GLOBAL NUCLEAR ENERGY UPDOWN

WORLD NUCLEAR INDUSTRY STATUS REPORT - 28 SEPTEMBER 2020 -

EXECUTIVE SUMMARY AND CONCLUSIONS

The World Nuclear Industry Status Report 2020 (WNISR2020) provides a comprehensive overview of nuclear power plant data, including information on age, operation, production, and construction of reactors. A new focus chapter in this year's report is Nuclear Power in the Age of COVID-19 that assesses the safety and security implications of operating nuclear facilities in a pandemic and provides a country-by-country overview of available information on staff infections, impacts and measures. Another special focus is the chapter on Nuclear Power in the Middle East that analyses the significance of the first operating nuclear power plant in the Arab world and the status of nuclear programs in five other countries in the region.

The WNISR assesses the status of new-build programs in the 31 nuclear countries (as of mid-2020) as well as in potential newcomer countries. WNISR2020 includes sections on seven Focus Countries representing about two-thirds of the global fleet. The Fukushima Status Report looks at onsite and offsite impacts of the catastrophe that began in 2011. The Decommissioning Status Report provides an overview of the current state of nuclear reactors that have been permanently closed. The chapter on Nuclear Power vs. Renewable Energy offers comparative data on investment, capacity, and generation from nuclear, wind and solar energy around the world. Finally, Annex 1 presents overviews of nuclear power in the countries not covered in the Focus Countries sections.

REACTOR STARTUPS & CLOSURES

Startups.

At the beginning of 2019, 13 reactors were scheduled for startup during the year; only six made it, three in Russia, two in China and one in South Korea. No new reactor started up worldwide in the first half of 2020, including in China.

Closures.

Five units were closed in 2019, of which two in the U.S., and one each in Germany, Sweden and Switzerland. Eight additional reactors were officially closed in Japan (5), Russia (1), South Korea (1) and Taiwan (1); most of these had not generated power in years.7 In the first half of 2020, three additional units were closed, two in France and one in the U.S.

OPERATION & CONSTRUCTION DATA

Reactor Operation and Production.

As of 1 July 2020, 31 countries operating 408 nuclear reactors—excluding Long-Term Outages (LTOs)—a decline of nine units compared to WNISR2019—10 less than in 1989 and 30 fewer than the 2002 peak of 438. Of the 28 reactors in LTO as of mid-2019, one was restarted, and one was closed; with five units entering the LTO category, there is, as of mid-2020, a total of 31 units in LTO as of mid-2020, all considered operating by the International Atomic Energy Agency (IAEA). These include 24 reactors in Japan (no change), three in the U.K., two in South Korea, and one each in China and India.

The total operating capacity declined by 2.1 percent from one year earlier to reach 362 GW as of mid-2020.

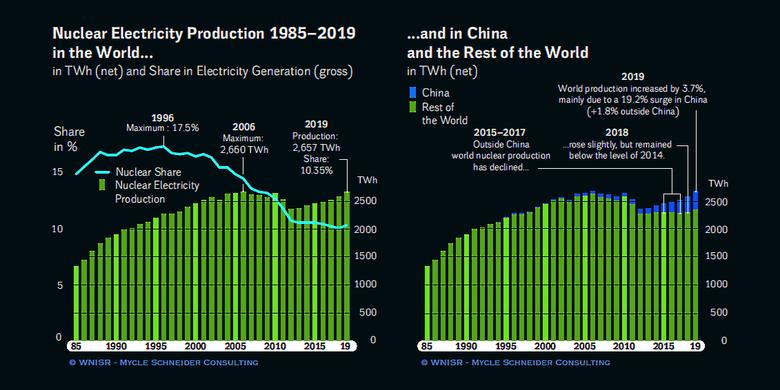

Annual nuclear electricity generation reached 2,657 net terawatt-hours (TWh or billion kilowatt-hours) in 2019, a 3.7 percent increase over the previous year—half of which is due to China's nuclear output increasing by over 19 percent—and only 3 TWh below the historic peak in 2006.

The "big five" nuclear generating countries—by rank, the United States, France, China, Russia and South Korea—again generated 70 percent of all nuclear electricity in the world in 2019. Two countries, the U.S. and France, accounted for 45 percent of 2019 global nuclear production, that is 2 percentage points lower than in the previous year, as France's output shrank by 3.5 percent.

Share in Electricity/Energy Mix.

Nuclear energy's share of global commercial gross electricity generation has marked a break in its slow but steady decline from a peak of 17.5 percent in 1996, with a small 0.2 percentage-point increase over the 10.15 percent in 2018 to 10.35 percent in 2019.

Nuclear power's share of global commercial primary energy consumption has remained stable since 2014 at around 4.3 percent.

Reactor Age.

In the absence of major new-build programs apart from China, the average age of the world operating nuclear reactor fleet continues to rise, and by mid-2020 reached 30.7 years. The mean age of the world's fleet has been increasing since 1984, when it stagnated.

A total of 270 reactors, two-thirds of the world's operating fleet, have operated for 31 or more years, including 81 (20 percent of the total) that have operated for 41 years or more.

Lifetime Projections.

If all currently operating reactors remained on the grid until the end of their licensed lifetime, including many that already hold authorized lifetime extensions (PLEX Projection), and all units under construction scheduled to have started up, an additional 135 reactors or 105 GW (compared to the end‑of‑2019 status) would have to be started up or restarted prior to the end of 2030 in order to maintain the status quo. This would mean, in the coming decade, the need to more than double the annual building rate the past decade from 5.8 to 13.7. Construction starts are on a declining trend. The required number of new units might be even higher because many reactors are being shut down long before their licenses are terminated; the mean age at closure of the 17 units taken off the grids between 2015 and 2019 was 42.4 years.

Construction.

Seventeen countries are currently building nuclear power plants, one more than in mid-2019, as Iran restarted construction of Bushehr-2 site, originally launched in 1976. As of 1 July 2020, 52 reactors were under construction—six more than WNISR reported for mid-2019 but 17 fewer than in 2013—of which 15 in China with 14 GW of capacity, less than half of the 5-Year target of 30 GW under construction by the end of 2020.

Total capacity under construction in the world increased by 8.9 GW to 53.5 GW. The current average time since work started at the 52 units under construction is 7.3 years, on the rise for the past two years from an average of 6.2 years as of mid-2017. Many units are still years away from completion.

- All reactors under construction in at least 10 of the 17 countries have experienced mostly year-long delays. At least 33 (64 percent) of all building projects are delayed.

- Of the 33 reactors clearly documented as behind schedule, at least 12 have reported increased delays and four have reported new delays over the past year.

- Thirteen reactors were scheduled for startup during 2019, but only six made it.

- Construction start of two projects dates back 35 years, Mochovce-3 and -4 in Slovakia, and their startup has been further delayed, currently to 2020–2021. Bushehr-2 originally started construction in 1976, that is 44 years ago, and resumed construction in 2019 after a 40-year-long suspension. Grid connection is currently scheduled for 2024.

- Five reactors have been listed as "under construction" for a decade or more: the Prototype Fast Breeder Reactor (PFBR) in India, Olkiluoto-3 (OL3) in Finland, Shimane-3 in Japan, the Flamanville-3 (FL3) in France, and Leningrad 2-2 in Russia. The Finnish project has been further delayed this year, grid connections of the French and Indian units are likely to be postponed again, and the Japanese reactor does not even have a provisional startup date.

- Nine countries completed 63 reactors—with 37 in China— over the past decade, with an average construction time (start to grid connection) of 10 years.

CONSTRUCTION STARTS & NEW-BUILD ISSUES

Construction Starts.

In 2019, construction began on six reactors—four in China and one each in Russia and the U.K.—and in the first half of 2020 on one (in Turkey). These were the first construction starts of commercial reactors in China since December 2016. This compares to 15 construction starts in 2010 and 10 in 2013. Construction starts peaked in 1976 at 44.

Over the decade 2010–2019, construction began on 67 reactors in the world. As of mid-2020, only 18 have started up, while 44 remain under construction (5 cancelled).

Construction Cancellations.

Between 1970 and mid-2020, a total of 93— one less than in WNISR2019 as Bushehr-2 restarted construction in 2019—that is one in eight of a total of 773 constructions were abandoned or suspended in 19 countries at various stages of advancement.

NUCLEAR POWER IN THE AGE OF COVID-19

COVID-19 is the first pandemic of this scale in the history of nuclear power. Nuclear utilities have been fast to point to the "crucial" role nuclear power played during the pandemic as a source of electricity. But the picture is more complex, with various safety and security routines becoming more difficult or impossible during a pandemic:

- Periodic and frequent testing is usually done at systems to provide assurance that vitally important functions like the emergency control room operations, emergency electricity supply or emergency core cooling are in good working order.

- Normally periodic testing and inspections are performed under the four-eyes principle (at least two people have to be always present), which becomes challenging if social distancing is followed.

- Particular staff groups, like control-room personnel, with specific knowledge and qualification for specific facilities cannot easily be replaced.

- Emergency situations like a fire or toxic gas buildup in the control-room could easily be exacerbated by the need of social distancing; the challenge is even greater in the emergency control-room.

- Infections amongst security staff, a limited number of highly trained forces for specific facilities, could rapidly lower the protection level.

Infections, and Operator Response Strategies.

Systematic national reporting on infections amongst nuclear staff did not happen anywhere, with the remarkable exception of Russia's Rosatom, whose Director General made weekly video presentations on the evolution of active cases and recovered persons.

- Russian Rosatom graphic illustrations indicate a total of about 4,500 infections in the group, with 1,200 still recovering as of the end of July 2020.

- Only a handful of infections have been reported from nuclear facilities in Japan and South Korea.

- French utility EDF in mid-June 2020 indicated around 600 cases amongst the nuclear staff over a 12-week period, reaching around 2 percent at the peak of the pandemic.

- The Swedish regulator reported "few cases" but did not give numbers.

- At the U.K. Sellafield site about 1,000 employees self-isolated and the reprocessing plant was shut down. At least one EDF Energy employee died of COVID-19 at the Hinkley Point C construction site but no numbers have been published about tested/infected staff.

- In the U.S., several nuclear power plant sites have reported up to dozens of infected staff (e.g. Limerick, Waterford). At the Millstone reactor, three operators were amongst those that tested positive. An outage at Fermi-2 may have led to 200-300 infections. Operator DTE Energy refused to disclose exact numbers.

While numerous fuel-chain and research facilities were shut down, no country reported an enforced shutdown of a nuclear power plant. Various measures were taken, including:

- Operators dramatically reduced staff levels in nuclear plants, e.g. in France, 15,000 employees (two thirds) of EDF's Nuclear Generation Division were put on telework. Reduced staff levels led to a lack of oversight of subcontractors.

- Regulators granted operators permission to impose strikingly long work hours. For example, in the U.S., workers could work for up to 16 work hours in any 24-hour period and up to 86 work hours in any 7-day period or 12-hour shifts for up to 14 consecutive days.

- In some cases, e.g. in Russia and Sweden, control-room staff and essential personnel were isolated, and/or onsite housing was provided for workers during outages (also in the U.S.).

- Social distancing and remote working practices have been employed widely, but implementation seems to have varied in degrees of speed and rigor. In some cases, trade unions have reported practices very different from operator declarations, complaining about lack of masks and insufficient social distancing. In France, workers walked off at least three reactor sites considering their health and safety were not appropriately protected.

- Force-on-force exercises in the U.S. as well as many other security and safety training-sessions in several countries have been suspended during the pandemic, leading to a degraded readiness level.

- In many cases, refueling and maintenance outages have been altered to eliminate "non-critical work" or were deferred entirely to the end of the year or even into 2021. In some cases, like at Germany's Grohnde and Spain's Trillo-1, outages have been stretched out to allow for a lower density of workers.

- In some cases, e.g. at Canada's Darlington-3 or Romania's Cernavoda-1, planned major overhaul has been rescheduled. In France, the installation of emergency diesel generators at five reactors was delayed for a second time, to February 2021, two years after the first delay was granted.

- The pace of construction in at least 12 of the current 17 countries building nuclear reactors has been impacted, but apparently only in Argentina construction activities were entirely halted (on CAREM-25). A large outbreak took place at the Vogtle plant in Georgia, the only nuclear construction site in the U.S., where over 800 staff tested positive, with over 100 still affected as of late August 2020. As of late May 2020, about 100 cases were reported at the Belarus Ostrovets site.

Infections, and Regulator Response Strategies.

Very little information has been made public about infections at national safety authorities and their Technical Support Organizations (TSOs). Some examples of infection levels and measures include:

- French regulator ASN claims that as of early August 2020 not a single staff person had tested positive. In late April 2020, the French TSO IRSN said 59 were "contaminated or likely to be", all of whom recovered, but strangely another IRSN spokesperson said in early September 2020 that only nine people were actually tested positive and only 13 total of 1,800 staff were tested at all. Apparently, neither ASN nor IRSN have systematic testing programs in place.

- Safety authorities and their TSOs in several countries (e.g. Canada, Finland, France, U.S.) decided to halt site visits (except in cases of emergency). ASN carried out about 6 percent of the number of inspections it carries out on average under normal circumstances. IRSN also entirely suspended environmental sampling.

- Regulators generally have been very "pragmatic" and "flexible" in their decision-making and approved most operator requests for exemptions, exceptions and deferrals.

- Degradation of Safety and Security. Nuclear officials in international organizations, industry groups, utilities and regulatory authorities have claimed in one way or another that all these measures were taken "while maintaining the required level of safety", as ASN put it. The U.K. Office for Nuclear Regulation (ONR) found "no significant change to dutyholders' safety and security resilience".

This confidence is difficult to comprehend because working conditions have clearly deteriorated in many nuclear facilities, because scheduled repair and upgrading work was often not carried out or delayed for many months, and operators of many nuclear power plants in the world were left without any physical regulatory oversight as inspectors stayed home. So not only valves, joints, pipes and weldings were not checked by the operators as planned, but no physical inspection actually made sure that operators were doing what they said they were doing. Considering the long list of fraud cases in the industry (for a selection see Introduction to Nuclear Power in the Age of COVID-19), fully operational independent regulators and their TSOs remain a crucial ingredient to nuclear safety and security.

Even if the pandemic were to slow down—there is of course no guarantee that no second wave hits nuclear countries—the situation will take time to significantly improve. Operators and regulators will be struggling to get back to operational modes that are closer to normality, leave alone catching up on all of the delayed activities, which will likely take several years.

In addition, bulk prices plunged as operational costs went up, bulk prices dropped and electricity consumption plunged. The financial viability of some of these utilities may be at stake. Indispensable cost cutting exercises will further exacerbate the pressure.

This is far from over.

MIDDLE EAST FOCUS

On the occasion of the first nuclear power plant entering the operational phase in an Arab country, i.e. Barakah in the United Arab Emirates (UAE), WNISR provides an overview of the nuclear energy ambitions of six countries in the Middle East: Iran, UAE, Turkey, Egypt, Saudi Arabia and Jordan (ordered by level of program advancement).

The region mainly depends on natural gas for electricity generation with five of the six assessed countries generating more than half of their power from gas; of these, three countries (Egypt, Jordan, UAE) rely on gas for more than 75 percent of the electricity.

Iran has one reactor in operation and another one under construction as well as various activities along the nuclear fuel chain. UAE has started up one unit in early August 2020, while three more reactors remain under construction. Turkey has two units under construction. As for Egypt, Saudi Arabia and Jordan, nuclear plans are more or less advanced, but no construction has yet begun. Egypt, Jordan and Turkey are struggling with high debt loads and unfavorable credit-ratings (highly speculative or "junk"). This makes capital-intensive investments like nuclear power particularly challenging, unless financing assistance from vendor countries is provided. While Egypt and Turkey have benefited from Russian financial assistance, Jordan is yet to obtain any financial aid.

Iran

- Construction had been disturbed by decades-long suspensions. Even after construction of Bushehr-1 had restarted in 1996, the project was plagued by delays and connected to the grid only in 2011, 35 years after construction first started, 15 years after construction restart.

- Production remains modest and in 2019, Bushehr-1 represented less than 2 percent of electricity generation in the country.

- According to official estimates, Iran's solar capacity potential is a stunning 40 TW (40,000 GW).

United Arab Emirates

- Construction of the Barakah plant by the Korean Electric Power Corp. (KEPCO) is about three years behind schedule. Barakah-1 was planned to start up in 201714, with Units 2, 3 and 4 following each other with one-year distance. Amongst the reasons for delays were construction problems (cracks/voids in the containment) and difficulties in establishing a local, trained operator workforce.

- Cost comparisons between the nuclear and solar options show:

• The official cost estimate of Barakah power of US$72/MWh in 2012 was below the lowest level of Lazard's international cost range for the year of US$78–114;

• A Power Purchasing Agreement (PPA) for a 1.2 GW solar photovoltaic capacity signed in 2017 at US$24.2/MWh; the plant was connected to the grid in 2019.

• Earlier in 2020, a solar power bid was made by EDF/Jinko for 1.5 GW at US$13.5/MWh, five times lower than the no doubt underestimated original cost of Barakah power and 9–14 times below Lazard's nuclear cost estimate for 2019 of US$118–192/MWh.

Turkey

- Construction at Akkuyu-1 was launched by Russian builder Rosatom in April 2018 followed by Akkuyu-2 in April 2020. Startup for the first unit was planned for 2023, which is unlikely to happen. The Akkuyu project has been in the planning since the 1970s and was delayed countless times. The construction itself was hampered with technical problems including cracks identified in the basemat that had to be repaired. Nuclear power has met with fierce opposition, nationally and locally, concerned about nuclear safety, earthquake risks and negative social impacts. Two thirds of Turkish people polled opposed nuclear power in a 2018 survey.

- Cost comparisons between the nuclear and solar options show that in 2018 solar PPAs came in at US$65/MWh, almost half the cost for nuclear electricity estimated in 2012.

Jordan

- Project Planning. Eleven years after the first feasibility study for nuclear energy, in 2018, Jordan pulled the plug on any project for large nuclear power plants and focused planning on Small Modular Reactors (SMRs). After signing cooperation agreements with potential vendors from China, Russia, U.K. and the U.S. no further progress has been made.

- Cost comparisons between the nuclear and solar options show a 2012-nuclear-cost estimate at around US$100, compared to a 2017-PPA for 50 MW solar at US$59/MWh connected to the grid in late 2019, and a bid at US$25/MWh in 2018. The country set a 20-percent target from renewable sources in the power mix for 2025.

Egypt

- Project Planning. The Egyptian Atomic Energy Commission was established in the mid-1950s and the idea of building nuclear power plants was explored as early as the mid-1970s. But it took until 2016 to sign a loan agreement with Russia for the construction of four Rosatom reactors. In March 2019, a site permit was issued for Dabaa on the Mediterranean cost. Construction is planned to begin in 2020.

- Cost comparisons show a 2015-estimate for nuclear power at US$110/MWh vs. a 2019-PPA for solar power at US$24.8/MWh, four times cheaper. In 2016, the Government set a 37-percent-share target for renewables in the electricity mix by 2035 vs. 3 percent for nuclear energy.

Saudi Arabia

- Project Planning. In 2018, the Government approved a nuclear program of two reactors to be built in the 2020s, and possibly more later. However, no vendor has been chosen and no site selected. The Government has also been interested in the development of domestic uranium mining and enrichment for fuel. The country has also shown interest in the development of SMR technology, without much tangible progress so far.

- Cost comparisons between the nuclear and renewable energy options are not possible because there are no cost estimates for nuclear power. However, a PPA for solar power at US$16/MWh, signed in 2016, underlines the competitiveness of photovoltaic electricity in the region.

FOCUS COUNTRIES

The following seven Focus Countries covered in depth in this report represent almost one fourth of the nuclear countries hosting about two-thirds of the global reactor fleet. Key facts for year 2019:

China.

Nuclear power generation grew by 19.2 percent in 2019 and contributed 4.9 percent of all electricity generated in China, up from 4.2 percent in 2018. Plans for future expansion remain uncertain.

Finland.

Nuclear generation reached a new record in 2019. The Olkiluoto-3 EPR project was delayed yet again, and, according to an announcement from April 2020, "regular production of electricity" will not happen before February 2022; that constitutes nearly two years of additional delay since the previous announcement only one year earlier, and 13 years after the original planned startup date.

France.

Nuclear plants generated 3.5 percent less power than in 2018, representing 70.6 percent of the country's electricity, the lowest share in 30 years. Outages at zero capacity cumulated 5,580 reactor-days or more than three months per reactor on average. All outages at 54 of the 58 units were extended beyond the planned duration, leading to an average 44-percent increase of the outage time. A damning report by the Court of Accounts slams the lack of government oversight of the Flamanville-3 EPR construction project that is at least 10 years behind schedule and recalculated the cost at over €201519 billion (US$202020 billion) including financing.

Japan.

Nuclear plants generated more power than in any year since Fukushima disaster began in 2011 and provided 7.5 percent of the electricity in 2019. As of mid-2020, nine reactors had restarted but that number has not increased since mid-2018. Four units were taken off the grid again in mid-2020 for various reasons, and power output is expected to drop by up to half in 2020. A large bribery scandal involving KEPCO management including the president rattled the industry.

South Korea.

Nuclear power output recovered by 9 percent after a decline of 19 percent since 2015 and supplied 26.2 percent of the country's electricity. If adopted, a draft energy bill under review would further reduce nuclear's role to providing just 10 percent of power by 2034.

United Kingdom.

Nuclear generation decreased again and provided only 14 percent of the power in the country, down from 17.7 percent in 2018. The fleet's aging units, over 36 years on average, are struggling with many technical issues, in particular irreparable damage to moderator graphite bricks leading to lengthy outages of the Advanced Gas-cooled Reactors (AGRs). Three units newly qualified for the LTO category. While construction officially started at Hinkley Point C-2, prospects for other new-build projects remain uncertain.

United States.

Nuclear power plants generated a new historic maximum of 809 TWh (+1.4 TWh), while their share in the electricity mix remained below 20 percent (19.7 percent). The continuous excellent productivity of the ageing U.S. fleet, average age 40 years, is intriguing and contrary to the performance of other early programs. The NRC issued its first license extension to 80 years. But nuclear units have increasing difficulties to economically compete in the market. State subsidies have been granted to four uneconomic nuclear plants to avoid their "early closure". Following the revelation of an unprecedented corruption scheme in Ohio, involving the State's Speaker of the House, two of these "bailouts" might be reversed. Many other units remain threatened with early closure for economic reasons. A series of other criminal affairs involving the nuclear industry were revealed over the past two months.

SMALL MODULAR REACTORS (SMRs)

Following assessments of the development status and prospects of Small Modular Reactors (SMRs) in WNISR2015 and WNISR2017, this year's update does not reveal great changes.

Argentina.

The CAREM-25 project under construction since 2014 is reportedly 55 percent complete. A significant construction interrupted work in November 2019 complaining about late payments and design changes. COVID-19 led to a complete construction stop.

Canada.

Three provincial Governments have embraced the idea to promote SMRs for remote communities and mining operations. Various models are being investigated. The environmental impact assessment process for the proposed first demonstration high temperature reactor is underway.

China.

A high-temperature reactor under development since the 1970s has been under construction since 2012. Startup has been delayed several times and is now planned for 2021, four years later than scheduled.

India.

An Advanced Heavy Water Reactor (AHWR) design has been under development since the 1990s, and its construction start is getting continuously delayed. No major news since WNISR2019.

Russia.

Two "floating reactors" were finally connected to the grid in December 2019. As construction started in 2007, it took about four times as long as planned. The costs were estimated at US$740 million in 2015 (likely underestimated) or US$11,600 per installed kilowatt, significantly more expensive than the most expensive Generation III reactors.

South Korea.

The System-Integrated Modular Advanced Reactor (SMART) has been under development since 1997. In 2012, the design received approval by the safety authority, but nobody wants to build it in the country, because it is not cost-competitive.

United Kingdom.

Rolls-Royce is the only company interested in participating in the Government's SMR competition but has requested significant subsidies, including for investing in a factory. The Rolls-Royce pre-design is at a very early stage but, at 440 MW, it is not really small. As of 1 September 2020, the design was not even under examination by the regulator.

United States.

The Department of Energy (DOE) has generously funded companies promoting SMR development. A single design by NuScale is in the final stage of the design certification process.17 However, the Nuclear Regulatory Commission and the Advisory Committee on Reactor Safeguards identified some significant safety problems that will have to be resolved in the future.

Overall, there are few signs that would hint at a major breakthrough for SMRs, either with regard to the technology or with regard to the commercial side.

FUKUSHIMA STATUS REPORT

Over nine years have passed since the Fukushima Daiichi nuclear power plant accident (Fukushima accident) began, triggered by the East Japan Great Earthquake on 11 March 2011 (referred to as 3/11 throughout the report) and subsequent events. The onsite situation is still not stabilized and numerous offsite challenges remain.

Onsite Challenges

Spent Fuel Removal from the pool of Unit 3 started in April 2019. Only about one fifth had been removed one year on. Units 1 and 2 have not gotten beyond the preparatory stage.

Fuel Debris Removal is now planned to start with Unit 2 by 2021. Further delays are likely.

Contaminated Water Management.

Water injection continues to cool the fuel debris of Units 1–3. Highly contaminated water runs out of the cracked containments into the basements where it mixes with water that has penetrated the basements from an underground river. The commissioning of a dedicated bypass system and the pumping of groundwater has reduced the influx of water from around 400 m3/day to about 170 m3/day. However, in FY2019, pumped contaminated water increased again to 180 m3/day. An equivalent amount of water is partially decontaminated and stored in 1,000‑m3 tanks. Thus, a new tank is needed every 5.5 days. The storage capacity onsite of 1.4 million m3 is expected to be saturated by the end of 2022. Plans to release the contaminated water into the ocean are widely contested, including overseas.

Worker Health.

As of March 2020, there were 7,000 workers involved in decommissioning work on-site, 87 percent of whom were subcontractors; only the remaining 13 percent worked for Tokyo Electric Power Company (TEPCO). Maximum effective dose levels accepted for subcontractors turned out eight times higher than for TEPCO employees.

Offsite Challenges

Amongst the main offsite issues are the future of tens of thousands of evacuees, the assessment of health consequences of the disaster, the management of decontamination wastes and the costs involved.

Legal Issues.

In September 2019, the Tokyo District Court acquitted three former TEPCO top managers accused of professional negligence resulting in injury or death. The ruling was widely condemned as flawed, and the lawyers for the plaintiffs have filed an appeal to the Tokyo High Court.

Evacuees.

As of April 2020, almost 39,000 Fukushima Prefecture residents—not including "self-evacuees"—were still officially designated evacuees. According to the Prefecture, the number peaked just under 165,000 in May 2012. The Government intends to continue the lifting of restriction orders for affected municipalities. However, according to a recent survey, only 1.8 percent of the people returned to Okuma Town and 7.5 percent to Tomioka Town.

Health Issues.

Officially, as of February 2020, a total of 237 people had been diagnosed with a malignant tumor or suspected of having a malignant thyroid tumor and 187 people underwent surgery. While the cause-effect relationship between Fukushima-related radiation exposure and illnesses has not been officially established, questions have been raised about the examination procedure itself and the processing of information. However, a 2019-study concludes that "the average radiation dose-rates in the 59 municipalities of the Fukushima prefecture in June 2011 and the corresponding thyroid cancer detection rates in the period October 2011 to March 2016 show statistically significant relationships".

Food Contamination.

According to official statistics, among over 266,000 samples taken in FY 2020, a total of only 157 food items were identified as being contaminated beyond legal limits. As of March 2020, post-3/11 import restrictions remain in place in 20 countries (three less than a year earlier).

Decontamination.

The contaminated soil in the temporary storage area in Fukushima Prefecture is currently being transferred to intermediate storage facilities in eight areas. As of June 2020, around 56 percent of the total amount of 14 million m3 had been shipped. The soil is to be processed through various stages of volume reduction before being shipped to a final repository.

DECOMMISSIONING STATUS REPORT – SOARING COSTS

As more and more nuclear facilities either reach the end of their pre-determined operational lifetime or close due to deteriorating economic conditions, their decommissioning is becoming a key challenge.

- As of mid-2020, 189 reactors were closed, eight more than a year earlier, of which 169 are awaiting or are in various stages of decommissioning.

- Only 20 units have been technically fully decommissioned, one more than a year earlier: 14 in the U.S., five in Germany, and one in Japan. Of these, only 10 have been returned to greenfield sites.

- The average duration of the decommissioning process is about 20 years, with a large range from 6–42 years.

- Progress in decommissioning projects around the world remains slow. In France, the two Fessenheim reactors entered the warm-up stage and Superphénix entered the hot-zone stage. In Germany four reactors advanced to the hot-zone stage, while one additional reactor entered the warm-up-stage. In the U.S., two more reactors entered the warm-up stage, while one plant finished the technical decommissioning process.

- Although they were early to start nuclear power programs, Canada, France, Russia and U.K. have not fully decommissioned even one reactor so far.

NUCLEAR POWER VS. RENEWABLE ENERGY DEPLOYMENT

Renewable energy deployment and generation has better resisted the impacts of the COVID-19 pandemic than the nuclear power sector. In the first quarter of 2020, renewables increased output by an estimated 3 percent and its relative share in global generation rose by 1.5 percentage points, while nuclear output fell by about 3 percent.

Costs.

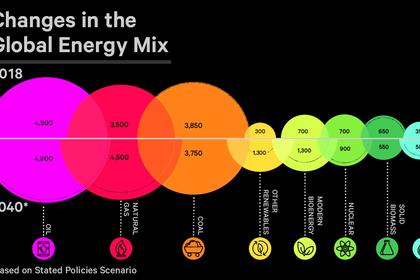

Levelized Cost of Energy (LCOE) analysis shows that between 2009 and 2019, utility-scale solar costs came down 89 percent and wind 70 percent, while new nuclear costs increased by 26 percent. The gap has continued to widen between 2018 and 2019.

Investment.

In 2019, for the third time after 2015 and 2017, the total investment in renewable electricity exceeded US$300 billion, almost ten times the reported global investment decisions for the construction of nuclear power of around US$31 billion for 5.8 GW. Investment in nuclear power is less than a quarter of the investment in wind (US$138 billion) and solar (US$131 billion) individually. China remains the top investor in renewables, spending US$83 billion in 2019, down 9 percent compared to 2018.

Installed Capacity.

In 2019, a new record 184 GW (+20 GW) of non-hydro renewables were added to the world's power grids. Wind added 59.2 GW and solar‑photovoltaics (PV) 98 GW, both slightly below the 2017-levels. These numbers compare to a net 2.4 GW increase for nuclear power.

Electricity Generation.

In 2019, annual growth for global electricity generation from solar was 24 percent, for wind power about 13 percent and 3.7 percent for nuclear power, half of which is due to China.

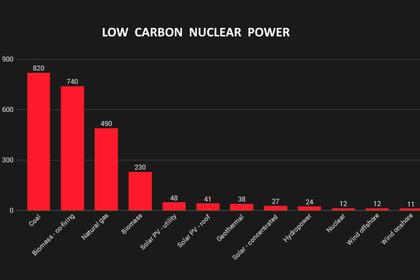

Low-Carbon Power.

Compared to 1997, when the Kyoto Protocol on climate change was signed, in 2019 an additional 1,418 TWh of wind power was produced globally and 723 TWh of solar PV electricity, compared to nuclear's additional 394 TWh. Over the past decade, non-hydro renewables have added more kilowatt‑hours than coal or gas, twice as many as hydropower, and 22 times as many as nuclear plants.

Share in Power Mix.

After experiencing the strongest annual growth on record, the share in power generation from new renewables (excluding hydro) reached 10.39 percent, surpassing nuclear energy's share (10.35 percent) for the first time.

In China, electricity production of 406 TWh from wind alone again by far exceeded the 330 TWh from nuclear, while solar power is already at 224 TWh.

In India, generation from wind power (63 TWh) outpaced nuclear again, but for the first time, generation from solar energy (46 TWh) exceeded the nuclear output of 41 TWh.

In the European Union, solar installed capacity for the first time exceeded the nuclear one in the EU28 with 130 GW vs. 116 GW. Wind had outpaced nuclear already in 2014 and has since enlarged the gap. Renewables (incl. hydro) generated a record 35 percent of electricity, while nuclear provided 25.5 percent. Hard coal generated electricity declined by an unprecedented 32 percent and lignite power by 16 percent, while natural gas increased by 12 percent. Wind power output grew by 14 percent and solar by 7 percent, while nuclear declined by 1 percent.

In the United States, electricity generation from coal plunged to a 42-year low, and in April 2019, for the first time since 1885, the renewable energy sector (hydro, biomass, wind, solar and geothermal) generated more electricity than coal-fired plants. While nuclear energy's share stayed stable, it is set to decline. With three reactors closed in 2019–1HY2020, and more closures expected, the nuclear capacity is shrinking. In 2019, for the first time, installed wind power exceeded installed nuclear capacity with 104 GW vs. 98 GW. Over the past decade, wind + solar have quadrupled combined electricity generation while nuclear production has not moved.

-----

Earlier: