NATURAL GAS: A KEY FUEL

THE ENERGY YEAR - August 19, 2020 - The staying power of natural gas

H.E. Yury Sentyurin, secretary-general of the Gas Exporting Countries Forum (GECF), talks to The Energy Year about why gas will retain a central role in the world’s future energy mix and projections for LNG demand in a market shaped by Covid-19. The GECF is an international governmental organisation set up for the exchange of experience and information among gas-producing countries.

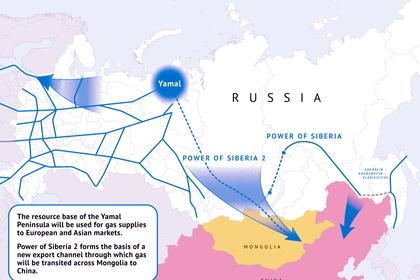

Where does the competition for gas lie in Europe in the short term?

European energy markets in general and gas markets in particular are highly competitive due to diversity of supply sources, interconnected networks and open access to pipeline networks, as well as sufficient LNG import and storage capacity.

Furthermore, energy policy frameworks like the Third Energy package accompanied by numerous gas hubs have created more competition for gas and LNG traders. Therefore, in Europe, there is not only gas-gas competition, but gas needs to compete with other sources of energy, including coal, renewables and nuclear.

Europe has strict environmental policies that call for the usage of clean fuels, and the EU Emissions Trading System (ETS) needs to work in this sense. However, we saw that natural gas lost more than 50 billion cubic metres (bcm) [1.77 tcf] in the power sector in the recent past to the benefit of coal and lignite due to the failure of EU ETS to limit greenhouse gas emissions and thus to price coal at its anti-environmental cost.

Simply put, in Europe, when coal is cheaper than gas, the demand switches to coal regardless of the issues related to the environment.

But recently, we have observed that there is coal-to-gas switching in the power sector in Europe due to the combination of high carbon prices and low gas and LNG prices.

The current spot gas prices are below USD 2 per million Btu (TTF: USD 2.43 per million Btu; NBP: USD 2.4 per million Btu).

If we consider the particular situation of the Covid-19 pandemic, the European Emission Allowances carbon prices averaged EUR 21.9/tCO2 in H1 2020, down by 7% year on year. With the above mentioned prices, we see that the economics are favouring the coal-to-gas switching. However, such switching has been limited due to the lower power demand.

As for renewable energy sources, we see them not as a competitor of natural gas, but rather as a partner of natural gas – a complementary source of energy relying on natural gas, the latter being a guarantee for the stability of the grid and security of supply for a demand baseload, as well as peak regimes.

In a nutshell, in the short term, coal is one of the main competitors of natural gas in the European gas market, driven by the possibility of fuel switching in power generation due to economics rather than environmental policies. In this competition, gas and coal relative prices, the spark spread and dark spread indexes, the carbon price, the EU Emissions Trading System and environmental policies are the key drivers.

In the medium and long term, will the main competitor for gas be solar and wind power?

We are not considering solar or wind power as competitors for natural gas. Switching to natural gas in Europe’s power generation sector will predominantly occur because countries are shifting away from coal and nuclear. However, we see that natural gas, as the cleanest hydrocarbon source, and renewables should be good partners in bringing an efficient solution for meeting energy and sustainability challenges. Continued deployment of renewables will make natural gas a key fuel, contributing to the stability and security of power systems.

Natural gas has inherent advantages including its affordability, reliability, low-carbon emissions and the security of supply even under a severe hit to global markets by Covid-19. It can replace coal in power generation, especially after the improvement of the switching economics coming from the low natural gas price. The other side is backing up the intermittent renewables. As a result, the medium-term outlook for natural gas is very promising.

Undoubtedly, solar energy and wind power energy will play a significant role in the future. This is primarily due to their nature of being renewable and having less negative impact on the climate. These benefits have stimulated policies adopted in Europe. Nonetheless, these types of energies are still not economically competitive with the abundant, economical and easy-to-use natural gas. Especially when it comes to the usage in some sectors that need high-temperature heat such as the steel and chemical industries, renewables are not known as efficient solutions.

The technology advancement in the renewable sectors that reduces cost and improves efficiency can promote the competitiveness of renewables in the long term. However, it is also assumed advancement in technology will materialise in the natural gas sector, especially in the field of CO2 and methane abatement.

It is a fact that renewables penetration, in particular in Northern and Western Europe, will continue growing at a rapid pace. The main drivers are technological improvements in larger offshore wind turbines, efficient solar panels, new batteries with fast-charging technology and continuously declining costs, which will all drive the development of renewables.

On the other hand, strong policy pushes in favour of renewables, such as the dropping of fossil fuels funding by the European Investment Bank, the European Green Deal and the European net-zero emission targets, set the framework in favour of renewables for European energy developments by 2050.

Achieving carbon neutrality by 2050, a goal that aims to see Europe become the first climate-neutral continent, will require a complete transformation of the EU’s economy.

Our view is that natural gas and biogas can be used as backup for electricity generation to back up solar and wind power, playing a major role in the transition period. Hydrogen and biogas could support the European Green Deal and carbon neutrality in 2050.

Is there a long-term future for gas in Europe as a standby or ramp-up fuel for power generation? If so, is battery power a real threat to gas?

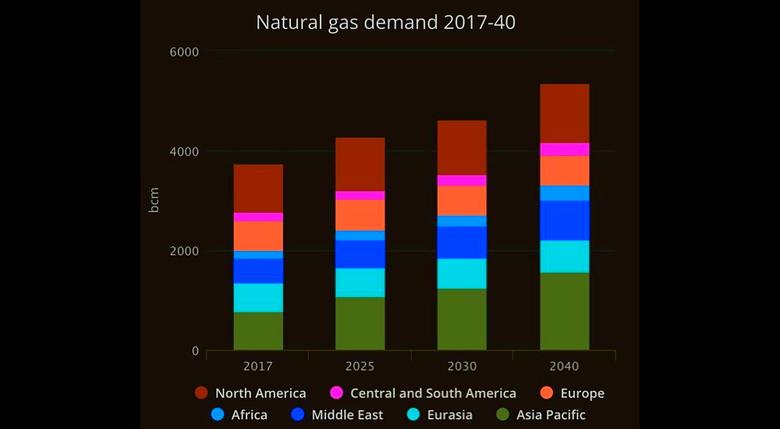

Policies to phase out coal-fired capacity and nuclear power plants in Europe will ensure a boost for natural gas demand in the power generation sector. In the mid-term, we are expecting growth of gas consumption in this sector, providing a share of about 20-22% of the continent’s electricity needs. In the long term, an aggressive build-up of renewables will weigh on gas-fired generation, gradually squeezing its share.

Nevertheless, gas-burning plants are characterised by a high flexibility and short start-up times, which make natural gas suited to complement and facilitate the deployment of solar-based and wind renewable energy sources. As for battery power, we are not expecting it to be a real threat to gas here. Undoubtedly, an anticipated progress in currently limited electricity storage will take place, but natural-gas technologies are already mature and affordable, while the critical role of gas in reducing emissions will gain momentum.

The batteries have some specific features that don’t place them in the same competitive position as gas. First is their very high costs for large storage capacities. Then there is the issue with the material resources used in batteries, such as lithium, which are largely concentrated in a few countries. Furthermore, the batteries are more suitable for short-term storage of energy, meaning that they can offer a backup for short-term periods, while gas-fired power plants offer a larger flexibility with their ability to offer backup for a long period of time, in case of prolonged under-supply from intermittent renewables.

The role of gas is not limited to ramping up or being standby power. We believe that natural gas will have a significant share even to meet the baseload in power generation. The potential for solar and wind turbines is not adequate to accommodate the huge demand in Europe. So we believe that natural gas will maintain a considerable share in this sector.

Will petrochemicals production be a key facet of the future of gas?

First of all, I should say that it is price dynamics that prescribe the future of petrochemicals. Specifically, the crude and natural gas prices are the main factor to determine the future of relevant capacities, and that is why the shale gas revolution in the United States has brought low-cost production of feedstocks, mostly NGLs or ethane.

Second, we forecast that global refinery capacity will grow by more than 14 million-16 million bpd during 2019-2050, with the increased demand from the developing countries being the principal driver for that growth. The refining market will also continue to rise by around 8 million bpd by 2050, thanks to the surge in urban population and economic and energy consumption trends.

Regarding your question, currently increasing demand for oil by transportation and industry in the petrochemical manufacturing sectors (plastics, fertilisers, steam and heat) is pushing up the demand. But we should note that over the long term, in line with plateauing and decreasing in global oil demand, refinery closures will be needed as refinery utilisation will drop.

On the other hand, according to our forecast the share of natural gas in the global energy basket will increase from the current 23% to about 27% in 2050, and one of the areas of this consumption driving that growth is the feedstock and petrochemicals sectors. We see that natural gas will replace feedstocks from coal gasification and liquefaction for electricity production and chemical plant cogeneration, and will remain as the feedstock for hydrogen production for hydrocracking, ammonia and syngas for methanol and its derivatives. Gas condensate (ethane, propane and butane) is an advantaged raw material via ethylene and propylene compared to naphtha produced from crude oil. In this regard, petrochemicals will consume over 100 bcm [3.53 tcf] of natural gas by 2050.

Natural gas as a feedstock at present amounts to around 3% of total gas demand. However, gas usage here will develop at a healthy pace, driven by global urban population growth, the increase in living standards and the movement of people from the lower to the middle economic class. Natural gas demand in gas-to-chemicals, petrochemicals and the fertiliser feedstock sector will grow in Russia, India, China, Egypt, the US, Qatar, Iran and Saudi Arabia.

Moreover, ethane feedstock offers an alternative route to access the petrochemical industry, as opposed to the growing trend of crude-oil-to-chemicals. One of the latest examples is a partnership between Qatar Petroleum and Chevron Phillips Chemical Company for a new ethylene and derivatives complex in Ras Laffan Industrial City, which will utilise ethane supplied from the Qatari North Field expansion.

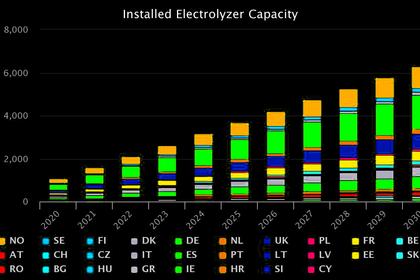

We are hearing more about the “hydrogen economy.” The cheapest route to make hydrogen is via syngas and reforming. Will this development shape gas production?

Natural gas has a very unique and diversified nature that makes it fit in several sectors and several development scenarios of global energy. Hydrogen is one of them. However, we believe that natural gas will keep playing a major role in displacing coal in several parts of the world, like the US and Asia-Pacific. Despite the deployment and the investment in several new energy sources, natural gas will remain positioned as reliable and flexible against other energy storage options.

Currently, the cheapest technology to produce hydrogen is natural gas reforming, which is sometimes interpreted as “grey hydrogen.” The cost of reforming can be as low as USD 0.90/KgH2. However, depending on the economic and geographic situation and availability of sources and technologies, this cost can reach more than USD 3/KgH2 while the cost of hydrogen produced from renewables (so-called green hydrogen) is above the level of USD 3/KgH2.

Nevertheless, we cannot say that this type of hydrogen production (grey hydrogen) is the future of gas as natural gas can be consumed in a variety of sectors. Besides, the environmental concerns around grey hydrogen will impose a significant uncertainty on the outlook for the level of grey hydrogen in future hydrogen production.

Through the application of CCUS (carbon capture, utilisation and storage) technologies along with the natural gas reforming that translates into blue hydrogen, the environmental concerns will be removed, and blue hydrogen can compete in both cost and environmental considerations with green hydrogen.

On that front, in our Global Gas Outlook 2050, we developed a dedicated scenario called the “Hydrogen Scenario,” and its results suggest that blue and green hydrogen will dominate the future of H2 production. According to these results, almost half of the produced hydrogen will be sourced from natural gas by 2050, mostly in the form of blue hydrogen. It is also forecast that more than 600 bcm [21.2 tcf], which accounts for around 10% of global gas production, will be consumed for hydrogen production by 2050.

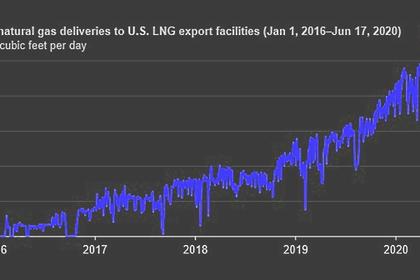

We are experiencing over capacity in the LNG market and hence low prices. When do you expect this overcapacity to be overcome?

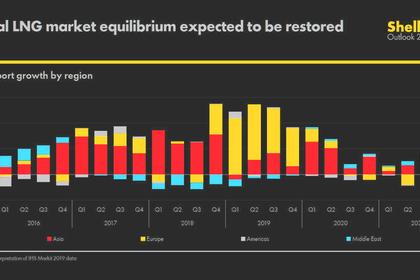

The spot LNG market was already in a state of oversupply before the Covid-19 pandemic as LNG supply was growing faster than LNG demand. However, countries’ lockdown measures in order to curb the spread of Covid-19 have led to a slump in gas demand, particularly in the power and industrial sectors, which has exacerbated the oversupply situation.

In addition to the impact of Covid-19, the Northern Hemisphere experienced a milder-than-normal winter season, which reduced gas consumption in the residential, commercial and power sectors due to lower heating requirements at the beginning of the year.

In 2020, we forecast that global LNG supply will slow to around 3-3.5%, assuming a loss of around 10 million-12 million tonnes of supply compared to our pre-Covid forecast. The negative forward price spreads between the European and Henry Hub gas prices over the 2020 summer season have led to a significant number of LNG cargo cancellations between June and August 2020 (up to 35-45 cargoes per month). Assuming that the lost LNG cargoes come to the market next year, LNG supply could grow by 6.5-7% in 2021.

Looking further ahead, LNG supply growth is expected to slow significantly by 2022-2023 to 1.5-2% per annum as fewer LNG projects are commissioned during this period. As such, we expect a tightening of the LNG market around 2022/2023, which will support a recovery in spot gas/LNG supply to above 2019 levels.

We have seen no new importers of LNG in 2019 and 2020 and relatively few FRSUs. Is this due to constraints on LNG trade or is a shortage of finance for gas-fired power stations the problem?

If we look just at bare numbers, the picture does not really look perfect. It is true that no new countries joined the club of LNG importers in 2019. This compares to one new importer in 2017 (Malta) and two new importers in 2018 (Bangladesh and Panama). As such, in 2019 the number of LNG importers remained at the 2018 level, namely 42 countries.

But we should realise that the number of LNG importers cannot rise exponentially every year. It takes potential LNG importers a relatively long time to take the crucial decision to construct LNG regasification terminals while increasing the share of gas in their energy mixes.

Most developed countries and major countries with emerging economies have already built and actively utilised LNG terminals. Meanwhile, among potential LNG importers, there are many developing countries with relatively low financial resources and relatively small gas markets. In the context of the current low price environment, many of these countries might take the decision to switch from coal and oil to gas in their energy mixes.

Speaking about short- and medium-term perspectives, we might be quite optimistic as various countries are going to complete new LNG regasification projects soon. In the coming years, we will witness the commissioning of LNG terminals in new importing countries, such as the Philippines and Croatia, with the infrastructure under construction there now. Meanwhile, Vietnam and Germany are very likely to take FIDs on LNG terminals soon.

Besides this, we should not forget that new opportunities are emerging for supplying regasified LNG to some landlocked countries and countries without LNG regasification infrastructure. Although technically these countries are not considered to be new LNG importers, they actually get access to regasified LNG through the neighbouring countries which possess LNG terminals. First of all, I mean some European countries, such as Hungary and Bulgaria, which will have a chance to receive regasified LNG from Croatia and Greece, respectively.

Regarding FSRUs, 13 new projects might be commissioned by 2025, with FIDs taken on four of them (two projects in India, one project in Croatia and one project in the UAE). We see a promising future for this segment of the LNG market, since FSRU projects are less costly and rather medium scale compared to onshore terminals, while they are more convenient for countries with relatively low LNG demand.

As countries ease their lockdowns, will electricity return to previous demand levels?

The Covid-19 pandemic affected the demand for electricity like other types of energy and sectors as a result of the shrinkage of economic activities during the lockdowns. Besides this, the coronavirus pandemic also inflicted shocks to both the demand and supply sides of energy, which added more fluctuations to the energy networks, including electricity grids.

However, the governments are trying to gradually ease the restrictions, while placing the health of their nations as a top priority. Therefore, through the reopening of some parts of the economy and the recovery of industrial activities, the demand for electricity and thus for energy is expected to improve gradually.

Here, I should reiterate that a rather significant portion of electricity is generated from natural gas-fuelled power plants and this share could substantially increase in the coming years thanks to the credentials of natural gas for power generation. As I mentioned earlier, credentials of natural gas for power generation, such as its affordability, higher grid stability and flexibility in power plants, highlight the importance and crucial role of natural gas for the electricity sector.

As far as natural gas is concerned, we expect the global demand for this commodity to fall in 2020 by up to 6% in a worst-case scenario, but it will recover in 2021 at more than its 2019 level.

I would like to highlight here that the GECF member countries will continue to play their role in supplying natural gas to consumers to support their power plants in sustainable electricity generation during the pandemic period as well as the post-corona economic recovery phase.

Many people in the least developed countries do not have access to primary energy. Is the GECF making efforts with governments in those countries to help realise the goal of universal energy access?

The GECF is open to dialogue with all countries. As we represent more than 70% of the world’s proven gas reserves and almost half of global marketed gas production, it is our goal to ensure global sustainable development and energy security as well as to increase energy access for the most vulnerable populations.

Africa and Asia currently have the most limited access to energy and the largest fuel substitution potential. In the residential sector, solid biomass makes up more than 40% of energy demand in developing parts of Asia and almost 85% in Africa. Natural gas can meet the energy needs of these populations while supporting the attainment of the UN Sustainable Development Goals, in particular Goal 7: “access to affordable, reliable, sustainable and modern energy for all.” This access can take different forms such as affordable gas-fired electricity, the expansion of gas networks to supply new areas or the development of small-scale LNG projects.

In this context, a vivid example of participation of our member countries in this process is the development of LNG trade within Africa, driven by Equatorial Guinea’s LNG2Africa initiative. This project opens up significant prospects for those African countries with limited infrastructure or that are lacking domestic gas. Gas-to-power will be the anchor sector for the development of regional gas supplies, allowing African nations to monetise locally produced gas and provide a clean and environmentally friendly energy source to their people.

The 5th GECF Gas Summit, which was held in Malabo, Equatorial Guinea, in November 2019, emphasised the role of natural gas in a rapidly evolving African energy mix. In fact, alleviating energy poverty in African countries through investment and delivering natural gas to the African region is in line with the Declaration of Malabo: “To promote the GECF cooperation with African countries to use gas as the core source of energy in their development programs and climate change policies, with the aim to overcome energy poverty, enhance development and to mitigate CO2 emissions.”

----

Earlier: