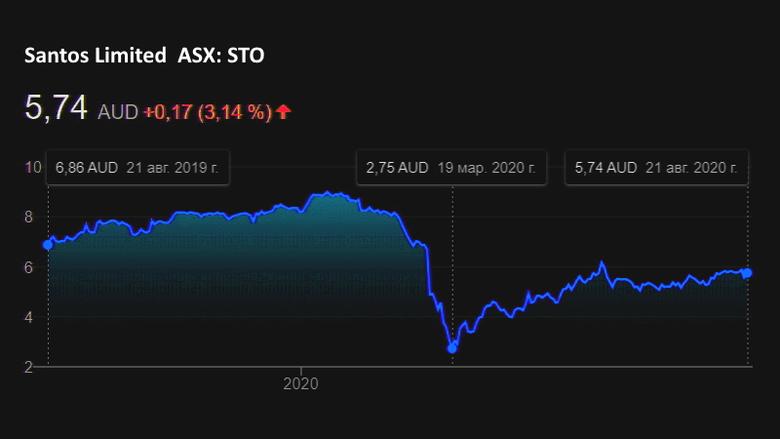

AUSTRALIA'S SANTOS NET LOSS $289 BLN

SANTOS - 20 TH AUG 2020 - Santos reports 2020 half-year results

Santos today reported first half free cash flow of US$431 million and underlying profit of US$212 million. The results reflect significantly lower oil prices compared to the previous first-half due to the impact of COVID-19 on global oil demand.

The reported net loss after tax of US$289 million includes the previously announced non-cash impairment due to revised oil price assumptions.

The Board has resolved to pay an interim dividend of US2.1 cents per share fully-franked, in line with the company's sustainable dividend policy which targets a range of 10% to 30% payout of free cash flow.

Given the ongoing uncertain economic impact of COVID combined with the lower oil price environment, the Board determined it was prudent on this occasion to set the interim dividend at the lower end of the target payout range. The Board will review the payout again when it considers the final dividend in February.

Santos Managing Director and Chief Executive Officer Kevin Gallagher said the first half of 2020 had delivered record production volumes and strong free cash flow, despite the significantly lower oil prices.

"These results again demonstrate the resilience of our cash-generative operating model in a lower oil price environment and strong operational performance across our diversified asset portfolio. Completion of the ConocoPhillips acquisition in May boosted our production to record levels and we expect even stronger production in the second half.

"Our disciplined operating model enabled us to maintain activities key to sustaining strong operational performance and stable production across all of our core assets, and we are now targeting a free cash flow breakeven oil price of less than US$25 per barrel in 2020.

"Consistent application of our disciplined operating model continues to deliver cost reductions and efficiencies, with unit production costs down 6 per cent to US$6.81/boe (excluding the ConocoPhillips acquisition).

"The acquisition of ConocoPhillips assets in northern Australia and Timor-Leste was fully-aligned with our growth strategy to build on existing infrastructure positions and delivered operatorship and control of strategic LNG infrastructure at Darwin.

"We were pleased to complete the acquisition in May for a reduced up-front purchase price and the integration of our two businesses is progressing well. Integration savings are being identified and realised rapidly, and we are now targeting the upper end of synergy guidance of US$50-75 million.

"Our balance sheet is strong with over US$3 billion in liquidity and we remain well positioned to leverage our growth opportunities when business conditions improve.

"COVID-19 and the low oil price has presented a challenging time over the past couple of months however our disciplined, low-cost operating model has allowed us to navigate these challenges while remaining well positioned for growth on the other side.

"Santos remains confident that when prices and demand recover, our projects will be better placed than those in our competitor countries to leverage the opportunities that will inevitably re-emerge.

"While FID on the Barossa project was deferred given the uncertain economic impact of COVID-19 combined with the lower oil price environment, since assuming operatorship we have progressed value improvement work targeting reduced project costs. Barossa remains an important project for Santos due to its brownfield nature and its low cost of supply.

"We are also well-progressed on Dorado pre-FEED and aim to take a FEED-entry decision on this exciting project in the second half of 2020.

"The Narrabri gas project was referred to the NSW Independent Planning Commission in June with a determination expected in the third quarter. Narrabri has the potential to supply up to half of NSW's natural gas demand.

"In the Cooper Basin, our focus on low-cost, efficient operations contributed to stronger production and record liquids throughput as we continue to optimise capital efficiency and identify new opportunities to extract value from our significant midstream infrastructure.

"We are also progressing FEED work for the Moomba carbon capture and storage project, which has the potential to significantly reduce emissions and be an enabler for the production of hydrogen in the future," Mr Gallagher said.

-----

Earlier: