NORWAY'S FUND DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

NORWAY'S FUND DOWN

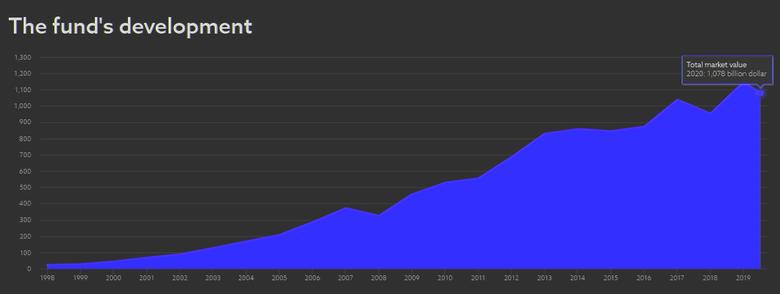

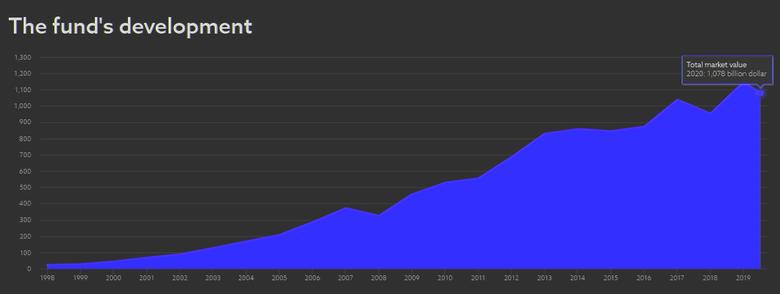

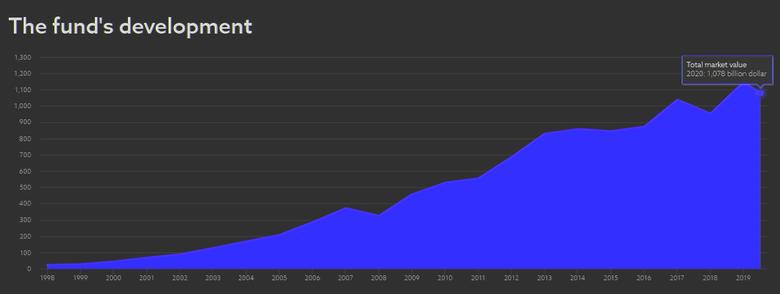

NORGES BANK- 18 August 2020 - The return on the fund's equity investment was -6.8 percent. Investments in unlisted real estate returned -1.6 percent, whereas the fixed income investments returned 5.1 percent. The fund's overall return was 11 basis points lower than the return on the benchmark index.

"There were major fluctuations in the equity market in this period. The year started with optimism, but the outlook of the equity market quickly turned when the Corona virus started to spread globally. However, the sharp stock market decline of the first quarter was limited by a massive monetary and financial policy response", says Deputy CEO of Norges Bank Investment Management Trond Grande.

Economic measures around the world combined with a gradual reopening in several countries contributed to an increase in optimism among investors.

"Even though markets recovered well in the second quarter, we are still witnessing considerable uncertainty", Grande says.

The krone depreciated against several of the main currencies during the first half of the year. The currency movements contributed to an increase in the fund's value of 672 billion kroner. In the first half of the year, 167 billion kroner was withdrawn from the fund.

The fund had a value of 10,400 billion kroner as at 30 June 2020, of which 69.6 percent was invested in equities, 2.8 percent in unlisted real estate, and 27.6 percent in fixed income.

The statement full PDF version

-----

Earlier:

2020, July, 27, 16:05:00

SANCTIONS 2020: 47 BLN

Total sanctioning value will end up at around $47 billion, an amount that would be even lower if not for recent developments in Norway and Russia.

2020, July, 27, 15:50:00

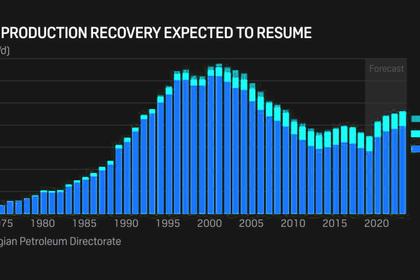

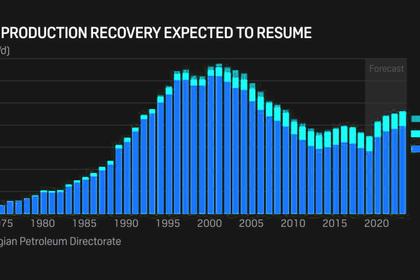

NORWAY'S OIL & GAS PRODUCTION 1.857 MBD

Norway's preliminary production figures for June 2020 show an average daily production of 1 857 000 barrels of oil, NGL and condensate.

All Publications »

Tags:

NORWAY,

FUND