U.S. HYDROGEN INVESTMENT $3 BLN

BLOOMBERG QUINT - September 02 2020 - Three power plants planned in New York, Virginia and Ohio will test whether hydrogen can one day replace natural gas in electric generation. Power producers Danskammer Energy LLC, Balico LLC and EmberClear are paying Mitsubishi Power Americas Inc. more than $3 billion for the facilities, which will collectively generate 3,284 megawatts of electricity. While the plants will initially run on natural gas alone, they'll eventually shift to burning green hydrogen produced and stored on-site. They're designed to make it easier to ramp up hydrogen use as production increases, said Chief Executive Officer Paul Browning.

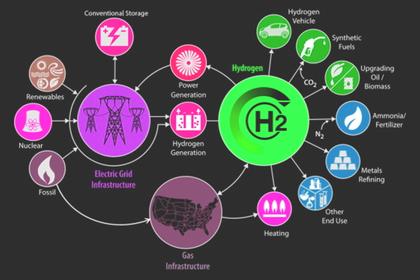

Green hydrogen -- produced by stripping the gas from water using electrolyzers powered by wind and solar -- is seen as key to eliminating carbon emissions from the industrial sector that now relies on natural gas as both a fuel source and a feedstock.

Other electric generators are also exploring integrating green hydrogen into their power production in an effort to slash emissions as more states set renewable-energy mandates. Utility NextEra Energy Inc. in July announced it will run one of its Florida power plants, in part, on hydrogen, using solar power to strip the gas from water.

"There is clearly an opportunity five to 10 years from now to displace the last 10% of the carbon emissions out of the electric sector by manufacturing hydrogen with renewables,"Jim Robo, NextEra's chief executive officer said during an earnings call in July.

Mitsubishi earlier this year announced its first hydrogen storage and power project for $1.9 billion in Utah to serve the Los Angeles Department of Water and Power, and has created a standard power plant design that is being used in the new U.S. projects. While the L.A. project is being built for a municipal utility, the others will serve competitive power markets in the Midwest and East Coast including PJM Interconnection, which operates the country's largest power, and the New York Independent System Operator.

The first will be Danskammer's 600-megawatt plant in Newburgh, New York. Danskammer Chief Executive Officer William Reid said in a statement the project would help the state meet its climate goals. The Balico plant in Virginia will generate 1,600 megawatts while EmberClear's Ohio facility will have a capacity of 1,084 megawatts. EmberClear is in the early stages of developing another plant using Mitsubishi's technology in eastern Pennsylvania, Chief Executive Officer Raj Suri said in a statement.

The plants are expected to be in service between 2023 and 2025, and hydrogen will be used to substitute gas as it becomes available.

"The timeline is going to be different for every project," said Mitsubishi's Browning. "It's not going to be driven by technology -- it's going to be driven by the needs of the local grid." The company is in discussions with other utilities and developers to build more hydrogen-ready plants, he said.

Mitsubishi Power, based in Lake Mary, Florida, is a fully-owned subsidiary of Mitsubishi Heavy Industries Ltd. in Tokyo.

-----

Earlier: