HYDROGEN NEED INVESTMENT

PLATTS - 24 Aug 2020 - Capital shortfalls and government inaction threaten renewable hydrogen projects with even a high level of deployment insufficient to meet demand projections for the decarbonized energy carrier, sustainable energy think-tank the Institute for Energy Economics and Financial Analysis (IEEFA) said in a report Aug. 24.

IEEFA estimated some 50 viable renewable hydrogen projects had been announced globally in the past year with a production potential of four million mt per year H2 via 11 GW of electrolyzer capacity and 50 GW of renewable capacity. In total the projects would need investment of $75 billion.

"There is, however, a serious risk that some of these projects may not be undertaken because of still-unfavorable economics and/or a lack of financing," report author Yong Por said.

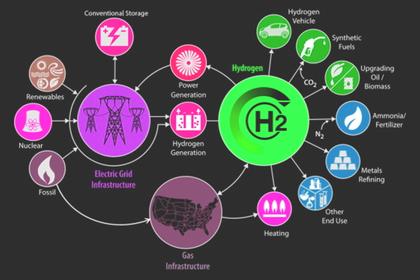

For projects to be successful, the manufacture of electrolyzers, fuel cells and associated equipment (hydrogen compressors, boilers, drive trains, storage tanks, bunkering facilities, pipelines, sensors, measuring equipment and liquefaction plants) would need to be significantly scaled up, while seaborne hydrogen transportation costs would need to fall, Por said.

With 34 of the 50 projects at an early stage, however, successful deployment needed significant government support.

Only two projects were operational (one in Japan, one in Brunei), with less than 1,000 mt/yr of hydrogen production capacity.

Transportation costs

The biggest projects were being planned for Australia and the Middle East, with economies of scale required for export-oriented plants.

IEEFA thought Australian hydrogen projects would choose the liquefied hydrogen path due to its LNG infrastructure. According to Australia's Hydrogen Roadmap, production costs of a moderate scale hydrogen liquefaction plant could be reduced from almost $5/kg to $1.8/kg in the best-case scenario.

"This is a significant reduction, but it is still 51% higher than our estimated industry average hydrogen production cost," the report said.

Production shortfall

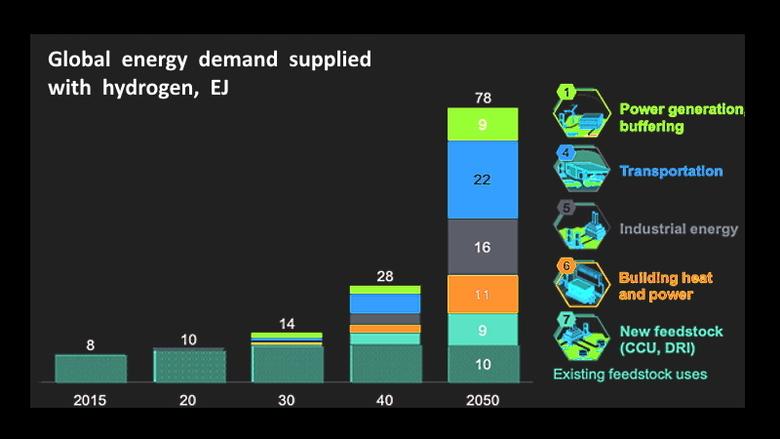

In aggregate, IEEFA saw global green hydrogen projects adding 3 million mt/yr hydrogen production, significantly short of targetted global green hydrogen demand of 8.7 million mt/yr in 2030.

Assuming typical proton exchange membrane (PEM) electrolyzer performance, 1 TWh of electricity can produce around 20,000 mt of hydrogen, according to S&P Global Platts Analytics.

"Curtailed renewables and negative electricity prices provide an opportunity for low-cost feedstock energy for H2 production," it said in a May 2020 report.

IEEFA's report noted, however, that only the EU's hydrogen plan put a strong emphasis on renewable (green) hydrogen production.

China's ambitious policy called for hydrogen to account for 10% of total energy by 2050 (equivalent to 60 million mt/yr) but this was based primarily on conventional hydrogen derived from fossil gas and coal-based feedstocks.

South Korea's hydrogen roadmap assumed use of blue hydrogen (produced from fossil fuels with carbon capture) for the bulk of hydrogen supply with liquefied green hydrogen not likely to be cost-competitive before 2030.

Japan's hydrogen roadmap meanwhile had a modest target of 300,000 mt/yr by 2030, incorporating blue and conventional hydrogen.

PEM bottleneck

The report also warned of a potential bottleneck in PEM electrolyzer supply, with large-scale producers mainly focused on alkaline electrolysers.

"PEM electrolysers are more suitable than alkaline electrolysers for small- and medium-scale hydrogen plants because they are compact and handle variable power supply from renewable sources more efficiently," it said.

-----

Earlier: