OIL PRICE: NOT BELOW $45 YET

REUTERS - AUGUST 28, 2020 - Oil prices edged lower on Friday as storm Laura past the heart of the U.S. oil industry in Louisiana and Texas without causing any widespread damage to refineries.

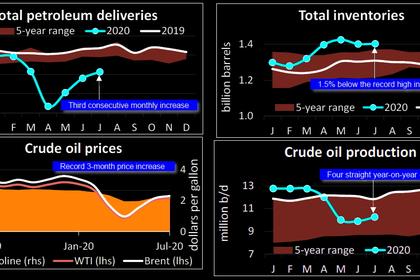

Brent crude LCOc1 futures for October, set to expire on Friday, was down 7 cents to $44.99 a barrel by 1154 GMT.

U.S. West Texas Intermediate (WTI) crude CLc1 futures were down 3 cents to $43.01 a barrel.

“With the U.S. Gulf hurricanes out of the way and preliminary assessment showing no damage to the upstream or downstream facilities, crude has surrendered most of the storm premium and could enter a holding pattern again,” said Vandana Hari, oil market analyst at Vanda Insights.

Indeed the market has been stuck in an unusually long spell of low volatility, analyst Eugen Weinberg at Commerzbank said, in contrast with stock markets.

“It didn’t even react to a weaker dollar. There’s no impulse in either direction. It has seldom had so little volatility for such a long period, especially given the dynamic situation on the demand and supply sides,” Weinberg said.

Hurricane Laura, since downgraded to a tropical depression, hit Louisiana early Thursday with winds of 150 miles per hour (240 km per hour). Buildings were damaged, trees fell and power was cut to more than 650,000 people in Louisiana and Texas, but refineries were spared from feared massive flooding.

U.S. producers had shut 1.56 million barrels per day (bpd) of crude output, or 83% of the Gulf of Mexico’s production, while nine refineries had shut around 2.9 million bpd of capacity, or 15% of U.S. processing capacity, ahead of the storm.

Late on Thursday, the Port of Houston, the top U.S. crude oil export hub accounting for about 600,000 bpd of shipments, was in the process of reopening to commercial shipping.

Further ahead, demand expectations continue to be bearish. The contango between Brent crude for nearby delivery and six-months ahead remained near its widest since late May at more than $2. LCOc1-LCOc7

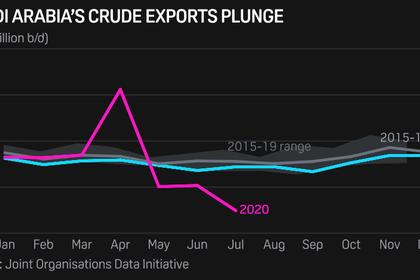

“Aside from Saudi Arabia, everyone else is clear that global oil demand won’t return to 2019 (levels) until at least 2022. The latest monthly estimate from the IEA/EIA/OPEC triumvirate suggests consumption will not recover to pre-pandemic levels next year,” PVM Oil Associates said in a daily note.

-----

Earlier: