UKRAINE'S GAS INFRASTRUCTURE UP

By Andriy Kropyvnytskyy Commodity Trader POSCO International Corporation

ENERGYCENTRAL - The calendar year 2020 has become stressful for all economic sectors in Europe. The market for natural gas is no exception. Gas balances in storages were irregularly high at the beginning of the year owing to expectations of market participants of interruptions in gas supply. Several other factors forced traders to pump even more gas underground during the first half of 2020. While occupancy rates of gas storages around Europe approach full capacities, gas infrastructure in Ukraine becomes attractive. Ukrainian officials have felt the coming demand right on time and implemented a set of incentives that would help traders in dealing with the gas surplus.

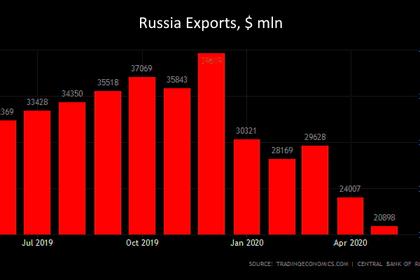

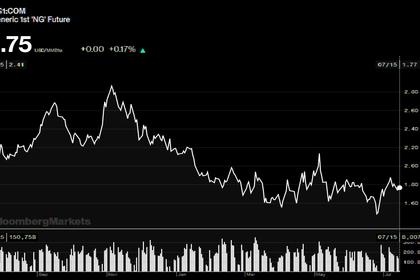

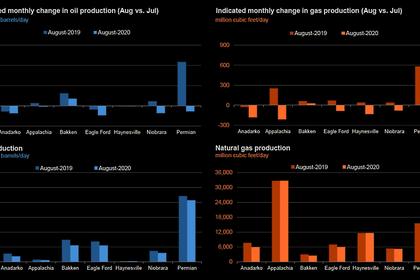

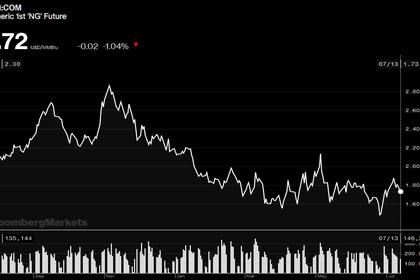

A recent slump in demand for natural gas in Europe

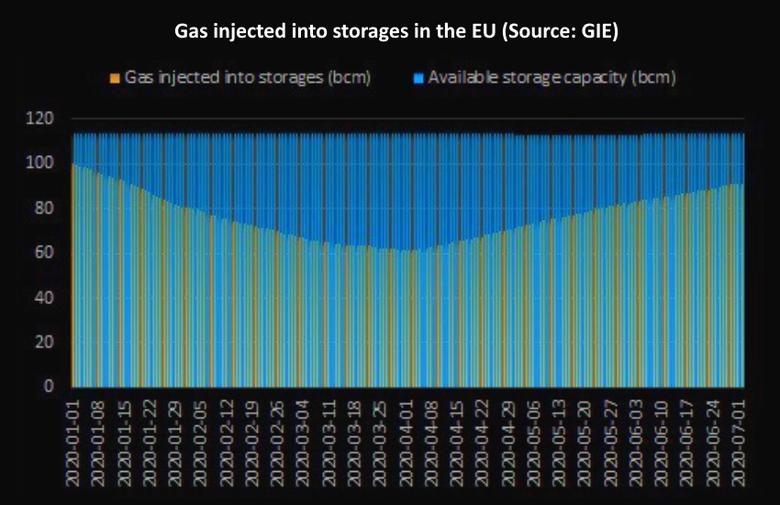

At the outset, occupancy rates of natural gas storage facilities in Europe break all records this year. The data of Gas Infrastructure Europe (GIE), an association acting on behalf of the natural gas infrastructure industry in Europe, indicates that gas storages in Europe contain 91.3 billion cubic meters (bcm) of natural gas as of July 1, 2020. This constitutes around 80.6% of the 113.2 bcm of total available storage capacity in the European Union (EU); what is more, gas storages in Germany are full by 88.4%, Austria – 90.2%, Hungary – 78.4% and Slovakia – 83.8%. Europe has been adding every month nearly 10 bcm of natural gas to its gas storages since April. If the trend continues like this, the storages will be full by the end of summer.

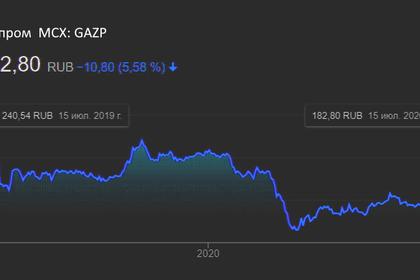

Several unanticipated factors have driven to this year’s extraordinary situation on the European market for natural gas. The long-lasting negotiation between Naftogaz and Gazprom about new transit agreement is probably the main reason for market uncertainty and associated remarkable filling rates at gas storages – traders around Europe had been accumulating significant stocks of natural gas in case the supply of Russian gas would get interrupted in 2020. Luckily, the agreement on transit was reached at the very end of 2019; meanwhile, gas stocks in the hands of traders reached unprecedented levels. For more information about the 2019 negotiations between Naftogaz and Gazprom, please, refer to my article “The Struggle for Natural Gas: the New Year’s Truce between the Two Warring State Monopolies”.

Warm winter and COVID-19 pandemic are the other two important factors that influenced the demand for gas storages in Europe. Regarding the former one, the World Meteorological Organization (WMO) reported in March that the last winter had officially become for Europe the warmest in history of temperature measurement. The average temperature in Europe over the period from December 2019 to February 2020 was indeed 1.4°C higher than the average temperature in the region over the period from December 2015 to February 2016 (the second warmest winter recorded in Europe). Particularly, February 2020 was almost 4°C warmer than the typical February during the period from 1981 to 2010. Considering natural gas is the energy resource used for heating, the warmer than expected winter adversely affected demand for the resource. In a year-on-year comparison, European demand for natural gas declined, as it happens, by 10% in January and by 3% in February.

COVID-19 factor joined the European economic agenda in early spring with the first lockdowns announced already in the middle of March. The greatest damage, however, was inflicted on economies in April and May. Closure of schools, shops, restaurants, and factories has significantly contracted economic activity in Europe. The study conducted by the Oxford Institute for Energy Studies indicates that demand for natural gas has fallen by 16% over the two-month period (April-May) compared to the relevant period in 2019.

The overall negative impact of the two factors (mild winter and COVID-19 pandemic) on natural gas markets in Europe is reflected in the undersupply of around 19 bcm of gas over the period from January to May 2020. This accounts for approximately 8% of the supplies over the same period in 2019. The gas surplus, which is represented by the natural gas that has not been delivered to customers because of the unforeseen drop in demand, has been injected by traders into gas storages around Europe.

The gas infrastructure of Ukraine

Considering the problem of free spaces for natural gas in the EU – European gas storages may be filled as early as in August – traders try to find new solutions to manage the surplus of natural gas. This is the best moment for Ukraine with its developed pipeline system and enormous underground storages to prove its value for the Energy Union.

Natural gas infrastructure in Ukraine is indeed one of the largest in the world. It consists of pipes with a total length of about 33 thousand km that allow for accepting 281 bcm of gas per year to the country. The transit capacity constitutes 146 bcm. The system is mainly used to transport Russian gas to European customers. The most valuable element of the gas infrastructure - 11 underground gas storages with a total capacity of 31 bcm. These facilities were mainly built on the sites of depleted gas fields. One may find more information about the century-old history of the gas industry in Ukraine in my article “The Ukrainian natural gas market from a historic, economic and political perspective”.

The storages support the safe transit of gas through the national pipeline system. Additionally, natural gas which is bought during low season for modest prices is stored in the underground storages till winter, when demand for gas increases (gas is used for heating) and in turn market prices for the commodity grow. This lowers annual average gas prices for customers.

Market reforms

The natural gas market in Ukraine has undergone remarkable reforms over the last 6 years. Harmonization of laws with European energy legislation along with the signing of interconnection agreements with transmission system operators (TSO) of neighboring countries became the key contributors to Ukraine’s energy security in the early stages. If by 2014 the country mainly imported natural gas from Russia, and those supplies were associated with economic and political risks, the liberalization of the natural gas market realized by newly elected democratic government enabled sourcing of natural gas from European spot markets.

Furthermore, a new legal environment attracted a batch of international traders to the Ukrainian market for natural gas. Such companies as DXT Commodities, Axpo Group, Trafigura, MET Group, and many others established their legal entities in Ukraine and started importing natural gas, storing it in gas storages inside the country, and selling it to both local industry and other traders for deregulated prices. Besides, the Ukrainian market has been organized in the form of a virtual trading point (VTP): a non-physical trading area that consists of national gas transmission infrastructure and covers all entry and exit points. As a result, prices for natural gas in Ukraine are now coherent with the ones in European countries. Interestingly, the increased competition among diversified suppliers of gas has pushed market prices down since 2014.

In 2019, the Ukrainian government intensified energy market reforms. The process was pushed by at that time ongoing negotiations between Naftogaz and Gazprom about gas transit agreement. The necessary precondition for the new transit agreement was the finalization of the unbundling process in Naftogaz Group. The process presumed the separation of gas transmission operations from production and commerce activities. The newly established Gas Transmission System Operator of Ukraine (GTSOU) consequently overtook the role of national TSO. This complied with requirements of the Third Energy Package.

The launch of backhaul – a virtual reverse flow of gas - is another vital change on Ukraine’s natural gas market. The backhaul presumes the offset of gas volumes in case of counter nominations for gas transportation. This means that only the balance volumes of gas will be transmitted across the border. The related agreements have been signed between GTSOU and TSOs of neighboring countries: Slovakia, Hungary, and Poland. The availability of backhaul adds transmission capacities for the flow of gas from Europe to Ukraine. In other words, this will allow European traders to inject more gas into Ukrainian storages in 2020.

Capacities

The physical capacities for gas import to Ukraine account for 14 bcm per year on the Slovakian border, 7 bcm per year on the Hungarian border, and nearly 2 bcm per year on the Polish border. This amounts to 23 bcm per year of capacities for gas import installed on the western border. Backhaul adds to this number the virtual capacities of around 17 bcm per year, so that the possible gas import, both physical and virtual, totals 40 bcm per year, or around 3.3 bcm per month. According to the latest operational data of Ukrtransgaz, the sole operator of Ukrainian underground gas storage facilities, the overall occupancy rate of Ukraine's gas storages constitutes 67.5%, meaning there is still about 10 bcm of free space in storages. Considering the capacity constraints for gas import on the western border of Ukraine, and the occupancy rates of Ukrainian gas storages, as well as the current injection rates in gas storages in Europe – traders have been adding every month around 10 bcm of gas to their stocks in the EU recently – there seems to be more than enough space in Ukraine to accumulate European gas until the heating season starts in Europe.

Incentives

Political and economic factors have adversely affected the demand for natural gas in Europe. However, this situation brought opportunities for Ukraine with its elaborate gas infrastructure. Market reforms of recent years have facilitated access of international players to the Ukrainian market for natural gas. On top of that, GTSOU has decided to further encourage market participants to use national gas infrastructure. In February 2020, for example, the operator introduced a new service to international traders – short-haul. This service provides all interested parties with discounted rates for transmission in the regime of transit. The rates may be up to three times lower than ordinary rates. This gas is not intended for the domestic market. When received on one interconnection point on the border, it should be moved to another interconnection point at once or stored in a customs warehouse. In the latter case, local legislation allows for keeping natural gas in storages without customs clearance for up to three years.

Conclusion

The unprecedented demand for the European gas storages has become a distinctive feature of 2020. It is explained by the uncertainty of late 2019 associated with the negotiation process between Naftogaz and Gazprom about gas transit, mild winter, and COVID-19 pandemic. Storage facilities in Europe will consequently be filled by the end of August. The situation has created a unique business opportunity for Ukraine: the country offers its large underground storages to traders around Europe. Luckily, the bottlenecks on the western border along with the current occupancy rates of the storages allow for accumulating all the available gas surplus on the European market. Moreover, European traders are well motivated to store extra volumes of gas in Ukraine - GTSOU had been trying to catch the wave, so it introduced discounted tariffs for the gas in transit. The so-called “short-haul” works especially well with the possibility of stocking natural gas in the customs warehouse for several years.

The recent developments in the collaboration between GTSOU, Ukrtransgaz, and the Ukrainian government on one side and TSOs of neighboring countries, international traders, and authorities of the EU on the other side contribute to the deeper integration of Ukraine into the Energy Union and turn the country to an energy hub in Central and Eastern Europe. The growing role of Ukraine as an energy depository for Europe will preserve a stable utilization of Ukraine's natural gas infrastructure after 2024 when the transit agreement with Gazprom expires. Additionally, depositing natural gas of international traders will bring revenues to both GTSOU and Ukrtransgaz which can be invested in the modernization of gas infrastructure.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: