ASIA'S COAL PRICES BOTTOM

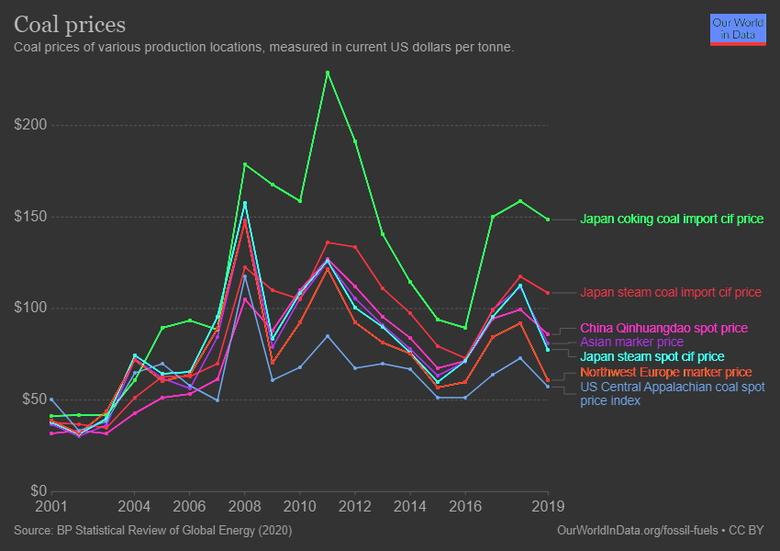

HSN - 26/08/2020 - Asian coal prices, which have fallen around 25% this year as power demand slumped due to the coronavirus outbreak, are unlikely to move higher before the end of 2020 as utilities work through inventories, traders and analysts said.

Coal prices have slumped to near five-year lows after falling by a third last year and are now at around $50 a tonne, a level not seen since 2016.

“We are bouncing along the bottom,” said Dale Hazelton, coal analyst at Woodmac in Singapore. “There was such a demand shock with the global lockdown, which greatly reduced power demand and that leads to greatly reduced coal demand.”

Producers will take a while to cut output to balance out supplies to the market and inventories are high for many utilities in Asia.

Year-on-year demand is going to be down about 60 million to 70 million tonnes, Hazelton said.

Global demand is expected to reach around 5,600 million tonnes by 2024, the International Energy Agency said in a recent report.

In Japan, big utilities are burning more liquefied natural gas (LNG), not only due to lower prices but also because they have contractual supply obligations that are hard to avoid, said a coal specialist at one of Japan’s trading houses.

Prices for LNG have risen in recent months due to supply constraints and seasonal demand increases but they remain well below historical highs.

Adding to the Asian coal market woes are restrictions by China on imports, especially from Australia, due to strict quotas that many analysts argue are partly politically motivated due to tensions between the countries.

“It’s really hard to say how the quota will impact imports because it is only a tiny part of the national supply and demand balance,” said a China-based analyst, who requested anonymity due to sensitivity of the issues.

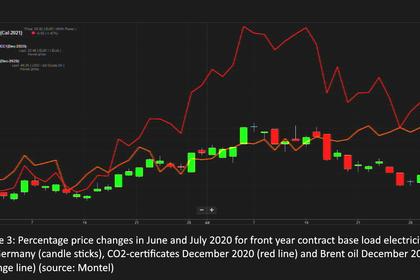

The following graphic compares returns for prices this year of coal (blue) and LNG (purple), the main fuels for producing electricity in the region.

-----

Earlier: