ASIA'S INVESTMENT OPPORTUNITY $1 TLN

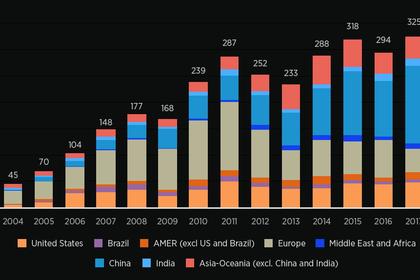

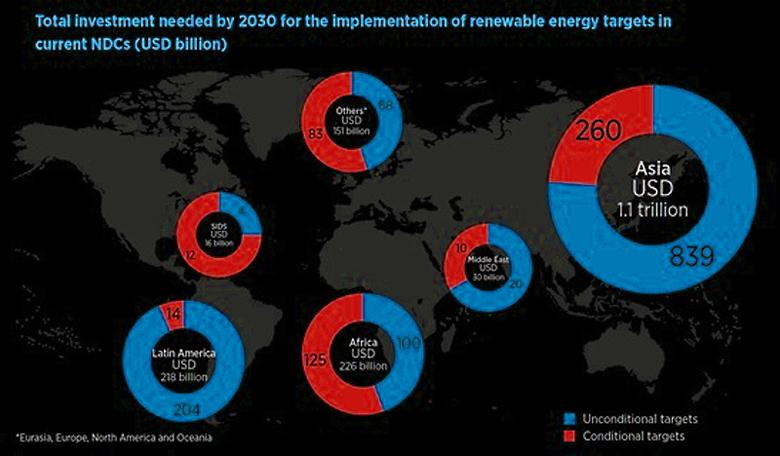

RENEWS - 8 September 2020 - Solar and wind represent a $1tn (€850bn) investment opportunity in Asia Pacific through 2030, equivalent to a 66% share of the region's power market, according to new data from Wood Mackenzie.

Fossil fuels, mainly coal and gas, make up the remaining $500bn.

Investments in renewables have overtaken fossil fuel power since 2013, the analyst outfit found.

Wood Mackenzie senior analyst Rishab Shrestha said the share of coal is falling and beyond 2030 gas will contribute 70% of fossil fuel investments with coal falling to 30%.

Shrestha said: "Traditionally, energy security and availability of low-cost coal are key drivers of coal investment in Asia.

"However, investment sentiment towards coal is waning as economies strive for a more sustainable and greener future.

"Coal investment will fall from its peak of $57bn in 2013 to $18bn by the end of the decade."

The region is also expected to add over 170GW of new power capacity annually in the next decade.

The pace of additions will accelerate from the mid-2020s and beyond 2030, Wood Mackenzie said.

Wood Mackenzie research director Alex Whitworth added: "The Asia Pacific region has entered a transition decade where wind and solar investment is expected to decline by 20% by 2025 from its peak in 2017."

Whitworth said "generous government subsidies" during the high-cost "renewable era" were key drivers of the previous growth period.

"In the next five years subsidies are being cut, grid constraints are increasing, and renewables investment is falling in key markets amidst more exposure to market forces. But even while some markets are hit hard, others develop rapidly," Whitworth added.

-----

Earlier: