2020-08-03 12:40:00

U.S. GAS PRODUCTION DOWN

U.S. EIA - July 31, 2020 - Natural Gas Monthly - Data for May 2020

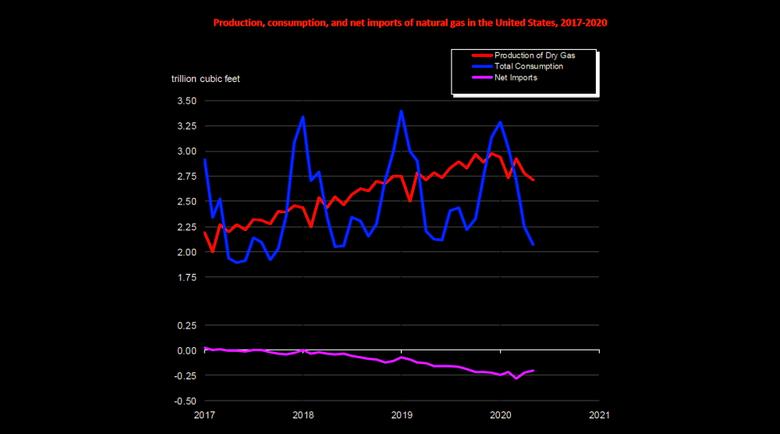

- In May 2020, for the first time in 36 months (since April 2017), dry natural gas production decreased year to year for the month. The preliminary level for dry natural gas production in May 2020 was 2,713 billion cubic feet (Bcf), or 87.5 Bcf/d. This level was 2.4 Bcf/d (-2.7%) lower than the May 2019 level of 89.9 Bcf/d. Despite this year-to-year decrease, the average daily rate of dry production was the second highest for the month since the U.S. Energy Information Administration (EIA) began tracking monthly dry production in 1973.

- Estimated natural gas consumption in May 2020 was 2,070 Bcf, or 66.8 Bcf/d. This level was 1.6 Bcf/d (-2.4%) lower than the 68.4 Bcf/d consumed in May 2019. Despite this year-to-year decrease, the average daily rate of natural gas consumption for May 2020 was the second highest for the month since EIA began using the current definitions for consuming sectors in 2001.

- The year-over-year average daily rate of consumption of dry natural gas in May 2020 increased in two of the four consuming sectors, and it decreased in the other two. Deliveries of natural gas by consuming sector in May 2020 were as follows:

- Residential deliveries: 238 Bcf for the month, or 7.7 Bcf/d

• Up 12.3% compared with 6.8 Bcf/d in May 2019. Residential deliveries were the second highest for the month since 2005. - Commercial deliveries: 164 Bcf for the month, or 5.3 Bcf/d • Down 11.8% compared with 6.0 Bcf/d in May 2019.

- Industrial deliveries: 621 Bcf for the month, or 20.0 Bcf/d • Down 7.7% compared with 21.7 Bcf/d in May 2019. Industrial deliveries were the lowest for the month since 2016.

- Electric power deliveries: 832 Bcf for the month, or 26.9 Bcf/d • Up 0.1% compared with 26.8 Bcf/d in May 2019. Electric power deliveries were the second highest for the month since EIA began using the current definitions for consuming sectors in 2001.

- Residential deliveries: 238 Bcf for the month, or 7.7 Bcf/d

- Net natural gas imports (imports minus exports) were -205 Bcf, or -6.6 Bcf/d, in May 2020, making the United States a net exporter. Natural gas imports and exports in May 2020 were as follows:

- Total imports: 189 Bcf for the month, or 6.1 Bcf/d

• Down 9.1% compared with 6.7 Bcf/d in May 2019. The average daily rate of natural gas imports was the lowest for the month since 1993. - Total exports: 395 Bcf for the month, or 12.7 Bcf/d • Up 7.0% compared with 11.9 Bcf/d in May 2019. The average daily rate of natural gas exports was the highest for the month since EIA began tracking monthly exports in 1973. Liquefied natural gas (LNG) continues to drive the year-on-year increase in exports. LNG exports in May 2020 were up 25.5% compared with May 2019. In May 2020, the United States exported 5.9 Bcf/d of LNG to 27 countries. The average daily rate of LNG exports was the highest for the month since EIA began tracking these rates in 1997.

- Total imports: 189 Bcf for the month, or 6.1 Bcf/d

-----

Earlier:

2020, July, 30, 12:20:00

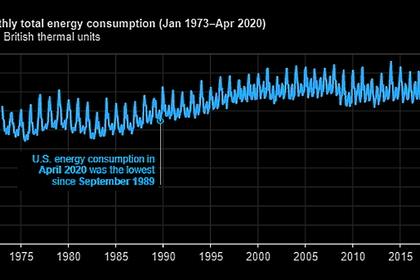

U.S. ENERGY CONSUMPTION DOWN

the United States consumed 6.5 quadrillion British thermal units of energy in April 2020,

2020, July, 27, 16:15:00

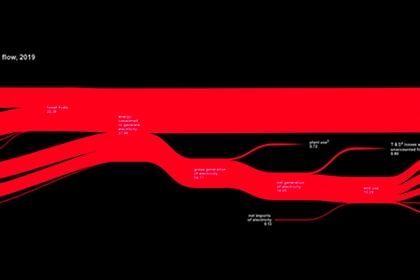

U.S. ENERGY CONVERSION LOSS

U.S. utility-scale generation facilities consumed 38 quadrillion British thermal units (quads) of energy to provide 14 quads of electricity.

2020, July, 14, 13:10:00

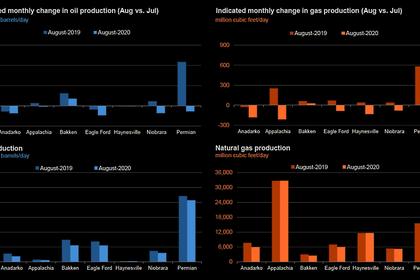

U.S. PRODUCTION: OIL (-56) TBD, GAS (-712) MCFD

Crude oil production from the major US onshore regions is forecast to decrease 56,000 b/d month-over-month in July from 7,546 to 7,490 thousand barrels/day, gas production to decrease 712 million cubic feet/day from 80,266 to 79,554 million cubic feet/day .

2020, July, 6, 10:55:00

U.S. ENERGY LOOSES

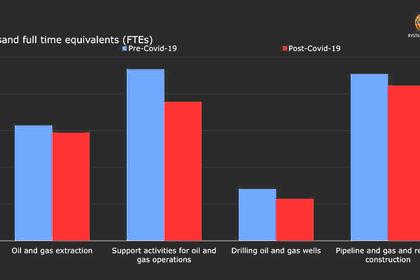

U.S. oil and gas extraction businesses shed 1,200 jobs last month.

2020, July, 6, 10:40:00

U.S. GAS KILLING

While long heralded as a cleaner alternative to coal and heating oil, gas is now getting shoved aside in the fight against climate change