AUSTRALIA'S STOCKS UP

REUTERS - SEPTEMBER 8, 2020 - Australian shares settled higher on Tuesday as sentiment was boosted by a report that banks would be required to take up more debt from the government to aid stimulus measures to combat the economic damage from the COVID-19 pandemic.

The S&P/ASX 200 index rose 1.1% to 6,007.8 at the close of trade, with U.S. S&P 500 futures up 0.5%.

Investors are probably looking forward to a possible rebound in U.S. stocks after a sell-off last week, said Henry Jennings, analyst at Marcustoday.

Australian banks will be required to buy up to A$240 billion ($175 billion) of new government debt to boost emergency liquidity levels, which will also cut government borrowing costs and help fund coronavirus stimulus spending, the Australian Financial Review reported on Tuesday.

"If the RBA is saying get out there and lend and get the economy moving, that's clearly a good sign for the banks - that the RBA has got their backs and is going to allow them to have some flexibility with capital requirements and balance sheets," Jennings said.

The country's "Big Four" banks — Commonwealth Bank of Australia, National Australia Bank, Australia and New Zealand Banking Group and Westpac Banking Corp - rose between 1.3% and 1.7%.

Markets shrugged off data that showed soft August business conditions data due to the Victoria lockdowns and weak employment figures over the month to Aug. 22.

Healthcare stocks finished 1.5% higher, with gains led by biotech company CSL, up 2.1%.

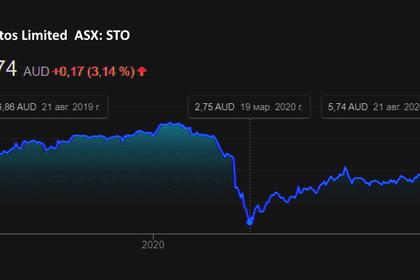

Industry heavyweights Woodside Petroleum and Santos gained 1.% and 1.8%, respectively, and led gains on the energy sub-index.

New Zealand's benchmark S&P/NZX 50 index rose 0.3% to finish the session at 11,895.63, with financial companies rising the most. ($1 = 1.3742 Australian dollars)

-----

Earlier: