U.S. OIL MARKET UPDOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

U.S. OIL MARKET UPDOWN

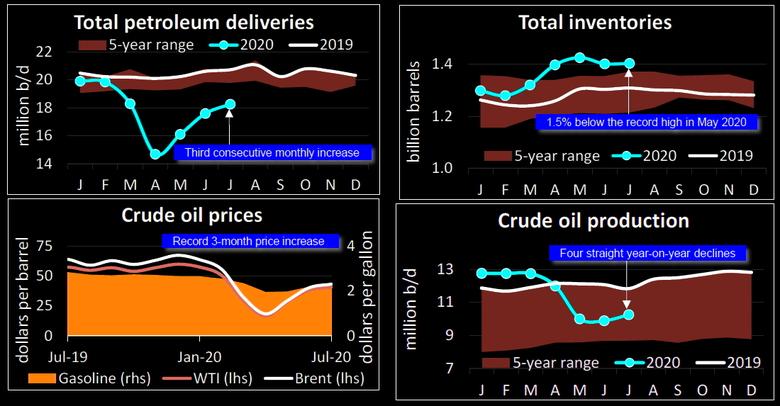

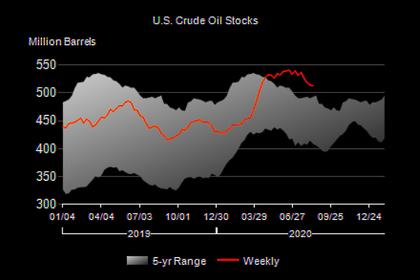

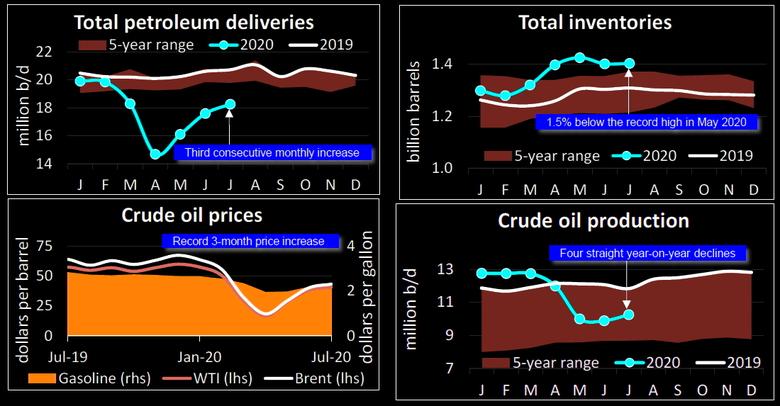

U.S. API - August 20, 2020 - U.S. petroleum markets continued to gradually improve in July with inventories backing down from record highs and demand posting its third consecutive monthly increase since April, according to data released today in the American Petroleum Institute’s July 2020 Monthly Statistical Report (MSR)

“Although the market remains uncertain, we saw encouraging signs in July with gradual rebalancing of oil supply and demand,” API Chief Economist Dean Forman said. “Increases in U.S. refinery throughput and capacity utilization in July – coupled with inventories receding from record highs – has reinforced expectations for the continued demand recovery.”

Led by motor gasoline, total U.S. petroleum demand rose to 18.3 million barrels per day (mb/d) in July, up 0.7 mb/d from the month prior but still down nearly 12 percent year-over-year. Meanwhile, jet fuel deliveries posted their second consecutive monthly increase, surging more than 44 percent between June and July and nearly 70 percent since May.

On the supply side, July marked the fourth consecutive month of year-on-year declines in U.S. crude oil production which averaged 10.3 mb/d for the month. The declines are consistent with the steep drop-off in oil-directed drilling activity, which has fallen to its lowest level since July 2009. By comparison, U.S. natural gas liquids production increased 3.8 percent in July to 4.9 mb/d in July – a record high for the month of July.

-----

Earlier:

2020, August, 24, 12:15:00

U.S. RIGS UP 10 TO 254

U.S. Rig Count is up 10 from last week at 254, Canada Rig Count is up 2 rigs from last week to 56

2020, August, 18, 12:30:00

U.S. PRODUCTION: OIL (-19) TBD, GAS (-421) MCFD

Crude oil production from the major US onshore regions is forecast to decrease 19,000 b/d month-over-month in August from 7,577 to 7,558 thousand barrels/day, gas production to decrease 421 million cubic feet/day from 79,684 to 79,263 million cubic feet/day .

2020, August, 17, 12:25:00

U.S. ENERGY RESILIENCE

The U.S. Technical Resilience Navigator (TRN) is a resilience planning tool that leads users through stakeholder engagement, organizational assessment, and ultimately, toward an actionable plan.

2020, August, 12, 14:00:00

U.S. FRACKING IS IMPORTANT

A ban on fracking may sound noble in some circles, but far from being a practical and permanent solution, it may pose significant impediments to energy generation in the United States and the national economy.

2020, August, 5, 12:10:00

U.S. OIL PRODUCTION DECREASING

Production of crude oil decreased in the United States in May 2020 by 1.99 million barrels per day (b/d)

2020, July, 30, 12:20:00

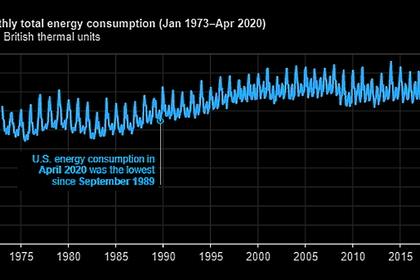

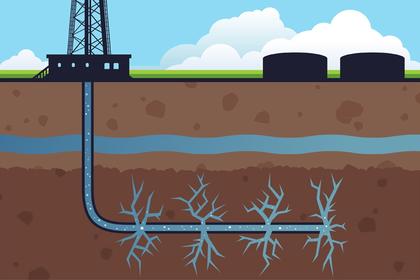

U.S. ENERGY CONSUMPTION DOWN

the United States consumed 6.5 quadrillion British thermal units of energy in April 2020,

All Publications »

Tags:

USA,

OIL,

DEMAND,

SUPPLY