BRITAIN'S HYDROGEN OPPORTUNITY

PLATTS - 09 Sep 2020 - Developing green hydrogen in the next five years will be critical to growing a significant UK manufacturing and export industry, a new report said Sept. 8.

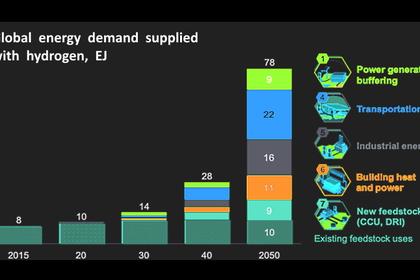

UK demand for hydrogen in 2050 is predicted at between 100 TWh and 300 TWh, of comparable scale to the UK's electricity system today.

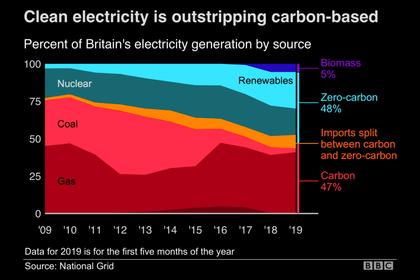

"With green hydrogen becoming as cheap as blue by the 2030s much of this could be produced by offshore wind and electrolysis," the Offshore Wind Industry Council and ORE Catapult said in the report, Solving the Integration Problem.

A combination of additional offshore wind deployment and electrolyser manufacture alone could create 120,000 jobs, replacing those lost in conventional oil and gas industries.

"The UK has outstanding offshore wind resource, with the potential for over 600 GW in UK waters, and potentially up to 1,000 GW, well above the figure of 75 GW-100 GW likely to be needed for UK electricity generation by 2050," the report said.

This opened the possibility of growing offshore wind beyond electricity needs, for production of renewable hydrogen for export, it said.

A green hydrogen industry based on renewables and electrolysis could be kick-started without waiting for operational carbon capture and storage, the report said.

Operational CCS is needed to produce blue hydrogen from steam methane reforming.

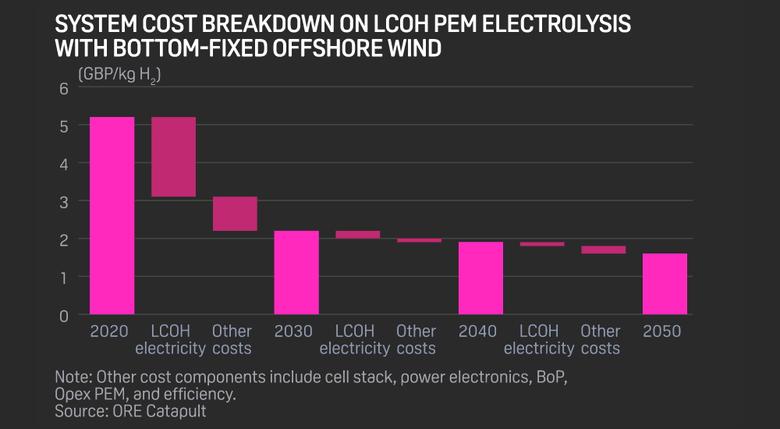

With accelerated deployment, green hydrogen costs could be competitive with those from natural gas-based production with CCS by the early 2030s, the report said, giving access to a GBP320 billion (cumulative gross value added) global market between now and 2050.

"This global market for equipment and hydrogen includes GBP250 billion of electrolyser exports. A further potential GBP48 billion from green hydrogen exports to Europe, would need an additional 240 GW of offshore wind," the report said.

Opportunities for further inward investment had been demonstrated in ITM Power and Ceres Power, with Siemens interested in investing in an electrolyser giga-factory in the UK, it said.

Cost forecasts

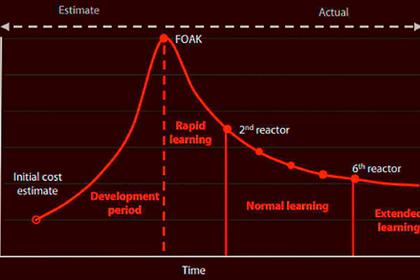

The report's scenario whereby green hydrogen becomes cheaper than blue hydrogen in the 2030s relied on accelerated deployment of electrolysis and various other favorable factors.

Without this green hydrogen (PEM electrolysis) costs would only be cheaper than blue hydrogen (SMR + CCS) around 2040, and cheaper that blue hydrogen (auto thermal reforming plus CO2) by 2050, report data showed.

In July Equinor said it was leading a project in the UK to develop one of the world's first "at-scale" facilities to produce blue hydrogen at Saltend Chemicals Park using auto thermal reforming.

Equinor -- one of the biggest suppliers of gas to the UK -- said that subject to supportive government policy, it would mature the project toward a final investment decision during 2023 with potential first production by 2026.

"Blue hydrogen is cheaper than green hydrogen, and for green hydrogen to actually work, it is very dependent on overcapacity in renewables," Equinor CFO Lars Christian Bacher said July 24.

The initial phase of the Saltend project would comprise a 600-MW auto thermal reformer with carbon capture, the largest plant of its kind in the world.

Hydrogen production capacity for such a plant would be around 125,000 mt a year.

It would enable industrial customers in the industrial park to fully switch over to hydrogen, and the on-site power plant to move to a 30% hydrogen to natural gas blend.

Note: for SMR 90% CO2 capture was assumed while for ATR 97%. The gas cost was assumed conservatively to reach £23/MWh by 2050. All costs normalized to 2012 values

Source: ORE Catapult

-----

Earlier: