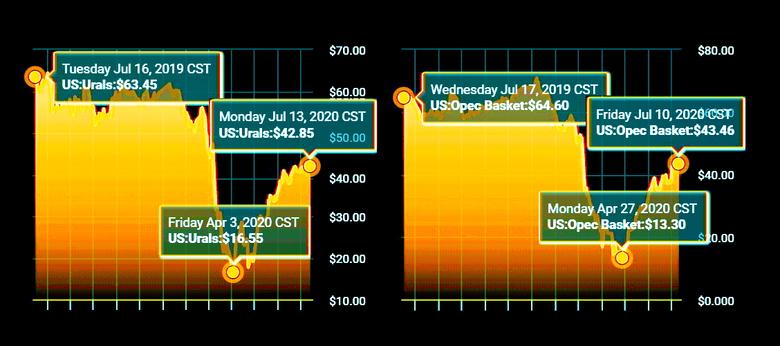

Strong compliance with the production quotas — driven in large part by Saudi and Russian diplomatic pressure — has played a major role in lifting crude oil prices from historic lows in April, when NYMEX crude futures went negative for the first time and ICE Brent slid into the teens. Both benchmarks have traded above $40/b in recent days.

In its upcoming monthly oil market report on July 14, the OPEC secretariat is expected to reveal production data showing that the OPEC+ alliance achieved 107% of its committed cuts in June, according to figures seen by Platts. That resulted in about 10.4 million b/d — more than 10% of pre-pandemic oil demand — being taken off the market.

Though the quotas are set to be eased in August, some of the production gains may be offset by compensatory cuts from Iraq, Nigeria, Kazakhstan, Angola and other OPEC+ members that did not fully comply with their quotas in May and June. Those countries have agreed to make additional cuts in July, August and September equivalent to their overproduction, which officials estimate would total up to about 300,000 to 400,000 b/d, on top of the scheduled 7.6 million b/d cuts those months.

With several countries easing COVID-19 lockdown measures and travel picking up, the OPEC+ alliance sees robust oil demand ahead.

Seasonal oil-fired power generation in the Middle East, where electricity consumption for air conditioning peaks in the summer, will add significant demand in the coming months.

OPEC+ members are expecting about 1 million b/d of extra demand for power generation.

"If you add that with the anticipated 300,000 to 400,000 b/d of compensation cuts, you're not far away from" a balanced market, an OPEC+ official said.

Russian energy minister Alexander Novak said July 2 that he was anticipating the "partial restoration" of the OPEC+ production cuts in August and was hopeful that the oil market in July would be balanced or even in deficit.

Under the terms of the deal, the cuts are set at 7.6 million b/d from August through the end of 2020, and then roll back to 5.8 million b/d for all of 2021 through April 2022. The JMMC, however, meets monthly and may recommend changes to the volumes, as market conditions warrant.

-----

Earlier: