RUSSIA'S GAS TO EUROPE DOWN

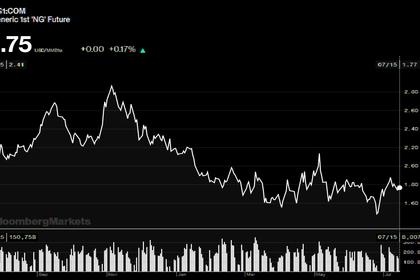

PLATTS - 04 Aug 2020 - Russian gas supplies to Europe fell to a new 2020 low in July, with exports dropping to just 9.6 Bcm, an analysis of data from S&P Global Platts Analytics and Entsog showed August 4.

Flows were hit by annual maintenance shutdowns on both the Nord Stream and Yamal-Europe lines during July, with Gazprom opting to meet its customer obligations mainly with gas from its European storage sites rather than increasing flows via alternative routes.

Russian exports to Europe via the four main corridors -- Nord Stream, Yamal-Europe, Ukraine and TurkStream -- had hovered around 11.1 Bcm over the previous three months, around 25% lower year on year.

A combination of factors -- including a second consecutive mild winter, high gas storage stocks, low prices, and weak demand -- has seen flows falling to an average of 350 million cu m/d so far this year.

Over January-July, Russian gas flows into Europe -- excluding the countries of the former Soviet Union in line with Gazprom's own sales data -- totaled 75 Bcm, down 25% year on year.

Russian gas flows via Nord Stream totaled 2.97 Bcm in July, or an average of 96 million cu m/d, as the pipeline was closed completely for annual maintenance for 12 days from July 14-25.

Russian gas supplies in the Yamal-Europe corridor via Belarus into Poland also fell -- averaging 73 million cu m/d -- impacted by five days of maintenance over the period July 6-10.

According to Platts Analytics data, heavy storage withdrawals at sites where Gazprom has capacity in Germany (Rehden and Katharina), in Austria (Haidach) and the Netherlands (Bergermeer) were used to offset the declines in exports.

"Storage withdrawals (mostly Gazprom's own) stepped in to fill the gap, while the increase in Russian imports via alternative routes was minimal," Platts Analytics said.

From July 26, storage facilities where Gazprom holds capacity switched back to injections.

Ukraine flows

Supplies via Ukraine edged up compared with June, with net flows up slightly month-on-month at interconnection points with Poland, Hungary, and Romania.

Net flows through the main interconnection point at Velke Kapusany on the border with Slovakia were down slightly as reverse flow limited the volume entering Slovakia by around 6 million cu m/d.

Since the start of August, significantly more gas is moving via Velke Kapusany in the west-east direction, which will see lower Russian gas volumes entering Europe via that point.

The startup in January of the 31.5 Bcm/year capacity TurkStream pipeline also triggered a major shake-up in how Russian gas reaches parts of Europe.

One of the strings is designed to bring Russian gas to the Turkish market directly -- for which no data is available -- while the other flows gas out of Turkey into Bulgaria. Both replace supplies previously sent via Ukraine on the Trans-Balkan pipeline.

Supplies via TurkStream into Bulgaria in July were 0.5 Bcm, or an average of 16 million cu m/d.

That was up on the average of 12 million cu m/d in June, which was the result of the complete shutdown of the line June 23-29 for maintenance.

Data on Russian exports in 2020 will be lower than the previous year as deliveries to Turkey via TurkStream are not included, while supplies to Turkey via the Trans-Balkan line were in 2019.

-----

Earlier: