OIL DEMAND WILL UP BY 6.6 MBD

OPEC - 14 September 2020 - Monthly Oil Market Report

Oil Market Highlights

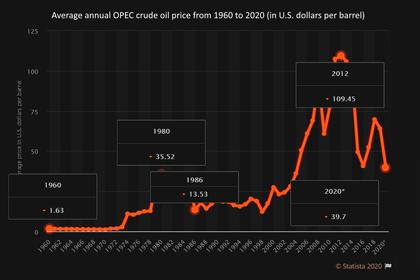

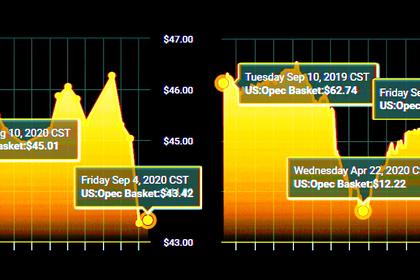

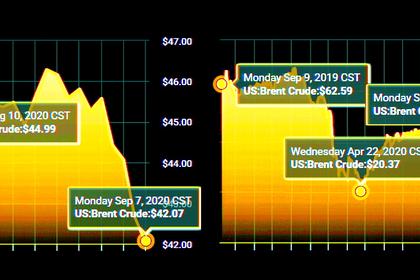

Crude Oil Price Movements

Crude oil spot prices extended gains in August, reaching a six-month high. The OPEC Reference Basket (ORB) value rose in August, increasing more than other spot references. On a monthly basis, the ORB increased by $1.77 to $45.19/b, up by 4.1%. Crude oil futures prices rose further in August by about 4% m-o-m, supported by positive market sentiment, steadily improving market fundamentals, positive economic indicators, and a weaker US dollar. On a monthly average, the ICE Brent front month rose by $1.80, or 4.2%, to average $45.02/b, while NYMEX WTI increased by $1.62, or 4.0%, to average $42.39/b. The price structures of the three main futures markets moved into a deeper contango. Hedge funds and other money managers showed no clear positioning trend in August amid the uncertain outlook on economic and oil demand recovery. The sweet/sour crude differential remained narrow in all markets.

World Economy

The global economic growth forecast is revised down to -4.1% for 2020 from -4.0% in the previous month, amid a further slowing momentum in especially emerging and developing economies. GDP growth in 2021 remains unchanged at 4.7%. The US is revised up slightly and forecast to contract by 5.1% in 2020, followed by growth of 4.1% in 2021. The Euro-zone is revised up as well and forecast to contract by 7.7% in 2020, but grow by 4.3% in 2021. Japan is revised down and forecast to contract by 5.5% in 2020 and recover to 3.2% in 2021. China's 2020 GDP growth remains at 1.8% followed by growth of 6.9% in 2021. India's 2020 growth forecast is revised down further from -4.6% to -6.2%, followed by growth of 6.8% in 2021. Brazil's 2020 GDP growth is revised up to -6.5%, before rebounding to 2.4% in 2021. Russia's 2020 forecast is revised down to -4.9%, while it is expected to recover in 2021 with a level of 2.9%. In addition to COVID-19-related developments, numerous uncertainties remain, including high debt levels, inflation, ongoing geopolitical risks, trade-related challenges, as well as the possibility of a hard Brexit.

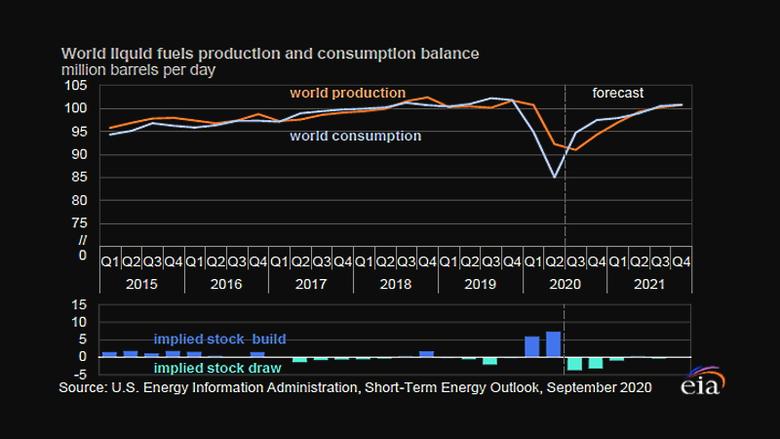

World Oil Demand

In 2020, the global oil demand contraction is revised down further by 0.4 mb/d, now contracting by 9.5 mb/d, to average 90.2 mb/d. In the OECD, demand is revised higher by around 0.1 mb/d due to lesser-than-expected declines in all sub-regions during 2Q20. In the non-OECD, the 2020 oil demand outlook is revised lower by around 0.5 mb/d, due to weaker oil demand performance in Other Asia, particularly in India. Turning to 2021, the negative impact on oil demand in Other Asia is projected to spill over into 1H21. At the same time, a slower recovery in transportation fuel requirements in the OECD will limit oil demand growth potential in the region. Additionally, risks remain elevated and skewed to the downside, particularly in relation to the development of COVID-19 infection cases and potential vaccines. Furthermore, the speed of recovery in economic activities and oil demand growth potential in Other Asian countries, including India, remain uncertain. As such, 2021 world oil demand is now forecast to grow by 6.6 mb/d, some 0.4 mb/d lower compared with the previous month's assessment to average 96.9 mb/d.

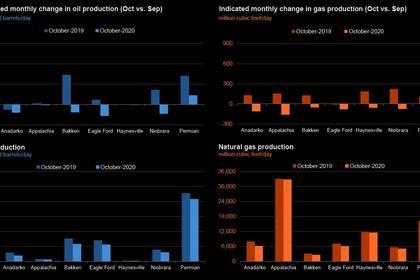

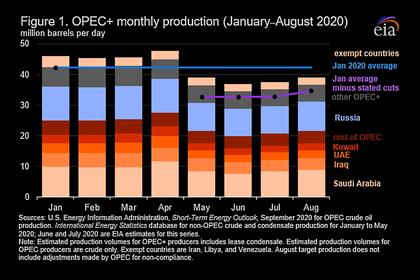

World Oil Supply

The non-OPEC liquids production forecast in 2020 is revised up by 360 tb/d, due to a higher-than-expected recovery in the US in June, which added 1.0 mb/d m-o-m, and now contracting by 2.7 mb/d, y-o-y. A production recovery has already begun in the US, Canada and Latin America in 3Q20, although Hurricane Laura partially impacted production in the US Gulf of Mexico (GoM). The main declines in 2020 are expected to be in the US with 1.0 mb/d, Russia with 1.1 mb/d and Canada. The non-OPEC liquids production forecast for 2021 is adjusted up by 371 tb/d and now is expected to grow by 1.0 mb/d. The US with 0.4 mb/d, Canada, Brazil and Norway will be the main drivers of growth. OPEC NGLs are estimated to decline by 0.1 mb/d, y-o-y, in 2020, with the preliminary 2021 forecast indicating growth of 0.1 mb/d, averaging 5.2 mb/d. OPEC crude oil production in August increased by 0.76 mb/d m-o-m to average 24.05 mb/d, according to secondary sources.

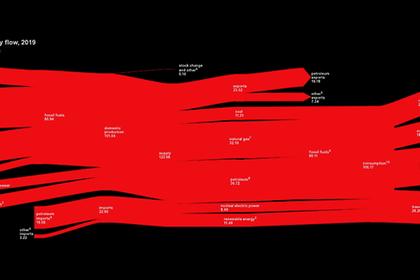

Product Markets and Refining Operations

In August, refinery margins globally witnessed a trend reversal and lost ground due to a growing surplus of products, as seen by higher product inventory levels. Consequently, product markets at the top and middle sections of the barrel weakened, particularly in Europe where refining economics hit record-breaking lows and remained barely positive, despite the positive performance at the bottom of the barrel witnessed in all regions.

Tanker Market

Dirty tanker rates in August settled at lowest levels seen since the end of June, and are likely to remain at these new levels for the coming months, amid ample tonnage and sluggish demand for tankers. Floating storage continued to unwind, removing the support to the high rates observed in recent months. Clean tanker freight rates picked up from the poor performance seen in the previous month, but remained below levels seen in the same month last year due to continued sluggish demand for product trade flows.

Crude and Refined Products Trade

Preliminary data shows US crude imports declined further in August, averaging 5.5 mb/d, approaching the quarter-century low seen in April of this year. US crude exports edged up last month, turning positive after five months of declines, to average 2.9 mb/d, well below the peak of 3.7 mb/d seen in February 2020. The latest monthly data showed continued strong flows of US crude to China in June, down from the massive 1.3 mb/d seen in May but still strong at 0.7 mb/d. China crude imports averaged the second-highest on record at 12.1 mb/d in July, down from a record high of 13.0 mb/d in the previous month. Customs data shows a further scale-back in crude imports in August to around 11.2 mb/d, but still 13% higher than last year's levels. Product imports fell sharply in July, down from an all-time high in May 2020, as naphtha and fuel oil imports contracted. Product exports edged lower with declines in gasoil and jet fuel outweighing an increase in gasoline. India crude inflows in July fell below 3.0 mb/d for the first time in more than a decade, following a sixth consecutive monthly decline. The decline came as state-run refiners maintained runs at 75% of capacity compared to 90% in June. Preliminary tanker tracking data points to a slight recovery in crude imports in August. Japan's crude imports picked up in July after bottoming out at the lowest in more than a decade the month before.

Commercial Stock Movements

Preliminary July data showed that total OECD commercial oil stocks fell by 4.5 mb m-o-m. At 3,231 mb, they were 273.7 mb higher than the same time a year ago and 260.6 mb above the latest five-year average. Within the components, crude stocks went down by 9.7 mb m-o-m, while product stocks increased by 5.3 mb m-o-m. OECD crude stocks stood at 95.6 mb above the latest five-year average, while product stocks showed a surplus of 165.1 mb. In terms of days of forward cover, OECD commercial stocks fell by 1.2 days m-o-m in July to stand at 72.2 days. This was 10.8 days above the July 2019 level and 9.9 days above the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2020 is revised down by 0.7 mb/d from the previous month to stand at 22.6 mb/d, around 6.7 mb/d lower than in 2019. Demand for OPEC crude in 2021 is revised down by 1.1 mb/d from the previous month to stand at 28.2 mb/d, around 5.5 mb/d higher than in 2020.

-----

Earlier: