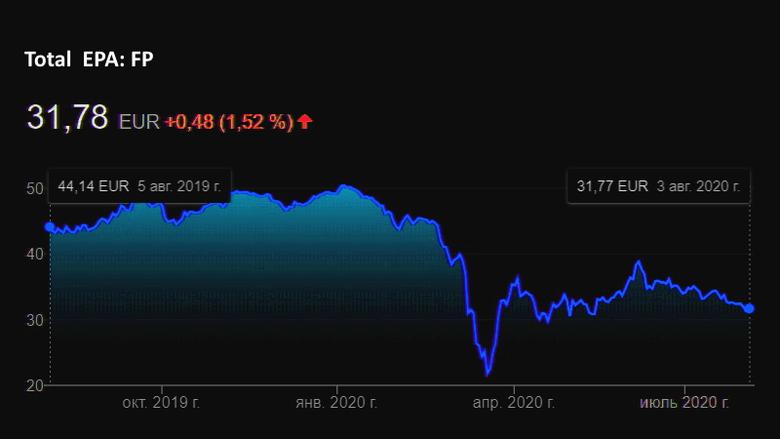

TOTAL NET INCOME $0.13 BLN

TOTAL - 30/07/2020 - SECOND QUARTER 2020 RESULTS

Total’s Board of Directors met on July 29, 2020, under the chairmanship of CEO Patrick Pouyanné to approve the Group’s second quarter 2020 financial statements. On this occasion, Patrick Pouyanné said:

« During the second quarter, the Group faced exceptional circumstances: the COVID-19 health crisis with its impact on the global economy and the oil market crisis with Brent falling sharply to 30 $/b on average, gas prices dropping to historic lows and refining margins collapsing due to weak demand.

OPEC+ production restraint, however, has contributed to the market recovery since June, with an average Brent price above 40 $/b. The discipline with which the countries implemented the quotas reduced the Group’s production by close to 100 kboe/d in the second quarter to 2.85 Mboe/d, and the Group now anticipates full - year production in the range of 2.9-2.95 Mboe/d in 2020.

Due to the significant slowdown of the European economy during the lockdown, the Group’s retail networks observed an average decrease in petroleum products demand on the order of 30% during the quarter, and the utilization rate at its European refineries fell to around 60%. However, June saw a rebound of activity in Europe to 90% of pre-crisis levels for the retail networks and 97% for its gas and electricity marketing business.

In this historically difficult context, the Group demonstrates its resilience, reporting $3.6 billion of cash flow, positive adjusted net income and a level of gearing under control. These results are driven in particular by the outperformance of trading activities, once again demonstrating the relevance of Total’s integrated model, and by the effectiveness of the action plan put in place from the start of the crisis, notably the discipline on spend.

Taking into account this resilience, the Board of Directors maintains the second interim dividend at €0.66 per share and reaffirms its sustainability in a 40 $/b Brent environment.

This quarter shows once again the quality of the Group’s portfolio with a breakeven below 25 $/b, benefiting from the strategy to focus on assets with low production costs, notably in the Middle East. Active portfolio management continues with the sale of non-operated assets in Gabon and the Lindsey refinery in the United Kingdom.

In the midst of these short-term challenges, the Group is resolutely implementing its new climate ambition, announced on May 5, 2020 with the entry into a giant offshore wind project in the North Sea as well as the acquisition in Spain of a portfolio of 2.5 million residential gas and electricity customers plus electricity generation capacity. Investments in low-carbon electricity will be close to 2 B$ and account for nearly 15% of Capex in 2020. In line with this ambition, the Group reviewed the assets that could have been qualified as “stranded assets”. The only assets concerned are the Canadian oil sands projects and the Board of Directors has decided to impair these assets in Canada for $7 billion.»

-----

Earlier: