OIL DEMAND WILL UP BY 7 MBD

OPEC - 12 August 2020 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

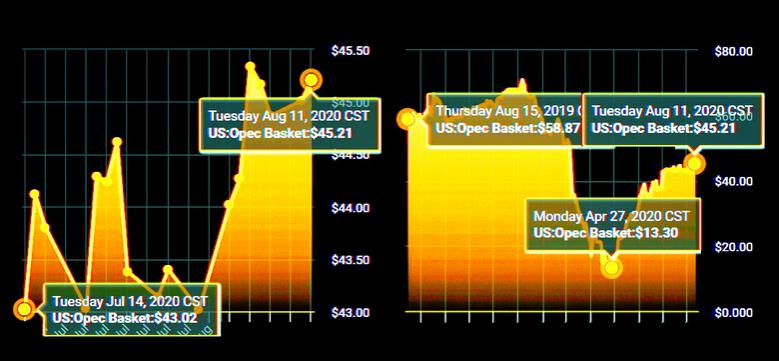

Crude Oil Price Movements

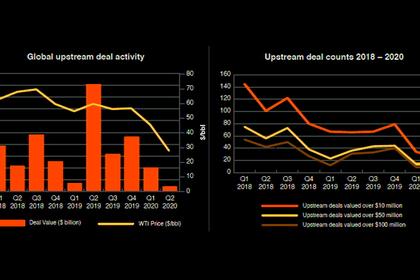

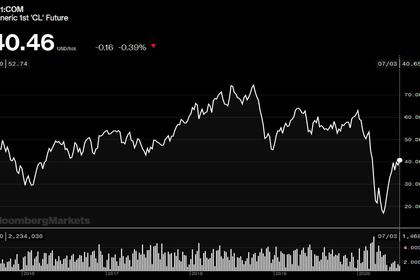

Spot crude oil prices rose further in July, the third consecutive monthly increase. The OPEC Reference Basket (ORB) averaged $43.42/b in July, gaining $6.37 over the previous month to reach its highest value since February this year. The ORB year-to-date average is $39.85/b. Crude oil futures also rose in July, again for the third consecutive month. ICE Brent ended the month $2.45 higher at $43.22/b, while NYMEX WTI rose by $2.45 to reach $40.77/b. The Brent-WTI spread remained unchanged at $2.46/b. Futures prices rose given continued improvement in oil market fundamentals and bullish economic data. All three futures market structures were in contango in July, with the forward curves steepening late in the month. Hedge funds and other money managers turned less positive on oil prices by the end of July, cutting their bullish bets on crude oil futures and options close to two-month lows.

World Economy

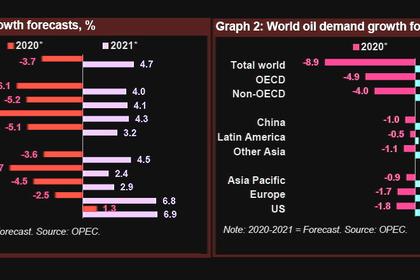

The global economic growth forecast for 2020 is revised down to -4.0%, compared to last month’s forecast of -3.7%, following a further negative impact from the COVID-19 pandemic. The recovery in 2021 is forecast to reach 4.7%, unchanged from the previous month. The US is revised down slightly and now forecast to contract by 5.3% in 2020, followed by growth of 4.1% in 2021. The Euro-zone is forecast to contract by 8.0% in 2020, but grow by 4.3% in 2021. Japan is forecast to contract by 5.1% in 2020 and recover to 3.2% in 2021. China’s 2020 GDP growth is revised up to 1.8% from 1.3%, followed by growth of 6.9% in 2021. India’s 2020 growth forecast is revised down from -2.5% to -4.6%, followed by growth of 6.8% in 2021. Brazil’s 2020 GDP growth is revised down to -7.0% from -6.7%, before rebounding to 2.4% in 2021. Russia’s 2020 forecast is revised down slightly to -4.7% from -4.5%, before recovering in 2021 to 2.9%.

World Oil Demand

In 2020, global oil demand growth is forecast to decline by 9.1 mb/d. This is 0.1 mb/d lower than last month’s forecast, mainly due to lower economic activity levels in a few major non-OECD countries. On a quarterly basis, the more-than-expected decline in the non-OECD countries in the 2Q20 was partially counterbalanced by better-than-expected demand in OECD Europe. The 2H20 is adjusted lower, compared to last month’s assessment, in line with the expected softer economic momentum, mainly in a few non-OECD countries. Total oil demand is now projected to reach 90.6 mb/d. For 2021, world oil demand growth is forecast to rise by 7.0 mb/d, unchanged from last month. Total world consumption is now pegged at 97.6 mb/d in 2021. The forecast assumes that COVID-19 will largely be contained globally, with no further major disruptions to the global economy. Consequently, economic activities are projected to rebound steady in both OECD and non-OECD. As a result, the OECD countries are expected to witness oil demand growth of 3.5 mb/d, y-o-y, in 2021. The non-OECD countries are expected to witness similar growth, with China and Other Asia leading the gains.

World Oil Supply

Despite the dramatic drop in oil output in 2Q20, particularly in OECD Americas, the non-OPEC liquids production growth forecast in 2020 (including processing gains) is revised up by 235 tb/d from the previous month’s assessment, due to a better-than-expected recovery in 2H20, and now is expected to decline by 3.03 mb/d, y-o-y. Major oil companies have reported some significant 2Q20 supply losses due to the COVID-19 pandemic. With the downward production adjustments from the non-OPEC countries participating in the Declaration of Cooperation (DoC) and production shut-ins in countries outside of the DoC during the same quarter, total non-OPEC supply in 2Q20 dropped by around 6 mb/d. However, non-OPEC crude oil production in 3Q20 is expected to witness some growth, particularly as of August. Non-OPEC liquids production in 2021 is revised up by 66 tb/d and is now expected to grow by 0.98 mb/d, mainly due to a better-than-expected recovery in production of Canada. Nevertheless, uncertainty surrounding financial and logistical constraints for US production, as well as a potential second wave of COVID-19 infections globally, remains a concern. OPEC NGLs are estimated to decline by 0.10 mb/d, y-o-y in 2020, while the preliminary 2021 forecast indicates growth of 0.08 mb/d to average 5.13 mb/d. OPEC crude oil production in July increased by 0.98 mb/d, m-o-m, to average 23.17 mb/d, according to secondary sources.

Product Markets and Refining Operations

Global refinery margins trended upwards last month, as a continued increase in mobility activities, amid the peak summer season, provided stimulus to product markets. Improvements were registered across almost the entire barrel, with Asian refining margins returning to positive territory. The strongest positive contribution came from the middle section of the barrel, although stronger refinery runs, led to higher inventory levels, and kept gains capped. Despite the positive m-o-m improvement, refining margins, in general, remain at unfavourably low levels, y-o-y.

Tanker Market

Dirty tanker rates fell further last month from the high levels seen mid-March this year. In fact, tanker rates fell to the subdued levels seen in 1H19, following the historic production adjustments undertaken by OPEC and non-OPEC producers participating in the DoC, as well as other major producers. OPEC sailings continued to decline in July, hitting the lowest on record. Volumes are likely to remain at historically low levels for the remainder of the year, in line with DoC commitments. Lacklustre product exports, amid weak demand and low refinery runs, weighed on clean tanker rates. Floating storage continued to unwind, removing a factor that has supported rates in recent months.

Crude and Refined Products Trade

Global crude and product trade remains muted compared to a year-ago levels. Preliminary data shows that US crude imports fell back in July, as the inflow of long haul tankers from the Middle East decreased. US crude exports edged up in July after four months of declines, averaging 2.8 mb/d, albeit remaining well below the peak of 3.7 mb/d observed back in February. Japan’s crude imports hit their lowest level in more than a decade in June, down by 39% from the peak seen in March, amid reduced refinery runs, and weak product demand in the Asian region. China’s crude imports surged to a record high of just under 13 mb/d in June as a wave of crude cargoes purchased at a time of low prices continued to be brought onshore. Crude inflows outpaced the country’s import capacity resulting in port congestion that delayed unloadings, which should keep imports high in July. Product imports fell back in June from the record high seen in May, but at 1.65 mb/d, they were still the second highest on record. India’s crude inflows continued to fall from the high levels seen in 1Q19, approaching a 9-year low of 3.3 mb/d in June.

Commercial Stock Movements

Preliminary June data showed that total OECD commercial oil stocks rose by 24.3 mb, m-o-m, the fourth consecutive monthly rise. At 3,240 mb, they were 301.5 mb higher than the same time one year ago, and 291.2 mb above the latest five-year average. Within the components, crude and products stocks rose m-o-m by 12.8 mb and 11.5 mb, respectively. OECD crude stocks stood at 120.3 mb above the latest five-year average, while product stocks exhibited a surplus of 170.9 mb. In terms of days of forward cover, OECD commercial stocks fell m-o-m by 3.9 days in June to stand at 73.4 days. This was 12.5 days above the June 2019 level, and 11.7 days above the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2020 is revised down by 0.4 mb/d from the previous month to stand at 23.4 mb/d, around 5.9 mb/d lower than in 2019. Demand for OPEC crude in 2021 is also revised down by 0.5 mb/d from the previous month to stand at 29.3 mb/d, around 5.9 mb/d higher than in 2020.

-----

Earlier: