U.S. OIL WRITE DOWNS

U.S. EIA - July 15, 2020 - According to their publicly filed financial statements, 40 U.S. oil producers collectively wrote down $48 billion worth of assets in the first quarter of 2020. Low oil prices contributed to significant declines in revenue and the value of proved reserves for these companies. Writing down the value of an asset—also called an impairment—is a non-cash adjustment when a company formally acknowledges the value of an oil property has declined below the cost of developing it and the company updates the estimated fair value. First-quarter 2020 financial results also reveal steps many companies took to stabilize cash flows, including increased use of credit and announcements of significant cuts to capital expenditure budgets.

The U.S. Energy Information Administration (EIA) collected this information using published financial reports of 40 publicly traded U.S. oil companies. Consequently, the observations do not necessarily represent the sector as a whole because the analysis does not include private companies that do not publish financial reports. In the first quarter of 2020, these 40 publicly traded companies collectively produced 6.1 million barrels per day of crude oil and other liquids in the United States, or about 30% of all the U.S. liquids production for the quarter.

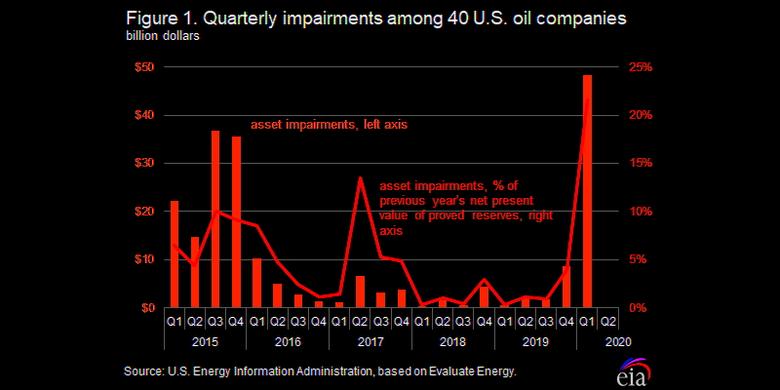

These companies’ asset impairments, when analyzed with respect to the estimated value of their proved reserves from 2019, reveal a significant decline in estimated cash flows from future production. Because proved reserves are the estimates of oil that are recoverable under existing technological and economic conditions, they are assets with several years of potential production and revenues. The $48 billion in impairments represented 22% of the net present value of the companies’ proved reserves as of the end of the previous year (2019), the most impairments recognized by these companies since at least 2015 (Figure 1). Even though companies will not have to value their 2020 proved reserves until the end of the year, these first-quarter impairments, combined with lower oil prices in the second quarter of 2020, indicate the net present value of proved reserves could continue to decline.

The U.S. Securities and Exchange Commission (SEC) requires public companies to report a standardized measure of the net present value of proved reserves in their annual financial reports. Companies determine an estimate of future production from their assets, then estimate revenue using the average of crude oil prices from the first trading day of each month of the previous year. Companies also estimate future development costs and taxes and then apply a 10% discount rate to convert the future net cash flow into present-day dollars. These estimates of proved reserves are limited by the uncertainties inherent in any estimation, and although the SEC guidelines are standardized, estimates of production potential, technology, and asset quality are likely to vary by company. On the other hand, these estimates are beneficial because they use a consistent methodology, allowing for comparisons across companies.

Even though this high level of first-quarter 2020 impairments represents a decline in both the value of proved reserves and the value of future cash flows, the near-term effect on an individual company’s cash balance is modest because impairments are not an immediate cash outflow. Nonetheless, most companies took two immediate steps in the first quarter of 2020 to improve cash flow amid falling oil prices—increasing borrowing and reducing capital expenditures. Many oil companies have a pre-determined agreement with a bank to draw down a certain amount of credit, which is typically used for cash management or other short-term needs. As of the first quarter of 2020, the median draw down for the 40 companies reviewed was 27% of available credit, the most since at least 2015 for this set of companies (Figure 2). The top quartile of companies drew down at least 61% of their respective credit facilities.

Although credit provided an immediate cash infusion for some companies, twice per year banks redetermine the amount of credit they make available to oil companies, which is based on the value of a company’s proved reserves. Because of the high impairment charges, many companies will likely see a reduction in their allowable credit during the next redetermination period in fall 2020.

In addition to increased borrowing, companies reduced capital expenditures in the first quarter of 2020 and announced further budget reductions for the remainder of the year. First-quarter 2020 capital expenditures totaled $15 billion, a decline of $3.9 billion (20%) compared with the first quarter of 2019. With the release of their first-quarter 2020 financial statements and subsequent investor presentations, these 40 companies announced capital budgets for all of 2020 totaling $33 billion, implying $18 billion of capital expenditure for the remaining three quarters of 2020 (Figure 3). If realized, these annual capital expenditures would be the lowest absolute level of spending since at least 2015 for this set of 40 companies and would be a 53% decline from 2019 levels.

Second-quarter 2020 financial results for these 40 companies will be released in August. Some producers publicly announced shutting in and curtailing a number of oil wells during the quarter. When coupled with significant declines in crude oil prices and refinery utilization rates, this set of companies is likely to see further declines in revenues and increases in impairments. Two companies among this set, Whiting Petroleum Corporation and Extraction Oil & Gas, Inc., announced bankruptcy in the second quarter of 2020, which could affect the publication of their financial statements.

U.S. average regular gasoline and diesel prices rise

The U.S. average regular gasoline retail price rose nearly 2 cents per gallon from the previous week to $2.20 per gallon on July 13, 58 cents lower than the same time last year. The West Coast price increased more than 3 cents to $2.80 per gallon, the Midwest price rose more than 2 cents to $2.13 per gallon, the East Coast and the Gulf Coast prices each rose more than 1 cent to $2.11 per gallon and $1.87 per gallon, respectively, and the Rocky Mountain price rose less than 1 cent, remaining virtually unchanged at $2.33 per gallon.

The U.S. average diesel fuel price rose less than 1 cent from the previous week, remaining virtually unchanged at $2.44 per gallon on July 13, 61 cents lower than a year ago. The Midwest price rose nearly 1 cent, remaining virtually unchanged at $2.31 per gallon, and the East Coast price rose less than 1 cent, remaining virtually unchanged at $2.53 per gallon. The West Coast price fell nearly 1 cent to $2.95 per gallon, and the Gulf Coast price fell nearly 1 cent, remaining virtually unchanged at $2.20 per gallon. The Rocky Mountain price was unchanged at $2.35 per gallon.

Propane/propylene inventories rise

U.S. propane/propylene stocks increased by 3.5 million barrels last week to 80.3 million barrels as of July 10, 2020, 7.3 million barrels (10.0%) greater than the five-year (2015-19) average inventory levels for this same time of year. Gulf Coast, Midwest, and East Coast inventories increased by 2.2 million barrels, 0.8 million barrels, and 0.6 million barrels, respectively. Rocky Mountain/West Coast inventories fell by 0.1 million barrels.

-----

Earlier: