OIL, GAS M&A

MEOG - Aug 09, 2020 - Total oil & gas industry M&A deals in Q2 2020 worth $23.95bn were announced globally, according to GlobalData's deals database.

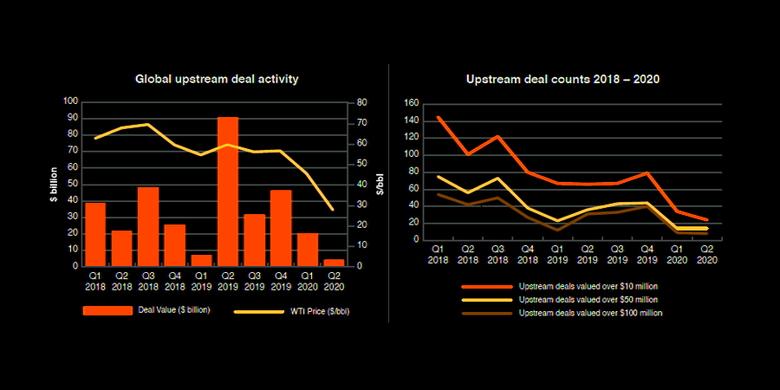

The value marked an increase of 114.2% over the previous quarter and a drop of 68.8% when compared with the last four-quarter average, which stood at $76.8bn.

Comparing deals value in different regions of the globe, Middle East and Africa held the top position, with total announced deals in the period worth $11.29bn. At the country level, the United Arab Emirates topped the list in terms of deal value at $10.12bn.

In terms of volumes, North America emerged as the top region for oil & gas industry M&A deals globally, followed by Asia-Pacific and then Europe.

The top country in terms of M&A deals activity in Q2 2020 was the US with 83 deals, followed by China with 33 and Canada with 21.

In 2020, as of the end of Q2 2020, oil & gas M&A deals worth $50.83bn were announced globally, marking a decrease of 79% year on year.

Oil & gas industry M&A deals in Q2 2020: Top deals

The top five oil & gas industry M&A deals accounted for 69.4% of the overall value during Q2 2020.

The combined value of the top five oil & gas M&A deals stood at $16.62bn, against the overall value of $23.95bn recorded for the month.

The top five oil & gas industry deals of Q2 2020 tracked by GlobalData were:

- Brookfield Asset Management, GIC, Global Infrastructure Management, NH Investment & Securities, Ontario Teachers’ Pension Plan and Snam’s $10.1bn acquisition of ADNOC Gas Pipeline Assets

- The $5bn asset transaction with BP by Ineos Group

- Total’s $575m asset transaction with Tullow Uganda and Tullow Uganda Operations

- The $541m asset transaction with Royal Dutch Shell by National Fuel Gas

- TPG Sixth Street Partners’ acquisition of Antero Resources for $402m.

-----

Earlier: