OIL PRICE: BELOW $46 AGAIN

REUTERS - SEPTEMBER 1, 2020 - Oil prices rose on Tuesday, reversing overnight losses against the backdrop of an equities bull run and a sliding U.S. dollar.

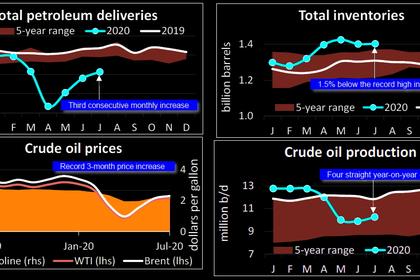

Brent crude LCOc1 futures climbed 61 cents to $45.89 a barrel by 1124 GMT. U.S. West Texas Intermediate (WTI) crude CLc1 futures rose 53 cents, hitting $43.14 a barrel.

The dollar was at it lowest in more than two years against a basket of currencies .DXY, pressured by the U.S. Federal Reserve's loosening of inflation policy last week, making dollar-priced commodities cheaper for global buyers.

Strong Chinese manufacturing data also lifted oil prices, said Jeffrey Halley, a senior market analyst at OANDA.

The Caixin/Markit Manufacturing Purchasing Managers' Index(PMI) showed China's factory activity expanded at the fastest pace in nearly a decade last month, bolstered by the first increase in new export orders this year.

Bulls also pushed up equities, with the MSCI world equity index .MIWD00000PUS close to a record peak on Tuesday.

Yet oil, which often moves in tandem with equities, remains reigned in by demand concerns.

PVM analyst Tamas Varga said oil prices are likely to move below recent levels, citing sizeable downward revisions to second-half demand estimates by the International Energy Agency and the Organization of the Petroleum Exporting Countries (OPEC).

In a Reuters poll of 43 analysts and economists, global oil demand was seen contracting by between 8-10 million barrels per day versus July's 7.2-8.5 million bpd consensus.

Brent was forecast to average $42.75 a barrel in 2020, up from July's $41.50 consensus and compared with an average price of $42.60 so far this year. Brent is expected to average $50.45 in 2021.

The 2020 U.S. crude CLc1 price outlook rose to $38.82 per barrel from July's $37.51.

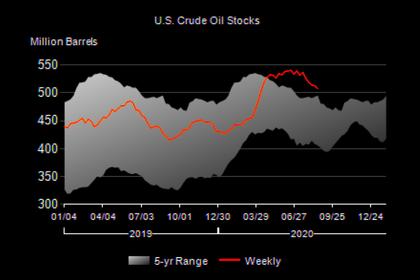

Ahead of the release of U.S. stockpile data from the American Petroleum Institute, due at 2030 GMT, a Reuters poll found that analysts expect U.S. crude stocks to have fallen by about 2 million barrels in the week to Aug. 28.

Gasoline inventories were expected to have fallen by 3.6 million barrels.

-----

Earlier: