GLOBAL OFFSHORE WIND 6.1 GW

GWEC - Global Offshore Wind Report 2020

Annual installations

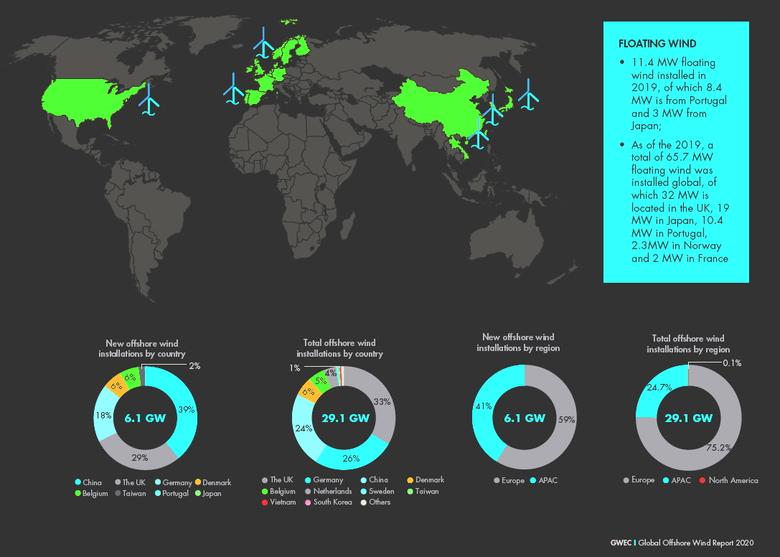

With 6.1 GW new capacity added, 2019 was the best year in history for the global offshore wind industry.

• China achieved a new record in 2019, installing 2.4 GW offshore wind in a single year. The United Kingdom came in second place, although it also had record installations of 1.8 GW in 2019. With 1.1 GW of new installations, Germany took the third place, followed by Denmark and Belgium.

• The results from the UK CfD Allocation Round 3 announced in September 2019 showed record low strike prices ranging from £39 to £41/MWh (in 2012 prices), which is about 30% lower than the auction held in 2017. In total, more than 5.4 GW offshore wind projects were awarded.

• In The Netherlands, Vattenfall won the second Dutch zero-subsidy offshore wind tender, totalling 760 MW, in July 2019 (repeating the zero-priced bids of the first round in 2018 and meaning that the project will only receive the wholesale price of electricity and no further support/payment). Those results prove how offshore costs have come down through technology innovation and economies of scale.

• The US offshore sector made great progress last year. The country’s total offshore wind procurement targets increased from 9.1 GW in 2018 to 25.4 GW in 2019 after New York and New Jersey upgraded their offshore targets, and more states released their offshore wind targets. Six states had selected more than 6 GW of offshore wind through state-issued solicitations as of December 2019 and more solicitations are expected to be issued in New York and New Jersey in 2020. The industry is now moving a phase of project construction planning and execution as more than 15 offshore projects are expected to be built by 2026.

• Development in the Asian offshore markets was also positive in 2019 – Taiwan connected its first utility-scale offshore project to the grid. On top of the 5.6 GW offshore wind to be installed by 2025, a further 10 GW is planned to be built offshore from the island between 2026 and 2035. Positive steps were also made in Japan last year to accelerate offshore wind development with its first offshore wind auction launched in summer 2020.

• Globally, offshore wind installations have grown from 3.4 GW in 2015 to 6.1 GW 2019, bringing its market share in global new installations from 5% to 10% in just five years.

Cumulative installations

The global offshore market grew on average by 24% each year since 2013, bringing the total installations to 29.1 GW, which accounted for 5% of total global wind capacity as the end of 2019.

• Europe remains the largest offshore market as the end of 2019, making up 75% of total global offshore wind installation. However, the activity level in Asia keeps increasing with China taking the lead followed by Taiwan, Vietnam, Japan, and South Korea.

• North America has only 30 MW offshore wind in operation in the US as of 2019 but deployment will accelerate in the coming years.

• The top five offshore wind market in total installations are: The UK, Germany, China, Denmark and Belgium.

-----

Earlier: