OIL PRICE: NEAR $45 OVER

REUTERS - AUGUST 20, 2020 - Oil prices fell on Thursday on demand concerns driven by cautious views from OPEC+ producers and the U.S. Federal Reserve regarding economic recovery from the coronavirus pandemic.

Brent crude LCOc1 was down 48 cents, or 1%, at $44.89 a barrel at 0933 GMT, and West Texas Intermediate (WTI) U.S. oil CLc1 fell 34 cents, or 0.8%, at $42.59 a barrel.

"The surge in COVID-19 infections over the summer has muted the recovery and anyone still believing in a V-shaped recovery needs to do some reassessment," said Hussein Sayed, chief market strategist at FXTM.

A firmer U.S. dollar also put pressure on oil prices, analysts said, leaving them stuck in their narrow trading range of recent weeks.

Oil prices have been rangebound since mid-June, with Brent trading between $40 and $46 per barrel, and WTI between $37 and $43.

The Organization of the Petroleum Exporting Countries and its allies, known an OPEC+, said on Wednesday that the pace of oil market recovery appeared to be slower than anticipated with growing risks of a prolonged second wave of the pandemic.

The group pressed oil nations pumping above output targets to cut more in August-September due to concerns about the strength of recovery in demand.

Prices were also pressured after several U.S. Fed members said additional monetary policy easing may be needed because a rebound in employment was already slowing.

"All roads in global and regional economies lead to the containment of the virus and the end of these roads is not in sight yet," said oil broker PVM's Tamas Varga.

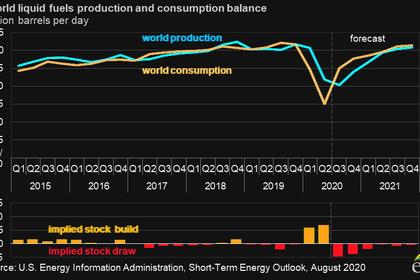

The U.S. Energy Information Administration said on Wednesday that U.S. fuel demand fell by more than 2 million barrels per day (bpd) to 17.2 million bpd in terms of product supplied.

Overall fuel demand in the last four weeks is down 14% from year-ago levels. As the summer driving season comes to a close, fuel demand tends to decline.

However, stockpiles of crude in the United States fell for a fourth straight week, even as net imports rose, the EIA said.

-----

Earlier: