CHINA'S SHARES UP

REUTERS - AUGUST 17, 2020 - Asian shares crept back toward recent peaks on Monday as Chinese markets swung higher, while investors waited to see if the recent sell-off in longer-dated U.S. Treasuries would extend and maybe take some pressure off the beleaguered dollar.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.5% to 565.74, moving nearer to the January top of 574.52.

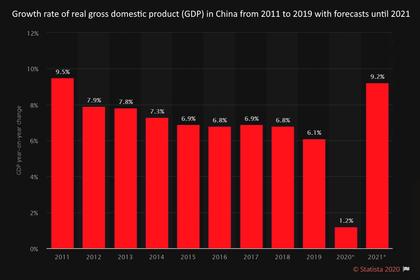

Chinese blue chips led the way with gains of 2.4%, with the country's central bank providing more medium term loans to the financial system.

Beijing also granted a patent for CanSino Biologics Inc's COVID-19 vaccine candidate Ad5-nCOV.

Japan's Nikkei dipped 0.6% after touching a six-month peak on Friday, as the country suffered its biggest economic contraction on record in the second quarter.

E-Mini futures for the S&P 500 firmed 0.28% to be just below the record close of 3,386.15. EUROSTOXX 50 futures eased 0.1% and FTSE futures 0.04%.

The U.S. second-quarter earnings season wraps up with the major retailers reporting this week, including Walmart Inc , Home Depot Inc and Kohls Corp.

Sino-U.S. relations remain a sticking point with U.S. President Donald Trump on Saturday saying he could exert pressure on more Chinese companies such as technology giant Alibaba after he moved to ban TikTok.

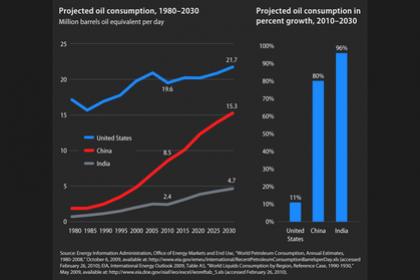

U.S. crude oil shipments to China will rise sharply in coming weeks, as the world's two top economies gear up to review their January deal after a prolonged trade war.

News that the scheduled review of the U.S.-China Phase-One trade deal over the weekend had been postponed indefinitely didn't elicit much of a reaction.

EYEING THE FED

The highlight of the economic calendar will be the release of the minutes from the Federal Reserve's last policy meeting.

"Market participants will be looking for insight into the details and exact timing of when the Fed's Monetary Policy Review will be completed, and also for more clarity with respect to the potential timing and structure of any changes to forward guidance," noted analysts at NatWest Markets.

Speculation is rife the Fed will adapt an average inflation target, which would seek to push inflation above 2% for some time to make up for the years it has run below it.

That combined with massive new debt supply caused a sharp increase in longer-term bond yields last week with 30-year yields rising 21 basis points as the curve steepened.

The lift in yields gave the dollar some respite after weeks of losses. Against a basket of currencies the dollar was a fraction lower at 93.016, still uncomfortably close to the recent trough of 92.521.

The euro flattened out a little late last week having met resistance around the two-year peak of $1.1915. Yet it still ended the week with a gain of 0.5% and was last holding firm at $1.1856.

"Investors strategically long EUR/USD should stick to the position," said CBA forex analyst Elias Haddad. "Greater Eurozone fiscal solidarity, real two-year swap rate differentials and relative central bank balance sheet trends between the Eurozone and the U.S. suggest the fundamental uptrend in EUR/USD is intact."

The single currency has also made a notable break higher on the yen to reach ground not trod since April 2019. Indeed, the yen fell against most of its peers last week, with the dollar holding at 106.59 yen on Monday.

In commodity markets, gold steadied at $1,943 an ounce , after the jump in bond yields saw it lose 4.5% last week in its worst performance since March.

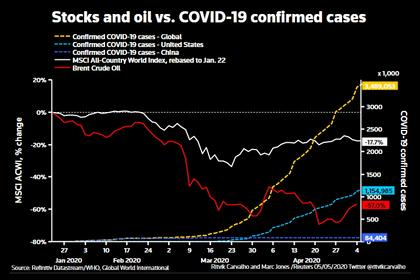

Oil prices edged ahead on hopes for Chinese demand and after data showed crude oil, gasoline, and distillate inventories all declined in the week-ending Aug. 7.

Brent crude futures rose 33 cents to $45.13 a barrel, while U.S. crude gained 38 cent to $42.39.

-----

Earlier: