SAUDI'S DERIVATIVES EXCHANGE

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

SAUDI'S DERIVATIVES EXCHANGE

AN - July 10, 2020 - Saudi Arabia's Capital Market Authority (CMA) plans to launch a derivatives exchange in the latest move to modernize the Kingdom's financial landscape.

An announcement about the launch of futures contracts will be made before the end of the third quarter of this year, Asharq Al-Awsat newspaper reported, citing CMA Chairman Mohammed El-Kuwaiz.

"We are in the phase of developing the derivatives market with intensive work on the options contracts and the futures contracts" he said.

He was speaking in an online discussion panel organized by the General Authority for Small and Medium Enterprises (Monshaat).

The markets chief said that the impact of the coronavirus on the market would be more visible in second quarter earnings and that the regulator was working on easing some of its procedures in response.

Tadawul is planning to launch additional derivative products gradually as part of its strategy to diversify its product offering and provide more investment opportunities for global investors.

Separately, Tadawul CEO Khalid Al-Hussan disclosed that the bourse has received a number of requests for new share offerings that are currently being reviewed. He said three companies had been approved to list on the parallel market known as "Nomu."

-----

Earlier:

2020, July, 7, 16:10:00

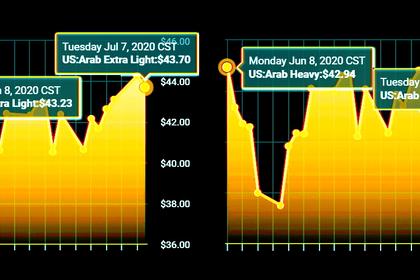

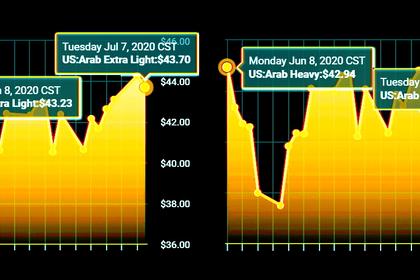

SAUDI'S OIL PRICES UP

State producer Saudi Aramco lifted the official selling price for its flagship Arab Light crude to buyers in Asia,

2020, July, 2, 12:00:00

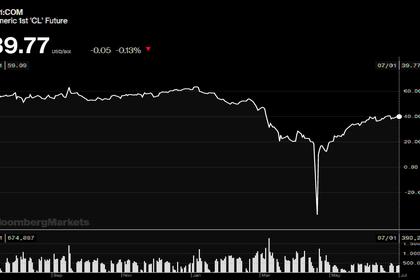

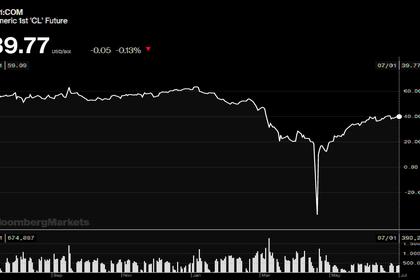

SAUDI ARAMCO'S OPTIMISM

There are different forecasts looking at between 95 and 97 MMbd by year-end

All Publications »

Tags:

SAUDI,

ARABIA,

FINANCE