NORWAY'S, U.S. OIL FUND

FT - SEPTEMBER 21, 2020 - Norway is proposing that the world's largest sovereign wealth fund plough more money into US equities in what would be the second big shift away from European investments in less than a decade.

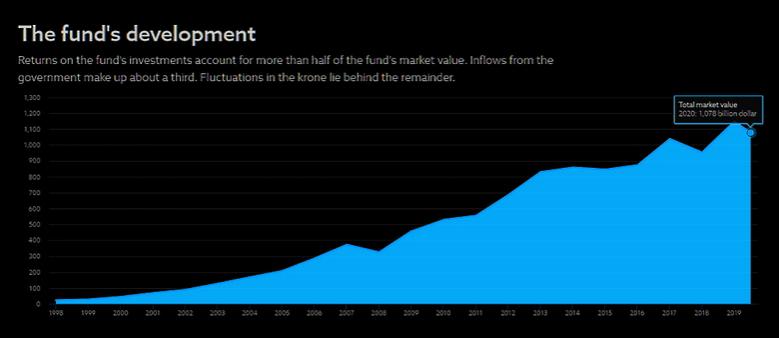

The country's centre-right government laid out plans on Monday to change the $1tn oil fund's reference index for equities, which is currently heavily tilted towards European investments.

If adopted by the Norwegian parliament, the changes would mean the fund — the biggest single investor in the world, owning on average 2.5 per cent of every listed company in Europe and 1.5 per cent of every global stock — would reduce its equity exposure in Europe from 33 per cent to 26.5 per cent. Its exposure to North America would rise from 41.6 per cent to 48 per cent while remaining stable to other developed and emerging markets.

Based on the fund's market value in equities of NKr7,145 ($775bn) at the end of 2019, it would imply $50bn of European equities being sold in favour of a similar amount in North American stocks.

"The changes we are proposing will ensure the investments better represent the distribution of value creation in listed companies globally," said Jan Tore Sanner, Norway's minister of finance.

The move would mark the second big rebalancing away from Europe in recent years. At the height of the eurozone debt crisis in 2012, Norway changed the fund's exposure which had been 50 per cent to Europe, 35 per cent to North America and 15 per cent to Asia.

Norway's oil fund was originally set up to mirror as closely as possible the trading patterns of the Scandinavian country's economy, which has strong trading ties with Europe. But over time the fund itself has advocated being more exposed to economies beyond Europe.

However, Norway's government, in its annual white paper on the fund, which was delayed from a spring release because of the coronavirus crisis, declined to recommend changing the fund's exposure to faster-growing emerging markets.

The government noted that emerging markets had more volatile returns "and are to a significant degree characterised by weaker institutions, less transparency and weaker protection of minority shareholders". It added: "Such country-specific issues make maintaining the role as a responsible investor more challenging."

The minority government also pushed back against allowing the oil fund more leeway in investing in unlisted companies. Currently, the only exception to its focus on stock market-listed groups is if the company is planning on an imminent initial public offering. However, controversy still surrounds the fund's decision in 2012 to invest in the company behind Formula One racing just before an IPO that was suddenly cancelled.

Norwegian politicians have repeatedly rebuffed attempts by the fund to invest more widely in private companies, something that the investor has argued is needed to keep pace with the rise of a technology sector where large companies are often staying off stock markets for longer than previously.

-----

Earlier: