JAPAN OIL IMPORTS DOWN

PLATTS - 31 Aug 2020 - Japan's crude oil imports during the peak summer demand season in July tumbled to their lowest level for the month in more than five decades, a stern reminder to major crude producers that Asia's third biggest petroleum consumer may struggle to register any meaningful oil demand recovery during the pandemic.

Japan's July crude imports, which were the lowest for the month since 1967, plunged 31.9% year on year to 2.09 million b/d, according to preliminary data released Aug. 31 by the Ministry of Economy, Trade and Industry.

The reduced crude imports came as Japanese refiners slashed shipments from key Middle Eastern crude suppliers on a yearly basis in July, and amid a sharp decline in imports from other suppliers, including zero intakes from the US and Indonesia.

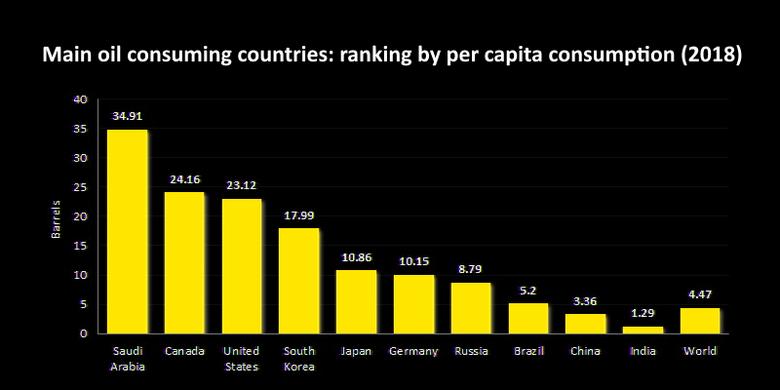

In July, Japan's crude imports from Saudi Arabia and the UAE, its two top suppliers, dropped 8.7% and 22% year on year to 928,930 b/d and 710,912 b/d, respectively. The combined imports accounted for 78.4% of the total imports in the month.

Crude imports from Qatar, the third largest supplier, plummeted 46.5% year on year to 159,962 b/d in July, while imports from Kuwait, the fourth largest supplier, dropped 34.8% on the year to 141,781 b/d.

The significant reduction in non-Middle Eastern crude imports in July, however, helped lift the share of crude oil imports from the Persian Gulf region to 95.2%, the highest the market share has been since records began in 1950.

Weak demand calls for price cuts

Middle Eastern sour crude supply has increased from Aug. 1 after OPEC+ members on July 15 pared back their production cut commitment.

However, the recent slew of tepid crude import data from Northeast Asia would raise alarm bells among major Persian Gulf producers, with many Asian refiners determined not to abruptly boost crude imports and refinery run rates as fuel demand recovery remains fragile across the region, industry officials and trading sources said.

There is a good chance that official selling prices could be cut for Middle Eastern crudes loading in October, as the recovery in the Platts Dubai market structure stalled in recent trading cycles amid fragile Asian oil demand and tepid refining margins, refinery officials and crude trading managers in Asia told S&P Global Platts.

The spread between the front-month Cash Dubai and same-month Dubai swaps averaged at minus 65 cents/b so far in August, compared with an average of 71 cents/b in July, Platts data showed.

The Dubai crude market structure is understood to be a key component in Saudi Aramco's OSP calculations.

Saudi Aramco is expected to cut October OSP differentials for Asia-bound crude by $1-$2/b, and ADNOC by 80 cents-$1.20/b, according to multiple Asian refiners surveyed by Platts in the week of Aug. 24. Both companies are expected to release their October OSPs in the coming days.

Keeping refinery runs low

The July crude imports, however, rose 9.4% from 1.91 million b/d in June, with demand for some of refined products showing month-on-month recoveries.

Japan's gasoline sales rose 4.7% month on month to 818,701 b/d in July, although it was down 6.1% from a year ago, marking the lowest level for the month since 1990, METI data showed.

Domestic jet fuel sales increased 25.2% month on month to 61,636 b/d in July as more domestic flights took to the skies from July 1.

Still, local refiners were cautious about overcommitting to crude procurement and crude distillation unit run rates, promoting fuel suppliers to turn toward importing more oil products, as opposed to producing the fuel themselves.

Japan's oil product imports jumped 23.2% year on year and 7.5% month on month to 623,650 b/d in July, while local refiners slashed their crude throughput by 30.6% from a year ago to 2.098 million b/d.

Japan was a net importer of gasoline for the fourth consecutive month in July due to low refinery run rates and a month-on-month recovery in domestic sales.

Japan imported an average of 90,534 b/d of gasoline in July, up 73.4% from a year earlier and 18.3% from June, while it exported 13,892 b/d of gasoline during the month.

Japan's oil products demand in July improved month on month, with narrower year-on-year contraction. However, the resurgence of COVID-19 cases in August could slow the pace of demand recovery due to re-imposition of restriction measures in some areas, oil markets adviser at S&P Global Platts Analytics JY Lim said.

Lim expects Japan's oil demand to drop by 330,000 b/d in 2020, with the assumption of GDP contracting by 5% this year.

-----

Earlier: