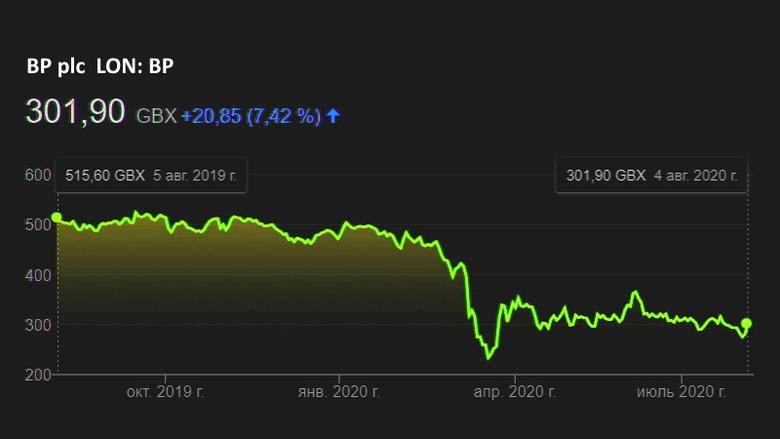

BP LOSS $16.8 BLN

BP - 4 August 2020 - BP p.l.c. Group results Second quarter and half year 2020

Resetting for the future in face of difficult conditions

– Underlying replacement cost loss for the quarter was $6.7 billion, compared with a profit of $2.8 billion for the same period a year earlier. The result was driven primarily by non-cash Upstream exploration write-offs – $6.5 billion after tax – principally resulting from a review of BP’s long-term strategic plans and revisions to long-term price assumptions, combined with the impact of lower oil and gas prices and very weak refining margins, reduced oil and gas production and much lower demand for fuels and lubricants. Oil trading delivered an exceptionally strong result.

– Reported loss for the quarter was $16.8 billion, compared with a profit of $1.8 billion for the same period a year earlier, including a net post-tax charge of $10.9 billion for non-operating items. This included $9.2 billion in post-tax non-cash impairments across the group largely arising from the revisions to its long-term price assumptions and $1.7 billion of post-tax non-cash exploration write-offs treated as non-operating items.

– Operating cash flow for the quarter, excluding Gulf of Mexico oil spill payments, was $4.8 billion, including a $1.5 billion working capital release (after adjusting for net inventory holding gains). Gulf of Mexico oil spill payments in the quarter of $1.1 billion on a post-tax basis included the scheduled annual payment.

– Proceeds from divestments and other disposals received in the quarter were $1.1 billion. This included the first payment from the agreed sale of BP’s petrochemicals business to INEOS, which delivered BP’s plans for $15 billion of announced transactions a year earlier than expected. The sale of the upstream portion of BP’s Alaska business also completed at the end of the quarter.

– Organic capital expenditure in the first half of 2020 was $6.6 billion, on track to meet BP’s revised full year expectation of around $12 billion, announced in April.

– BP’s redesign of its organization to become leaner, faster moving and lower cost, including the announced reduction of around 10,000 jobs, is expected to make a significant contribution to the planned $2.5 billion reduction in annual cash costs by the end of 2021, relative to 2019. Restructuring costs of around $1.5 billion are expected to be recognized in 2020.

– During the quarter BP issued $11.9 billion in hybrid bonds – a significant step in diversifying its capital structure, supporting its investment grade credit rating, and strengthening its finances.

– Net debt at the end of the quarter was $40.9 billion, $10.5 billion lower than in the first quarter. Gearing at the end of the quarter was 33.1% compared with 36.2% at the end of the previous quarter. This reflected the increase in equity associated with the issuance of hybrid bonds and the lower net debt, partly offset by the reduction in equity associated with the second-quarter loss.

– A dividend of 5.25 cents per share was announced for the quarter, compared to 10.5 cents per share for the previous quarter. This dividend decision is aligned with BP’s new distribution policy announced separately today.

-----

Earlier:

2020, June, 16, 13:25:00

BP WRITE-OFFS $17 BLN

BP actions will lead to non-cash impairment charges and write-offs in the second quarter, estimated to be in an aggregate range of $13 billion to $17.5 billion post-tax.

|

2020, June, 10, 12:20:00

BP CUTTING 10,000 JOBS, $3 BLN

BP will begin a process of cutting 10,000 jobs following the end of a three-month redundancy freeze that started in March.

|

|