GLOBAL SHARES UP

REUTERS - AUGUST 11, 2020 - World stocks inched to 5-1/2 month highs on Tuesday, lifted by bets a U.S. fiscal stimulus package will be reached and by signs Sino-U.S. tensions have eased ahead of a crucial round of trade talks.

While investors took cheer from an order from President Donald Trump restoring some enhanced unemployment payments and suspending payroll taxes, the mood is watchful as sparring continues in the U.S. Congress over extending fiscal stimulus.

Economic data worldwide also remains a cause for concern, the latest being a steep drop in exports from trade bellwether South Korea and Britain seeing its biggest job losses since 2009.

But Brent crude futures stayed close to five-month highs LCOc1 and the dollar index held at a one-week high =USD after U.S. Treasury Secretary Steven Mnuchin said he was optimistic a bipartisan stimulus deal will be reached soon.

Commerzbank analysts said markets were shrugging off doubts over the legality of Trump’s order and appeared convinced Congress would agree a deal.

“Not without good reason, because in the election campaign both parties have an interest in presenting themselves well,” they said.

“Who wants to be seen as the stingy bad guy even in times of great need?”

A pan-European share index rose almost 1% , with auto shares leading the way after a surge in Chinese car sales and futures tipped a stronger Wall Street ESc1 open.

MSCI's global equity index rose 0.4% .MIWD00000PUS while a benchmark of Asian shares outside Japan .MIAPJ0000PUS gained nearly 1%. Japan's Nikkei .N225 climbed 1.9%.

The world index is now a whisker off February record peaks.

There are also hopes Beijing’s sanctions on 11 U.S. citizens - a response to U.S. sanctions on Chinese individuals over the Hong Kong crackdown - may end this round of tit-for-tat moves between the two powers.

“It has left the White House untouched,” said Vishnu Varathan, head of economics at Mizuho Bank in Singapore.

“That gives some relief that China is still giving some priority to the (trade deal) dialogue,” he said.

U.S. and Chinese officials hold talks on Saturday to review the first six months of the Phase 1 trade deal. While China is lagging targets on energy and farm goods purchases from the United States, markets seem confident trade ties will be insulated from the diplomatic noise.

Such optimism kept safe haven assets under gentle pressure, with gold XAU= and other precious metals down 1%-3% on the day while 10-year U.S. Treasury yields US10YT=RR were near a two-week high of 0.5870%.

Mainland Chinese shares were the exception, dragged some 1% lower by jitters before the talks and weaker tech shares, following the U.S. Nasdaq drop the previous day .SSEC .CSI300

Jason Borbora-Sheen, portfolio manager at Ninety One Asset Management, said headlines would generate oscillations, but the issue did not pose serious risks “from an equity perspective or from a corporate perspective, simply because that issue has been at the forefront of investors (minds)”.

ONWARDS AND UPWARDS

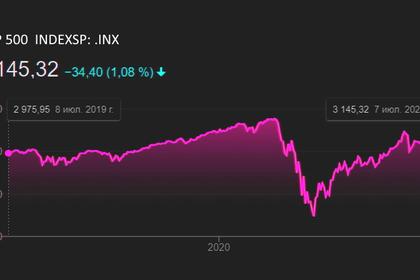

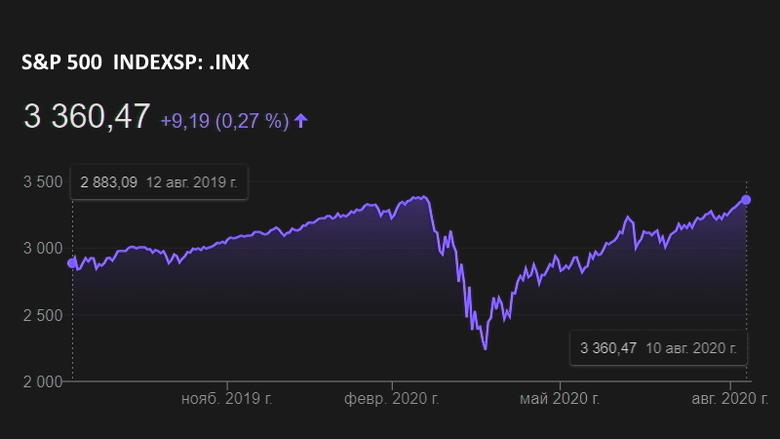

Tuesday's gains follow a robust Wall Street session when the Dow .DJI and S&P500 .SPX rose and investors rotated towards value stocks and out of tech, reflecting optimism over the growth outlook.

The S&P 500 sits less than 1% below a February record high hit in February, while Asian ex-Japan shares are within 2% of a January peak.

On the currency markets, the euro-dollar flatlined EUR=EBS. The euro is down 1.6% over the last three sessions as its 10% rally since March loses steam.

One factor underpinning the dollar’s decline - and equity strength - is the declining real, or inflation-adjusted, Treasury yield.

But in a danger signal for the euro-dollar rally, German real yields seem to have caught up with U.S. peers as euro zone inflation expectations have risen. EUIL5YF5Y=

-----

Tags: SHARES, STOCKS, INDEXES, BONDS