EUROPE'S CLIMATE DEPENDENCE

FT - AUGUST 31 2020 - The EU's over-reliance on imports of critical raw materials threatens to undermine crucial industries and expose the bloc to supply squeezes by China and other resource-rich countries, the European Commission will warn member states this week.

Shortages of elements used to make batteries and renewable energy equipment could also threaten the bloc's target of becoming climate neutral by 2050, a report by the Brussels executive will say.

The document is part of an urgent focus in Europe on security of imports of vital goods, as the coronavirus pandemic triggers transport disruption and growing tensions between western capitals and Beijing.

"The pandemic has revealed Europe's dependencies in certain products, critical materials and value chains," Thierry Breton, EU industry commissioner, told the Financial Times.

"The era of a conciliatory or naive Europe that relies on others to look after its interests is over."

The emerging strategy prioritises securing the supply of a list of raw materials critical to European industries through exploration, investment and improved recycling.

The EU estimates that to meet its climate neutrality goal, it will need up to 18 times more lithium and five times more cobalt in 2030. The forecasts rise to 60 times more lithium and 15 times more cobalt by 2050.

The list has been expanded to 30 materials from 27 in 2017, adding four metals while removing the gas helium, the FT has learnt.

The updated tally highlights growing concerns over China's dominance in markets for common industrial metals, adding to longstanding worries over Beijing's control of many "rare earth" elements used in consumer electronics and wind turbines. Bauxite — the main aluminium ore — and titanium, which is heavily used in the aerospace industry, have both been added.

As much as 93 per cent of the EU's magnesium, which is used in products ranging from car seats to laptops, comes from China, according to the Commission. Brazil, ruled by Jair Bolsonaro, the populist president, supplies 85 per cent of the European bloc's niobium, a crucial part of steel alloys used in jet engines, girders and oil pipelines.

All but 2 per cent of EU borate supplies, used in fire retardants and the oil industry, come from Turkey, with which the bloc has an increasingly tense relationship under President Recep Tayyip Erdogan.

"As we come to an increased understanding of the importance of these materials, we are also entering a moment of increasingly politicised trade ties," said Kristine Berzina, a senior fellow at the German Marshall Fund of the United States.

"The EU should take lessons from its long struggle with dependence on Russia for energy and act as a unified bloc, rather than individual states."

While countries including the US and Australia have conducted similar strategic raw materials audits, Europe's dependency problems are greater because it lacks their abundant mineral deposits.

The EU's green agenda has driven the addition of strontium and lithium to the critical materials list. Strontium is used in magnets for electric cars, while lithium — like cobalt, which remains on the list from 2017 — is crucial to rechargeable batteries.

China dominates processing of all of these materials before they go into batteries, making European carmakers reliant on Chinese suppliers. While more than 60 per cent of the cobalt comes from the Democratic Republic of Congo, for example, more than 80 per cent is refined in China before being turned into battery chemicals. For lithium, almost all of the supply from Australia, the largest producer, is processed in China.

"Europe can reduce its import dependency, it can support domestic mining — but it's very unlikely in the critical battery raw materials that it will ever be self-sufficient," said Andy Leyland, an analyst at Benchmark Mineral Intelligence, a consultancy.

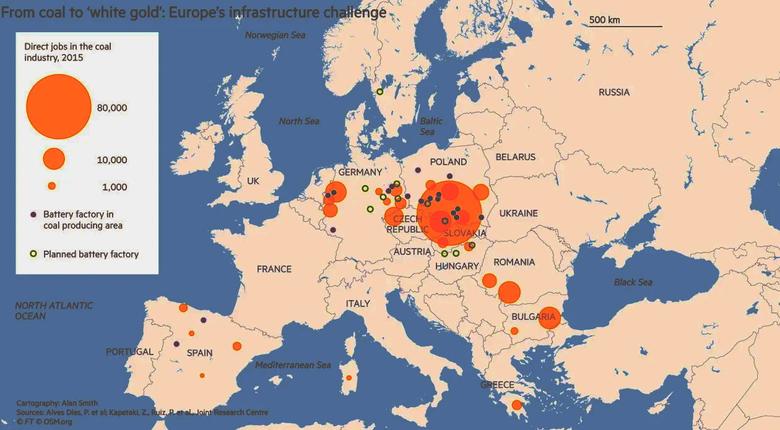

The European Investment Bank has pledged to invest €1bn to support a pan-European battery industry, including financing raw-materials extraction and processing, and the new classifications will help funnel investments.

"If you want the EU to fund your project they will have a number of boxes to tick . . . and [one is] if it is a critical raw material that you're producing," said Vincent Pedailles of Infinity Lithium, which is waiting for a permit to develop a mine in Spain.

The commission plans to launch an EU raw materials alliance, based on existing ventures to promote the development of advanced battery and hydrogen fuel technologies. Bolstering supply security for rare earth metals and elements used in magnets will be among the initial priorities, as will promoting investment and innovation within Europe. Brussels also plans to promote recycling of vital elements and, where possible, greater production in the EU. One possible measure will be to use the EU’s Copernicus earth observation satellite to find new resources and manage existing ones. The commission’s concerns chime with those of many member states who are promoting companies involved in strategic raw material production. But the proposals are bound to reignite the debate on how much ramping-up or reshoring of production in the EU is possible — or desirable, given the environmental damage that comes with big mining projects.

-----

Earlier: