STOXX 600 DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

STOXX 600 DOWN

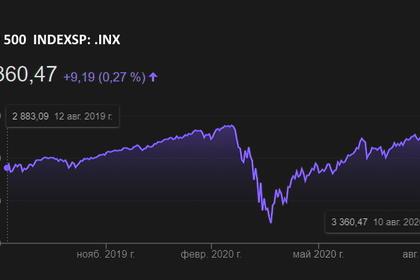

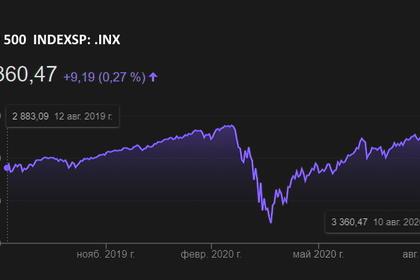

REUTERS- AUGUST 19, 2020 - European stocks slipped on Wednesday, failing to draw strength from a record run for Wall Street’s S&P 500, as investors feared a resurgence in coronavirus cases could dent a nascent economic recovery in the continent.

The pan-European STOXX 600 index was down 0.1% by 0715 GMT, with utilities, mining and oil and gas leading losses.

BP, Total and Royal Dutch Shell were down between 0.4% and 1% as crude prices slid on concerns about U.S. fuel demand.

Trillions in dollars of stimulus and a rally in technology stocks helped the S&P 500 confirm a bull market on Tuesday, but doubts over the strength of a global recovery from the health crisis limited gains across other markets.

Several countries in Europe imposed fresh travel curbs due to a pick-up in coronavirus cases.

German utility group RWE fell 5.2% as it launched a share issue to finance its purchase of wind turbine maker Nordex’s project development pipeline.

Shipping group Maersk jumped 5.6% as it reinstated full-year earnings guidance above its previous forecast.

-----

Earlier:

2020, August, 17, 12:40:00

CHINA'S SHARES UP

Chinese blue chips led the way with gains of 2.4%

2020, August, 11, 14:00:00

GLOBAL SHARES UP

A pan-European share index rose almost 1% , with auto shares leading the way after a surge in Chinese car sales and futures tipped a stronger Wall Street ESc1 open.

2020, August, 10, 11:30:00

GLOBAL STOCKS UP

The broader Euro STOXX 600 rose 0.6%

2020, August, 5, 12:00:00

CHINA'S SHARES UP

The Shanghai Composite index closed up 0.2% at 3,377.56.

2020, August, 4, 14:25:00

ASIA'S STOCKS UP

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1.05%

2020, July, 28, 11:25:00

CHINA'S STOCKS UP

China's Shanghai Composite index was up 0.7% at 3,227.96.

All Publications »

Tags:

STOCKS,

SHARES,

BONDS,

INDEXES