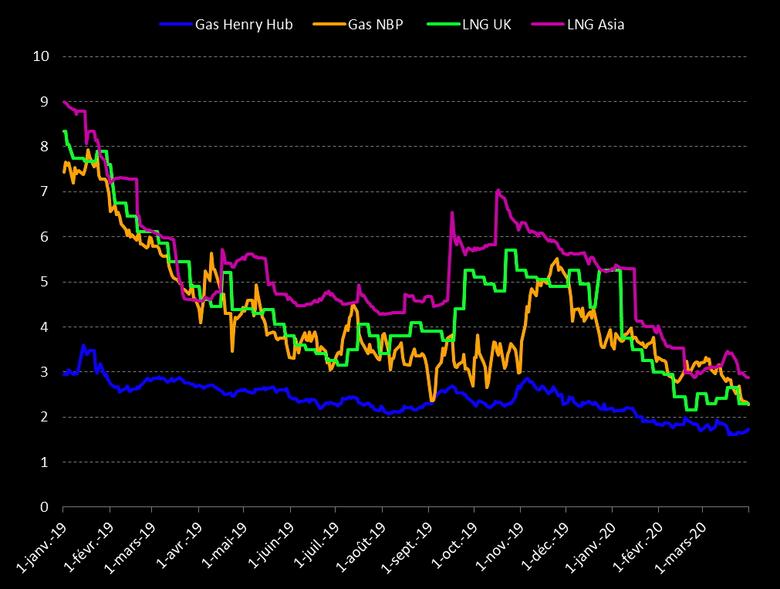

ASIA'S LNG PRICE $4

PLATTS - 28 Aug 2020 - Asian spot LNG prices are holding up at the $4/MMBtu level after nearing a seven-month high in mid-August, but bullish sentiment has somewhat eased since then as markets look for direction, before winter demand sends prices to what analysts estimate could be around $6/MMBtu this peak season.

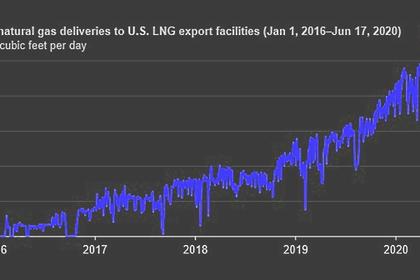

Uncertainty for the next few weeks stems from the lack of firm buying interest in Asia, US export constraints due to hurricanes and cargo cancellations, high European gas prices and supply disruptions in the Asia- Pacific region. There is also the looming scenario of a second wave of COVID-19 infections.

S&P Global Platts JKM for October was assessed at $4.058/MMBtu on Aug. 27 after it had surged to $4.175/MMBtu on Aug. 18 -- the highest since Jan. 20, when JKM closed at $4.184/MMBtu. JKM struggled for most of June and July between $2/MMBtu and $2.5/MMBtu until reports of outages in Australia and US cargo cancellations.

While some traders pointed to possible support from a bullish European gas market, others were skeptical as fundamentals in Asia have remained largely unchanged in August.

"[I don't see Pacific prices going up], not for the prompt anyway, as availability is pretty healthy and therefore sellers can't raise their offers in the absence of bids," a Singapore-based trader said.

"[There's] a widening bid/offer gap as offers have been raised to above $4/MMBtu. Plus, the winter contango might collapse, so some are looking to quickly offload their floating cargoes," another trading source noted.

A recent rally in European TTF prices lifted sentiment in the Pacific region, but even the front-month TTF contract has started to ease, after rallying to $3.178/MMBtu on Aug. 26 from a year-low of $1.158/MMBtu on May 28 on the back of outages and maintenance in Europe.

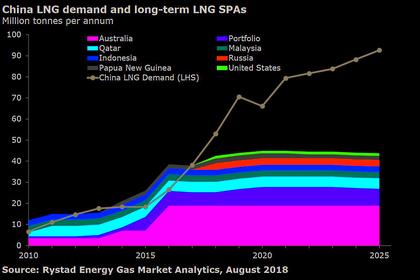

Some market sources were particularly bearish on end-user demand from North Asia. Major players like South Korea's Kogas and China's CNOOC were expected to receive cargoes that they had deferred earlier this year in the first quarter of 2021, while national oil companies in China were heard to have already completed procurement for the winter season, with underground storage facilities near capacity.

Other end-users maintained a "wait-and-see" approach towards winter purchases.

ANALYST FORECASTS

"Fundamentals still skew bearish in the near-term despite warmer temperatures across the region," according to the latest JKM Weekly Price Forecast by S&P Global Platts Analytics.

It said "the staggered outage for Gorgon, which is now expected to see one train offline in October and another in January, signals that supply disruptions within the Asia-Pacific Basin will be muted through the end of the year compared to the potential impact of a full facility shutdown."

"However, supply outages across the region are starting to roll off and a much smaller degree of cargo cancellations out of the US will likely keep spot LNG prices in check in the near term until seasonal demand kicks in," Platts Analytics added. It expects JKM at $6/MMBtu in January.

Gorgon LNG, one of Australia's largest LNG producers, has been facing reports of cracks at its propane pressurization tanks, and markets feared a complete shutdown of the facility until a staggered maintenance was announced.

Bank of America Global Research said in an Aug. 20 note that although global inventories are sitting at the highest level ever for this time of the season as we head towards the seasonal inventory peak in October, injections have slowed slightly in recent weeks and there is lesser risk of congestion and resulting price collapse in October.

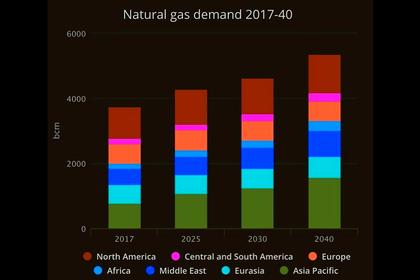

"Moreover, once we look past the seasonal peak in inventories, LNG demand should see the largest seasonal ramp up ever from 27 million mt in August to 37 million mt in December. This sequential tightening in the global LNG balance in winter should push December 2020 JKM prices above $6/MMBtu, currently trading at $5.1," BofA said.

It said LNG cargoes could well be filled a little sooner than normal as LNG shipping rates are still very low, as compared to previous years, making floating storage economical for the next couple of months, meaning LNG tanker rates should rise into the winter too.

-----

Earlier: