OPEC+ PRODUCTION CUT

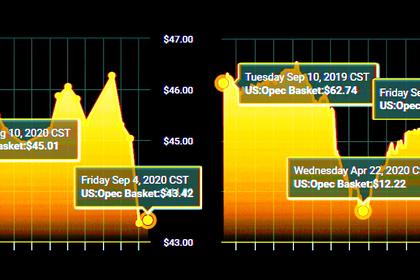

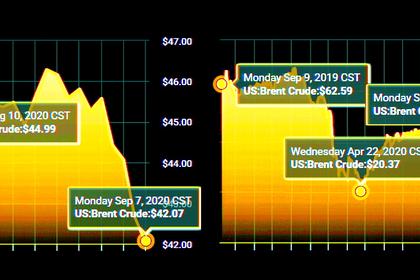

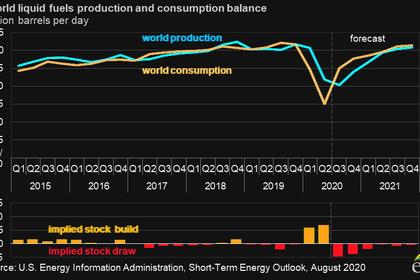

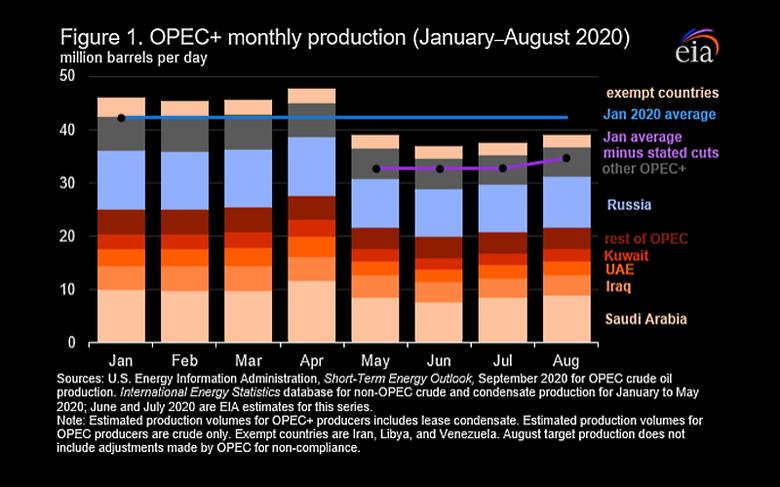

U.S. EIA - September 10, 2020 - As global demand for petroleum liquids declined significantly in March and April 2020, global oil inventories increased at record levels, rising by an average of 5.9 million barrels per day (b/d) in the first quarter and 7.2 million b/d in the second quarter of 2020. As a result of the lower demand and ample global oil inventories, global crude oil prices fell in March and April to record lows. In response to these market conditions, on April 15, members of the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+) agreed to reduce crude oil production. The OPEC+ agreement called for a decrease in crude oil output by a combined 9.7 million b/d in May and June, a combined decrease of 9.6 million b/d in July 2020, and a combined decrease of 7.7 million b/d in August (not accounting for compensation cuts for under-complying countries). Compared with January levels, OPEC+ production fell by an estimated 5.9 million b/d in May, 7.9 million b/d in June, 7.1 million b/d in July, and 5.6 million b/d in August. U.S. Energy Information Administration (EIA) data show that OPEC production in May decreased by 6.0 million b/d from April, which was the largest monthly production decline on record. Between January and July 2020, OPEC crude oil production decreased by 5.7 million b/d. The non-OPEC partner countries reduced their production by 2.8 million b/d in July from production levels in January 2020. EIA data for non-OPEC producers include crude oil and condensate production (Figure 1).

However, OPEC crude oil production increased in August, and EIA’s recently released estimates show that crude oil production rose by nearly 1.0 million b/d month on month. EIA estimates that production among the non-OPEC partner countries also increased in August by 530,000 b/d.

In addition to the cuts agreed to on April 15, crude oil production in Saudi Arabia, Kuwait, and the United Arab Emirates (UAE) decreased by an additional 1.1 million b/d from May to June, with Saudi Arabia accounting for 77% of this decrease. The three countries voluntarily deepened production cuts in response to global inventory builds that were reaching record highs in the second quarter. Crude oil production in Saudi Arabia decreased from 9.9 million b/d in January to an 18-year low of 7.7 million b/d in June. To meet the additional cuts, the UAE reduced production from various crude oil grades and shut in production from its 370,000 b/d Bab field in late June for scheduled maintenance. Kuwait reduced output from the Khafji field in the Neutral Zone. Production in the Neutral Zone was shut in between October 2015 and June 2020 because of a dispute between Kuwait and Saudi Arabia, which share the Neutral Zone production fields.

Crude oil production in Iraq was 0.9 million b/d lower in July compared with January. The declines in Iraq’s crude oil production resulted from a combination of voluntary cuts and COVID-19-related operational challenges, including restricted mobility for personnel and equipment. Trade press reports indicate that beginning in March, some fields shut in or reduced output because of COVID-19 issues. Contractual obligations with international oil companies (IOC) that operate larger fields in southern Iraq and financial pressures exacerbated by low oil revenues provided additional challenges for Iraq’s government and oil sector, making production cuts difficult to implement in May. However, in June Iraq and the IOCs agreed to further reduce production from the southern fields, including Rumaila, West Qurna 1, and West Qurna 2, which contributed to crude oil production falling from 4.6 million b/d in January to 3.7 million b/d in July.

Crude oil production in Nigeria fell from 1.8 million b/d in January to 1.4 million b/d in June as a result of planned maintenance at the Bonga floating, production, storage, and offloading vessel and a reported reported COVID-19 outbreak at the oil field. EIA’s crude oil production figures do not include production from the Agbami stream because it is classified as a condensate.

Angola made progressively larger cuts from May to July, reaching a crude oil production low of 1.2 million b/d in July from 1.4 million b/d in January. This reduction is partly the result of deferred offshore development by a number of IOCs operating in Angola because of the low global crude oil price environment. However, Total S.A, an operator of a number of oil fields in Angola reportedly restarted drilling in August.

Production among non-OPEC participants in the April 15 agreement also fell. Crude oil and condensate output in Russia saw significant declines, decreasing by approximately 2.0 million b/d from January 2020 until July. Major Russian oil firms that have cut production since April decided to reduce capital investments this year in response to low oil prices and economic fallout from the pandemic. EIA estimates that Russia’s crude oil and condensate production increased to 9.5 million b/d in August.

Kazakhstan’s government required production cuts from the country’s large and mid-sized fields from May through July, resulting in an output decline of more than 350,000 b/d between January and July 2020. In addition, production from Kazakhstan’s two largest crude oil fields, Tengiz and Kashagan, also declined. These two fields produce light crude oil grades that tend to yield more jet fuel and gasoline and are generally slated for exports.

Mexico’s government also agreed to cut production to comply with the April 15 agreement. EIA data and analysis show that Mexico’s output declined as a result of ongoing lack of investment, natural decline in mature fields, and logistical challenges related to COVID-19. Mexico’s Ku-Maloob-Zaap field, in particular, has seen declines during the past two years.

Iran, Libya, and Venezuela were exempt from the production cuts because of economic sanctions or domestic political instability in their respective countries.

EIA estimates that the agreement has brought global supply lower than the level of global demand in recent months. Although challenges still remain in the global oil market because inventory levels remain much higher than where they began in 2020, EIA expects inventories to continue to decline in the coming quarters, resulting in a relatively balanced market by the end of 2021 (Figure 2).

U.S. average regular gasoline and diesel prices decrease

The U.S. average regular gasoline retail price decreased by more than 1 cent from the previous week to $2.21 per gallon on September 7, 34 cents lower than the same time last year. The Midwest price decreased by nearly 6 cents to $2.07 per gallon. The Rocky Mountain and West Coast prices remained unchanged at $2.35 per gallon and $2.86 per gallon, respectively. The East Coast price increased by more than 1 cent to $2.17 per gallon, and the Gulf Coast price increased by less than 1 cent, remaining virtually unchanged at $1.89 per gallon.

The U.S. average diesel fuel price decreased by nearly 1 cent from the previous week, remaining at $2.44 per gallon on September 7, 54 cents lower than a year ago. The East Coast, Midwest, West Coast, and Rocky Mountain prices decreased by nearly 1 cent to $2.51 per gallon, $2.32 per gallon, $2.96 per gallon, and $2.38 per gallon, respectively, and the Gulf Coast price decreased by less than 1 cent to $2.18 per gallon.

Propane/propylene inventories rise

U.S. propane/propylene stocks increased by 2.2 million barrels last week to 97.4 million barrels as of September 4, 2020, 10.3 million barrels (11.9%) greater than the five-year (2015-19) average inventory levels for this same time of year. East Coast, Midwest, Gulf Coast, and Rocky Mountain/West Coast inventories increased by 1.0 million barrels, 0.6 million barrels, 0.4 million barrels, and 0.2 million barrels, respectively.

-----

Earlier: