U.S. LPG FOR ASIA UP

PLATTS - 12 Aug 2020 - US LPG cargoes slated to arrive in Asia in September are estimated around 2.05 million mt, traders said in the week of Aug. 9, adding to comfortable volumes from the Middle East.

This comes as demand from China and Indian is showing initial signs of recovery, while Indonesia is seeking term cargoes.

The balanced market is keeping CFR North Asia propane price for front-cycle H1 September delivery cargoes around one-week lows at $353/mt on Aug. 11, according to S&P Global Platts data, though exporters and traders hope for even stronger demand to mop up the incoming supplies.

Concerns over a closing US-to-Asia arbitrage for October-delivery cargoes, have again stoked discussions of possible cargo cancellations, traders said. Uncertainty over regional demand was heard to have prompted about eight cancellations of August-loading cargoes and five are being considered for September loading, traders said. However, despite the cancellations, exporters can still sell their cargoes on spot basis, they added.

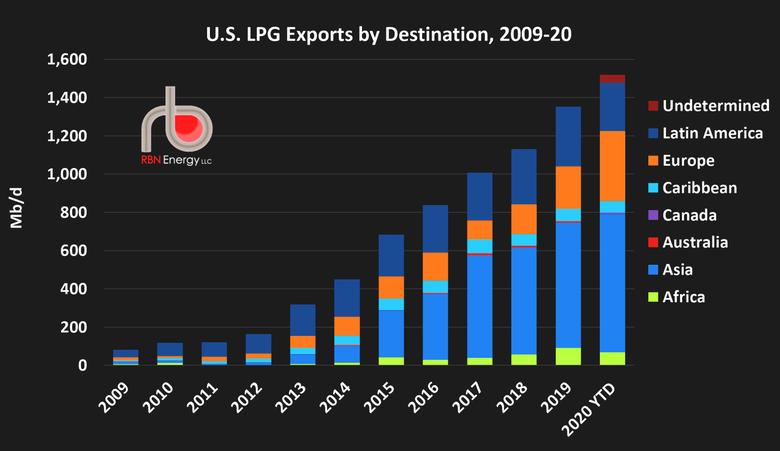

The September US cargo arrivals to Asia followed recent active loading activities at US export terminals, where in July, some 72 VLGCs were loaded for Asian and European markets, matching the record seen in April, ship brokerage Gibson said in a report dated Aug. 6. Sixty three VLGCs were loaded in May and 66 in June, the report said.

A Western trader said: "If September is only about 2 million mt, that is pretty big drop."

In contrast, around 2.8 million mt arrived in Asia in June and some 2 million mt in July, compared with monthly average shipments of 1.7 million mt in 2019. The lower shipments to Asia were attributed to more US propane being retained in the West, especially to Europe, given the firming naphtha-propane spreads in recent months.

Eyes on Saudi supply for September

The market is seeing advanced loading dates for September-loading term cargoes from Qatar Petroleum and UAE's ADNOC, while Saudi acceptances of September nominations are expected early next week and forecast without cuts. The market was also expecting some increase in Saudi exports on supply of deferred cargoes, while Kuwait has been regularly offering monthly spot cargoes lately.

On the swaps market, front-month September CP propane was valued Aug. 11 at $369.5/mt down $2/mt day on day, and was notionally indicated at $365.5/mt on August 12.

The difference between September FEI propane swaps – indicating the CFR market -- and Saudi CP – for the FOB market – was razor-thin at plus $2.50 on August 11, narrowing from $7.5/mt the previous session, Platts data show. The FEI/CP spread was notionally indicated at plus $3/mt on August 12, according to brokers.

While the FEI swap was still positive, the thin margin signaled that ample US supply competing with Middle Eastern cargoes for slowly recovering Asian demand, is keeping the arbitrage economics precarious, market sources said.

On July 29, the FEI/CP spread was in a discount of $4/mt, Platts data showed.

Traders said Indonesia's state-run Pertamina was still reviewing offers into its tender seeking four 44,000 mt evenly split LPG cargoes for loading over September–December 2020. This tender, which was converted into FOB US basis from CFR basis, closed last week and was valid till Aug. 7.

Traders said it might be difficult to get US cargoes on FOB basis, as freight rates are "too high", while the arbitrage is closing.

VLGC rates on the Houston-to-Chiba route hovered around more than four-month highs at $94/mt over July 31 to Aug. 10, before retreating to $92/mt on Aug. 11, Platts data showed.

Freight on the Ras Tanura-to-Chiba route hit a six-month high of $64/mt over Aug. 3-4, before easing to $63/mt on Aug. 11, Platts data showed.

-----

Earlier: