CHINA'S OIL & GAS UP

PLATTS - 19 Aug 2020 - China's top offshore producer CNOOC Ltd reported record-high oil and gas output of 257.9 million barrels of oil equivalent, or 1.42 million boe/d, in the first half of 2020, despite the COVID-19 pandemic dampening global energy demand, the company's interim report showed late Aug. 19.

On an average daily basis, the volume was up 5.5% from 1.34 million boe/d in the same period of last year.

The increases in oil and gas output mainly came from domestic assets, including production from three new projects in Bohai which started up in H1.

Domestic production jumped 11.4% year on year to 173.9 million boe.

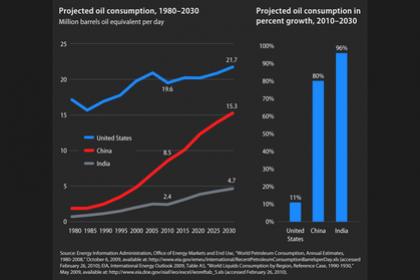

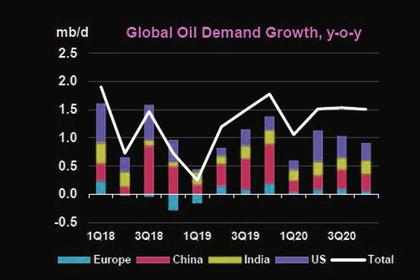

This was in line with the rising trend in China's upstream output. The country boosted its natural gas production by 10.3% on the year to 94.02 Bcm in H1, while its crude oil output also edged up 1.7% year on year to 712.11 million barrels, data from the National Bureau of Statistics shows.

CEO Xie Keqiang said in an online press conference Aug. 19 that output cuts overseas included high-cost oil sands assets in Canada and US shale projects.

CNOOC Ltd's crude output from overseas assets was down by 5.6% year on year to 66.1 million barrels due to high costs, the company said, with output in Canada seeing the steepest reduction, at 23.8% year on year, to 9.6 million barrels.

CNOOC Ltd owns a 100% working interest in the 45,000 b/d Long Lake oil sands project in Canada, and three other oil sands projects, as well as onshore shale oil and gas projects in the US -- Eagle Ford, where it has a 27% interest, and Rokies where it holds 12%.

Its crude output in Europe also dropped to 10.4 million barrels from 12.6 million barrels in H1 due to maintenance on the Buzzard field in the North Sea, CFO Xie Weizhi said in the press conference.

Due to the worldwide energy demand slump, CNOOC Ltd in late April had reduced it oil and gas output target to 505 million-515 million boe, or about 1.39 million boe/d, compared with the originally planned 1.43 million boe/d.

Its H1 production almost hit its originally planned target.

Amid the crude price slide, CNOOC Ltd further slashed its all-in costs by 11.3% year on year to $25.72/boe in January-June, the company said.

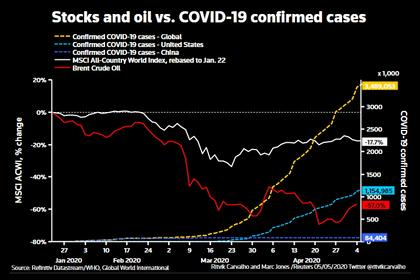

However, its net profit fell 65.7% to Yuan 10.38 billion ($1.5 billion) due to a 31.8% decline in total revenue.

Crude benchmark Dated Brent slumped to a multi-year low of $13.24/b on April 21 from $66.09/b on January 2 this year, but has since recovered to around $45/b.

The company raised capital expenditure by 5.6% on the year to Yuan 35.6 billion ($5.15 billion) in H1.

The company boosted its development spending by 20.4% year on year to Yuan 21.7 billion, while cutting its exploration expenditure by 19.8% to Yuan 6.9 billion.

CNOOC Ltd earlier adjusted its full year 2020 capex target to Yuan 75 billion-85 billion ($11.58 billion), down from actual spending of Yuan 79.6 billion in 2019.

-----

Earlier: