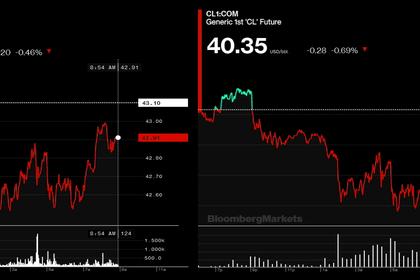

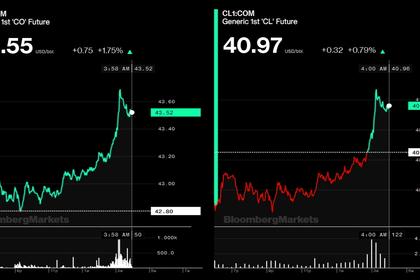

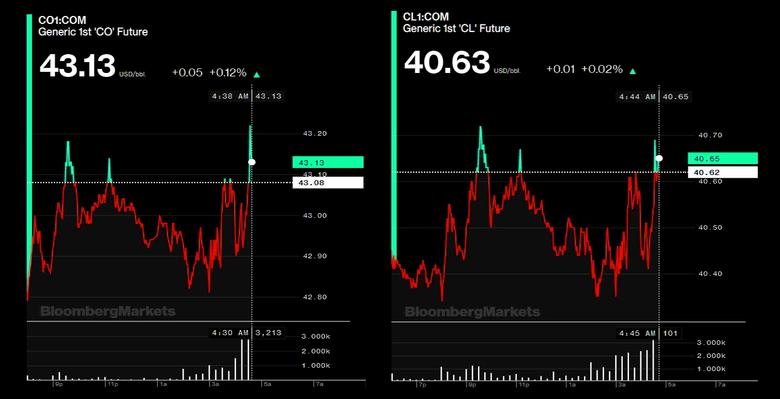

OIL PRICE: NEAR $43 YET

REUTERS - JULY 8, 2020 - Oil prices dipped on Wednesday as industry data showing a build in U.S. crude stockpiles added to worries about oversupply while a surge in coronavirus cases in the United States and other areas cast doubts over a pick-up in fuel demand.

Brent crude futures fell 11 cents, or 0.3%, to $42.97 a barrel by 0642 GMT. U.S. West Texas Intermediate (WTI) crude futures dropped 11 cents, or 0.3%, to $40.51 a barrel, holding to the narrow range of the past few weeks.

"The market has a lot of concerns about an rise in the COVID-19 cases, in the United States in particular," said Victor Shum, vice president of energy consulting at IHS Markit.

"I see Brent remaining in the band between $37 and $44 for the next few weeks," he said.

The U.S. coronavirus outbreak crossed a grim milestone of over 3 million confirmed cases on Tuesday as more states reported record numbers of new infections.

U.S. crude oil stockpiles rose last week, against expectations for a draw, although gasoline and distillate inventories fell more than expected, data from industry group the American Petroleum Institute showed.

The U.S. Energy Information Administration (EIA) said on Tuesday that U.S. crude oil production is expected to fall by 600,000 barrels per day (bpd) in 2020, a smaller decline than the 670,000 bpd it forecast previously. The U.S. is the world's biggest oil producer.

However, it also expected global oil demand to recover through the end of 2021.

"The EIA's forecast of a lower decline in U.S. output was partially cushioned by its outlook for firm demand recovery, which limited losses in oil markets," Hiroyuki Kikukawa, general manager of research at Nissan Securities said.

"Still, expectations that the Organization of the Petroleum Exporting Countries (OPEC) and allies would taper oil output cuts from August weighed on sentiment," he said.

Abu Dhabi National Oil Co (ADNOC) plans to boost oil exports in August, the first signal that OPEC and its allies, together known as OPEC+, are preparing to ease record oil output cuts next month, three sources familiar with the development told Reuters.

Key ministers in the OPEC+ grouping are due to hold talks next week.

-----

Earlier: