ОПЕК+: 102%

МИНЭНЕРГО РОССИИ - Москва, 17 сентября. - Под председательством Министра энергетики Российской Федерации Александра Новака и Министра энергетики Королевства Саудовская Аравия Абдулазиза бен Сальмана состоялось 22-ое заседание Совместного Министерского мониторингового комитета ОПЕК+.

Комитет рассмотрел ежемесячный отчет, подготовленный Совместным техническим комитетом (JTC), и изменения на мировом рынке нефти с момента его последнего заседания 19 августа 2020 года. Комитет также рассмотрел прогнозы развития ситуации на рынке на четвертый квартал 2020 года и на 2021 год.

Комитет рассмотрел данные о добыче нефти за август 2020 года и приветствовал положительные показатели с точки зрения совокупного уровня исполнения договоренностей для стран-участниц ОПЕК и стран, не входящих в ОПЕК, в соответствии с документом «Декларации о сотрудничестве», который был зафиксирован на уровне 102% в августе 2020 года, включая Мексику согласно вторичным источникам.

Совместный министерский мониторинговый комитет подтвердил важность полного соответствия заявленным показателям снижения добычи и скорейшей компенсации перепроизводства.

СММК также поддержал просьбу нескольких стран-членов продлить период компенсации добычи до конца декабря 2020 года после получения гарантий от них о полной компенсации своего перепроизводства. Это жизненно важно для продолжения усилий по восстановлению баланса и обеспечению долгосрочной стабильности нефтяного рынка.

По итогам заседания Александр Новак отметил сохраняющееся успешное исполнение Соглашения странами ОПЕК и не-ОПЕК.

«Уровень исполнения договоренностей продолжает держаться на высоком уровне в более чем 100%. Для сравнения в июле было 95%. В августе Россия исполнила свои обязательства близко к 100%, на уровне 98%, это высокий уровень, мы полностью привержены подписанному Соглашению и призываем другие страны продолжать движение к достижению результатов по скорейшей балансировке рынка», - сказал он.

Таким образом, участники соглашения показали, что стали более ответственно подходить к исполнению Соглашения.

«Сегодня запасы, накопленные во 2-ом квартале, постепенно сокращаются, в августе сокращение остатков составило 105 млн баррелей, в июле – 34 млн баррелей», - подчеркнул он.

Александр Новак также отметил высокий уровень доверия к ОПЕК, сложившийся на рынке за период действия сделки.

«ОПЕК сыграл решающую роль в повышении прозрачности, стабильности и предсказуемости мирового нефтяного рынка, между ее производителями и потребителями. Высоко ценим взаимодействие России с ОПЕК, что закреплено в Энергетической стратегии России до 2035 года и является одним из наших приоритетов.

Следующие заседания СТК и СММК назначены на 15 и 19 октября 2020 года соответственно.

-----

OPEC+: 102%

OPEC - 17 Sep 2020 - The 22nd Meeting of the Joint Ministerial Monitoring Committee (JMMC) took place via videoconference on Thursday 17 September 2020, under the Chairmanship of HRH Prince Abdul Aziz Bin Salman, Saudi Arabia's Minister of Energy, and Co-Chair HE Alexander Novak, Minister of Energy of the Russian Federation.

The Committee reviewed the monthly report prepared by its Joint Technical Committee (JTC) and developments in the global oil market since its last meeting on 19 August 2020. The Committee also considered market prospects for the fourth quarter of 2020 and into 2021.

The Committee reviewed the crude oil production data for August 2020 and welcomed the positive performance in overall conformity for participating OPEC and non-OPEC countries of the DoC, which was recorded at 102% in August 2020, including Mexico as per the secondary sources.

The JMMC reiterated the critical importance of adhering to full conformity and compensating overproduced volumes as soon as possible.

The JMMC supported, and recommended, to the OPEC and Non-OPEC Ministerial Meeting, the request of several underperforming participating countries in the DoC to extend the compensation period till end of December 2020, after pledging that they will fully compensate for their overproduction. This is vital for the ongoing rebalancing efforts and helping deliver long-term oil market stability.

The JMMC observed that the recovery has not been even across the world and an increase in COVID-19 cases has appeared in some countries. In the current environment, the JMMC emphasised the importance of being pro-active and pre-emptive and recommended that participating countries should be willing to take further necessary measures when needed.

The Committee thanked the JTC and the OPEC Secretariat for their contributions to the meeting.

The next meetings of the JTC and the JMMC are scheduled for 15 and 19 October 2020, respectively.

-----

Earlier:

2020, September, 17, 17:05:00

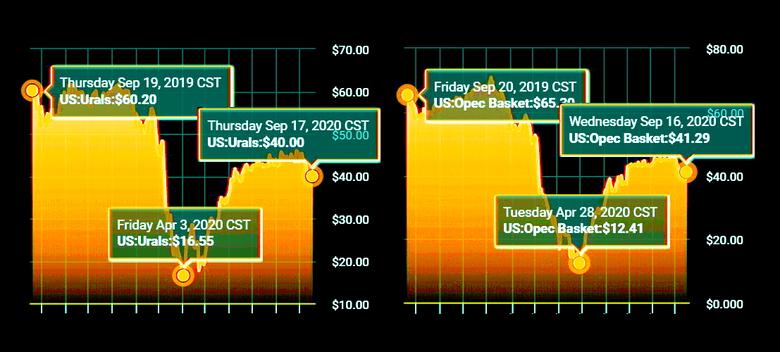

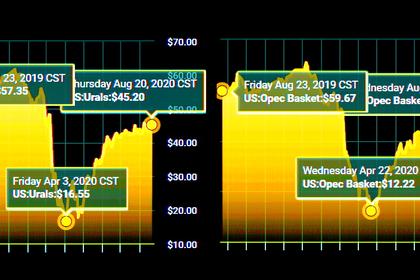

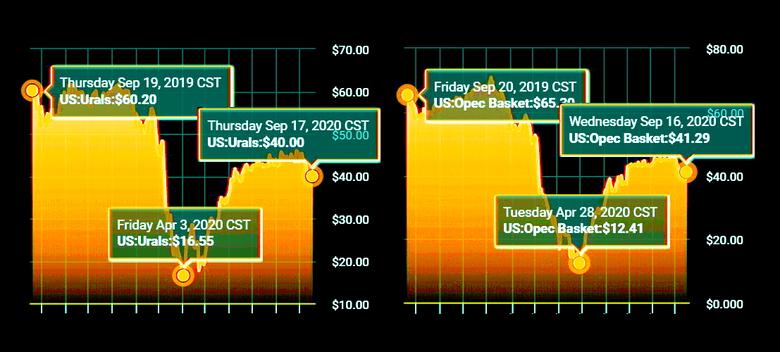

OIL PRICE: NOT BELOW $41 YET

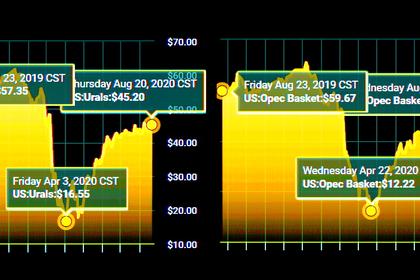

Brent was down 22 cents, or 0.5%, to $42.00 a barrel , WTI fell 28 cents, or 0.7%, to $39.88 a barrel.

2020, September, 16, 12:15:50

OIL PRICE: NOT BELOW $41 ANEW

Brent rose 85 cents, or 2.1%, to $41.38 a barrel, WTI rose 92 cents, or 2.4%, to $39.20.

2020, September, 15, 16:25:00

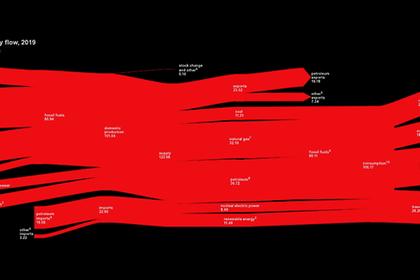

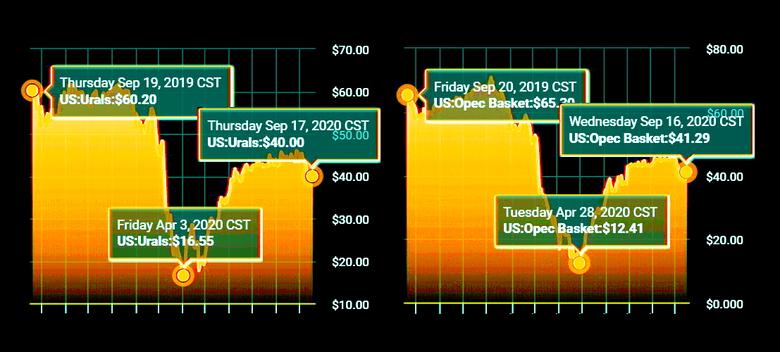

U.S. FOSSIL FUELS 80%

In 2019, 80% of U.S. domestic energy production was from fossil fuels, and 80% of domestic energy consumption originated from fossil fuels.

2020, September, 11, 12:20:00

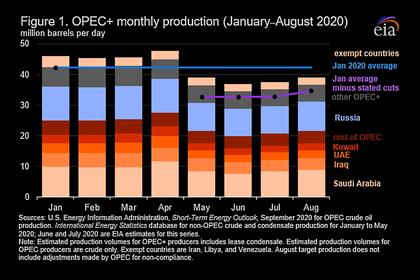

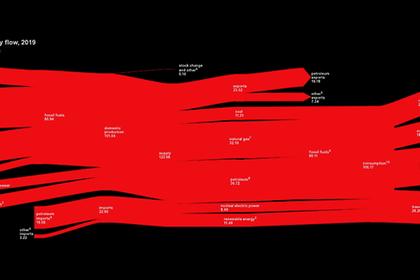

OPEC+ PRODUCTION CUT

The OPEC+ agreement called for a decrease in crude oil output by a combined 9.7 million b/d in May and June, a combined decrease of 9.6 million b/d in July 2020, and a combined decrease of 7.7 million b/d in August

2020, September, 7, 11:35:00

БАЛАНС НЕФТЯНОГО РЫНКА

в июле нефтяной рынок достиг баланса, снижение спроса компенсировалось сокращением добычи, запасы нефти в странах ОЭСР снизились на 34 млн баррелей

2020, August, 21, 11:30:00

ВЫСОКИЙ УРОВЕНЬ ИСПОЛНЕНИЯ СОГЛАШЕНИЯ

«Все страны согласились, уровень исполнения – 97% - это очень высокий уровень. Из тех 9,7 млн баррелей, сокращение которых было запланировано, было сокращено 9,4 млн барр»,

2020, August, 21, 11:25:00

OPEC+ : FRAGILE MARKET

OPEC+ underscored the fragility of the market and significant uncertainties, particularly associated with oil demand, and called for vigilance by all participating countries.

All Publications »

Tags:

РОССИЯ,

ОПЕК,

САУДОВСКАЯ АРАВИЯ,

RUSSIA,

OPEC,

SAUDI,

ARABIA