OFFSHORE WIND ASSETS UP

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OFFSHORE WIND ASSETS UP

REUTERS - SEPTEMBER 10, 2020 - BP signed a $1.1 billion deal with Norway's Equinor on Thursday for a 50% stake in two U.S. offshore wind developments.

Analysts say the offshore wind sector provides a good route to scale for oil companies, which have recently announced lofty renewable power capacity targets as they try to curb dependence on fossil fuels and reach their climate goals.

Below is a round-up of other deals this year by European oil majors in the sector, in alphabetical order:

EQUINOR

Equinor and Japan's Jera and Electric Power Development Co (J-Power) formed a consortium to jointly submit a bid for offshore wind power projects in Akita, northern Japan.

SHELL

Shell and Dutch energy firm Eneco won a joint tender for a 750 megawatt (MW) Dutch offshore wind project to be built by 2023.

TOTAL

French energy group Total and Macquarie's Green Investment Group entered a partnership to develop five large floating offshore wind projects in South Korea

The projects have a potential joint capacity of around 2.3 gigawatts (GW), and Total and Macquarie aim to start construction of the first project of around 500 MW by the end of 2023. No financial details were revealed.

Total this year also acquired a 51% stake in SSE's Seagreen 1 British offshore wind farm project.

Total paid 70 million pounds ($91 million) upfront, with earn-outs up to 60 million pounds in aggregate, subject to performance. The 1,075 MW project should be completed in 2022-2023.

-----

Earlier:

2020, September, 7, 11:05:00

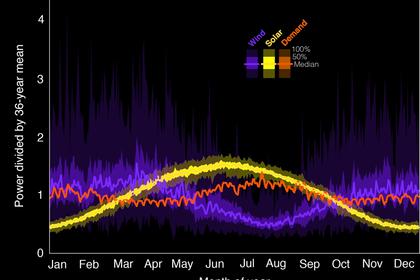

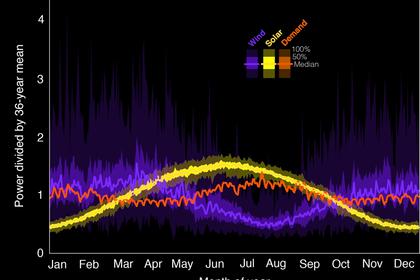

VOLATILITY OF RENEWABLES

Some renewable systems, such as solar and wind, are inherently intermittent.

2020, August, 14, 11:45:00

WIND, SOLAR UP DOUBLE

The data showed wind and solar power increased 14% in the first half of 2020

2020, August, 13, 13:25:00

RENEWABLES FOR EUROPE

According to this research, three options could be pursued individually or in combination to achieve this goal: Offshore wind power, large solar parks, and roof-top solar systems.

All Publications »

Tags:

OFFSHORE,

WIND,

RENEWABLE