ARGENTINA'S DEFAULT $65 BLN

REUTERS - AUGUST 4, 2020 - Argentina said on Tuesday it had reached a deal with three creditor groups to restructure $65 billion in sovereign debt, potentially helping it climb out of a damaging default and revive the recession-hit economy.

The Economy Ministry said in a statement here it would adjust some payment dates and legal clauses to sweeten what had been touted as its "final" proposal made in early July, without increasing the overall principal or interest payout.

A major grain producer and once one of the world’s wealthiest countries, Argentina fell into its ninth sovereign default in May and is headed for an estimated 12% economic contraction this year on the back of two years of recession.

“Today (we) have reached an agreement that will allow members of the creditor groups and such other holders to support Argentina’s debt restructuring proposal and grant Argentina significant debt relief,” the ministry said.

That included the Ad Hoc Group, Argentina Creditor Committee and the Exchange Bondholder Group, a trio which united last month to oppose a previous government offer, sparking a deadlock that threatened to derail an eventual deal.

The ministry said it would extend the deadline for creditors to formally accept the new deal to Aug. 24.

It had been set to expire on Tuesday.

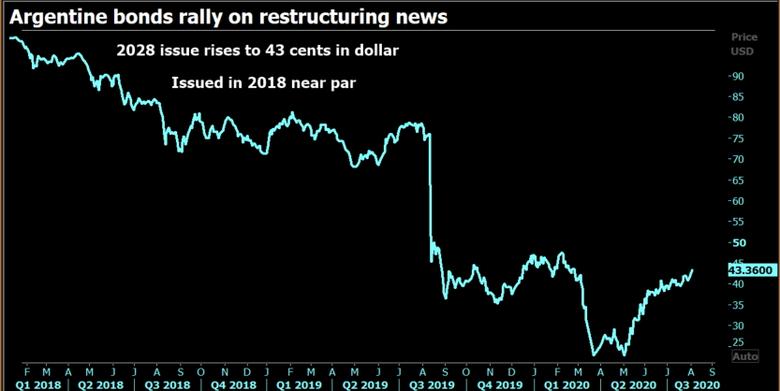

News of the deal helped lift the government’s existing eurobonds by as much as 3 cents. They had already rallied on Monday in anticipation.

The country had been at an impasse with creditors, which included big-name funds such as BlackRock and Ashmore, over revamping the debt ahead of Tuesday’s deadline. There was no immediate confirmation of an agreement from the creditor groups.

But investors were cheered.

“It is good for bondholders to be able to put this behind them and good for Argentina as it can return to a clean sheet,” said one holder of Argentina eurobonds not affiliated with any groups, who asked not to be named.

“It helps for creditors on the NPV (net present value) but not a lot, and means Argentina will eventually be able to return to financial markets when needed.”

PAYMENT DATE CHANGES

As part of the deal, the government said it would adjust some payment dates for the new bonds set out in the offer sent to creditors on July 6. This would not raise the aggregate amount of principal or interest payments for Argentina but would enhance the proposal’s value for creditors, it said.

A key issue during the restructuring talks were so-called collective action clauses (CACs), which determine how future changes can be made to bond agreements.

Some bondholders, fearing Argentina would try to use the CACs to adopt the “Pac-Man” strategy of attempting to get them on board one at a time, had made informal contact with global bodies including the International Monetary Fund (IMF) for their support to amend legal clauses.

To address creditors’ proposals on the contractual framework, the government said in its statement it would adjust certain aspects of the CACs in the new bond documentation.

Under the deal, payment dates on the new bonds will be Jan.9 and July 9, instead of March 4 and Sept. 4. The new bonds will begin amortizing in January 2025 and mature in July 2029.

New U.S. dollar and euro-denominated 2030 bonds will begin amortizing in July 2024 and mature in July 2030, Argentina said, with the first instalment in an amount equivalent to one half of each remaining instalment.

The new dollar and euro-denominated 2038 bonds to be issued in exchange for existing discount bonds will begin amortizing in July 2027 and mature in January 2038, the ministry said.

President Alberto Fernandez and Economy Minister Martin Guzman had been adamant that Argentina was unable to surpass the offer made in early July after months of talks.

Argentina struck a $57 billion loan deal with the IMF in 2018 and has said it will seek a new program with the fund after it wraps up its talks with private creditors.

Graphic: Argentine bond - here

-----

Earlier:

2020, May, 22, 12:40:00

ARGENTINA'S OIL RESTORATION: $45

Argentina's oil-producing provinces applauded the reference price as well as an elimination of the 8% export tax when Brent is less than $45/b.

|

2020, February, 24, 10:20:00

ARGENTINA'S RENEWABLE UP BY 86%

Renewable power production in Argentina jumped by 85.9% year-on-year to 956 GWh in January

|

2019, May, 31, 12:20:00

RUSSIA'S NUCLEAR FOR ARGENTINA

Argentina and Russia have set up a working group tasked with specifying the project on the construction of a nuclear power plant (NPP) in the Latin American country,

|