CHINA'S GAS PRODUCTION WILL UP

PLATTS - 28 Aug 2020 - State-run PetroChina plans to continue increasing domestic gas production, while keeping its natural gas and LNG imports stable or even higher in the second half of 2020 after it had restructured its pipeline business, CFO Chai Shouping said during the company's 2020 interim results teleconference late Aug. 27.

Natural gas and LNG is set to remain Petrochina's strategic business after it had agreed to transfer gas pipeline, storage facilities and LNG terminals to China Oil & Gas Piping Network Corp., or PipeChina, for a 29.9% stake in the latter on July 23, Chai said.

In order to cope with the fierce market competition, PetroChina plans to ramp up its domestic gas production, as the gross profit rate from this segment is a hefty 10%-20%, Chai said. The company will also focus on the development of the downstream end-user market, including city gas, and gas power generation businesses, he added.

In the first half of the year, the Hong Kong-listed company produced 57.32 Bcm of domestic gas, 10.9% higher from a year ago to account for 61% of China's total gas output during the period, the company's report and data from the National Bureau of Statistics showed.

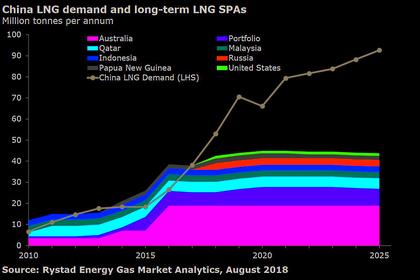

Meanwhile, PetroChina plans to keep natural gas and LNG import volumes flat, or slightly higher in H2, from the 30.5 Bcm in January-June and put more effort at lowering import losses, Chai said.

"Import losses would fall slightly as import cost declines from H1," he said.

Natural gas and LNG imports have been a loss-making business for PetroChina for a few years already. The segment registered a Yuan 11.8 billion ($1.72 billion) loss in January-June, widening the loss by Yuan 630 million from a year ago, Chai said.

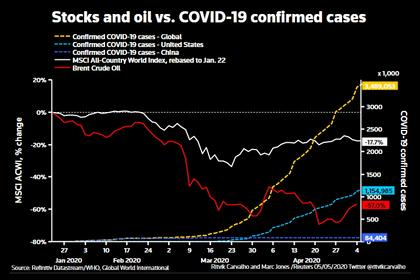

He outlined two reasons behind the losses. Firstly, the National Development & Reform Commission's lowering of non-residency gas prices to off-peak season levels ahead of schedule in late February in order to reduce end-users' costs in light of the COVID-19 outbreak, and secondly, the Chinese market was significantly oversupplied with low-priced spot LNG.

PetroChina produced 833.7 million barrels of equivalent oil, or 4.56 million boe/d, of oil and gas in H1, up 7% despite most of its international peers cutting production following the plunge in crude prices.

It still made Yuan 10.35 billion operational profit from upstream exploration, development and production sector, despite plunging 80.7% from H1 2019, the company's report showed.

REFINING LOSS

However, its refining segment made a loss of Yuan 13.64 billion in H1 amid weak domestic demand, price declines and high inventory cost, in contrast with the Yuan 2.78 billion profit it made in the same period of last year, according to the report.

The cost included about Yuan 13 billion in provisions, to pay for the government's Price Adjustment Risk Fund, deputy financial general manager Weng Xingbo said during the call.

In comparison, most of its local, independent peers were profitable in H1 as they had mis-reported sales of gasoline and gasoil to avoid paying the fund.

In China, gasoline and gasoil retail ceiling prices are set to move in line with a basket of international crude prices, while they are in the range of $40-$130/b. Oil product producers are required to pay the additional earnings from the higher oil product price due to the suspension of the retail ceiling price adjustments for gasoline and gasoil when crude prices fall below $40/b. The amount will be injected into the government's Price Adjustment Risk Fund.

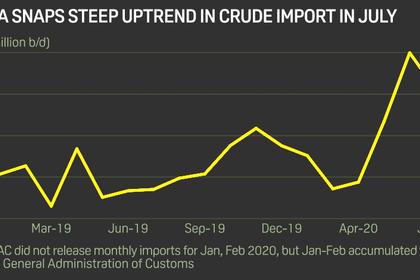

PetroChina processed 568.2 million barrels, or 3.1 million b/d, of crude in H1, falling 4.9% year on year. Jet fuel/kerosene output slumped 29.4% year on year, the most among oil products, to 4.26 million mt, the report showed

NEW ENERGY

As an integrated oil and gas giant, PetroChina has joined the bandwagon to invest in new energy projects in a bid to diversify its energy business.

The company has been exploring the feasibility of new energy development, such as hydrogen, solar power and geothermal, with an annual investment of about Yuan 1 billion-2 billion in the sector currently, Liu Wentao who leads PetroChina's planning department, said during the call.

During the fourteenth five-year plan period (2021-2026), to achieve more synergy from hydrogen, solar power along with gas power generation, the company initially planned to lift its annual investment in new energy from Yuan 3 billion-5 billion to about Yuan 10 billion, she said.

Moreover, the company prefers to work with external partners, such as establishing joint ventures, to have diverse methods for developing new energy businesses, Liu said.

In January-June, PetroChina reduced its capital expenditure by 11% year on year to Yuan 74.76 billion and targets to slash its 2020 spending by 23% to Yuan 228.5 billion ($33.22 billion).

-----

Earlier: