U.S. LNG WILL UP

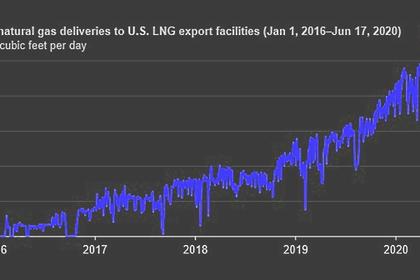

REUTERS - Aug 31, 2020 - U.S. LNG exporters faced an adverse market in 2020 as contract customers paid to reject cargoes rather than take them amid sharply lower spot prices caused by a supply glut, but demand will begin to improve.

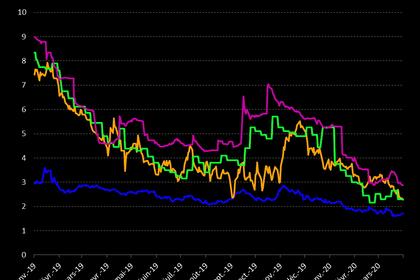

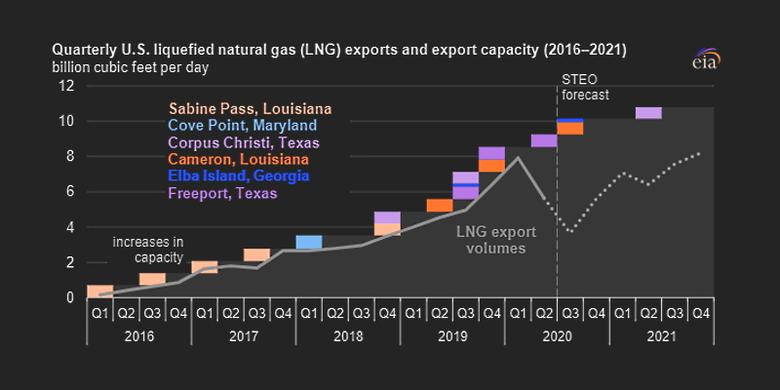

U.S. LNG exports fell to 3.2 Bcf/d in the third quarter from 7.9 Bcf/d in the first quarter. They may rise to 5.5 Bcf/d in the fourth quarter and 7.1 Bcf/d in first quarter 2021, the Energy Information Administration (EIA) projected in mid-August.

“The current market is really challenged but the outlook is actually not that bad. Beyond this year, until 2023 there is very little new production capacity scheduled to come on line meaning that demand can catch up,” Benjamin Nolan, managing director at Stifel Financial Corp., told Reuters Events.

“Consequently there is a very steep contango in the forward curve,” he said by e-mail on Aug. 12.

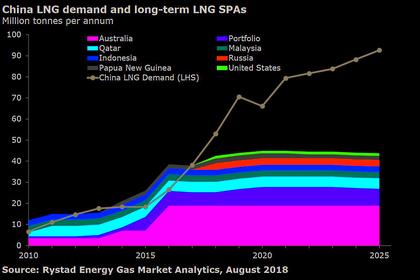

“Asia in particular has much higher demand in the winter and usually starts buying aggressively in September/October. Most companies with contracted volumes are likely to take instead of paying and spot cargoes are likely to be shipped,” he said.

Worst-performing commodity?

LNG became “the worst-performing global energy commodity” during the pandemic, the Institute for Energy Economics and Financial Analysis (IEEFA) said on July 29.

The U.S. LNG industry “is suffering through a worse-than-worst case scenario” because of a market collapse on a scale inconceivable four years ago. LNG performed worse than coal or oil during the pandemic, it said.

“Maybe from a price perspective that could be true. From a consumption perspective, I don’t believe it is,” Nolan said.

“I’ve seen consumption estimates for the year anywhere from -3% to 2%, which is far greater than consumption for either of the other two,” he added.

A barrage of cargo rejections

Global LNG supplies saw a 6% on-year increase in first half 2020 to 188 million tonnes (Mt), Cheniere Energy officials said on Aug. 6 during the second-quarter discussion.

The U.S. contributed most LNG growth with a 64% on-year exports rise to 26Mt, said Anatol Feygin, Cheniere’s CCO, according to a Motley Fool’s transcript.

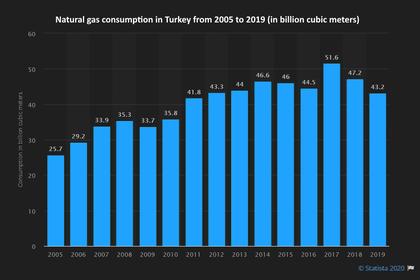

“With weak LNG demand in Asia, more global production was pushed into Europe,” he said.

Cheniere shipped 78 cargoes in April-June, down from 128 in January-March.

Cheniere earned $458 million from cancelation fees paid in April-June for third-quarter cargoes. It earned $53 million in January-March from second-quarter cancelations.

The U.S. LNG export capacity utilization in the summer was below 50%, the EIA said.

Companies like Cheniere and Freeport LNG “have take-or-pay contracts for virtually all the capacity. They can just dial back production, but there is very little financial impact,” Nolan said.

U.S. LNG capacity

Cheniere, owned by investors including Carl Icahn, has a Corpus Christi terminal with 15 million tonnes annual capacity (Mtpa). It plans to add 10Mtpa in 2021.

Cheniere also has 30Mtpa at Sabine Pass, Louisiana with five trains each with 0.7Bcf/d. It plans to add 0.7Bcf/d by 2023.

Cameron LNG (Sempra Energy with partners including Total and Mitsui) said on Aug. 10 it started operations at Hackberry, Louisiana of its third train. Train 2 started in February, and the first in Aug. 2019.

Freeport LNG announced May 4 its third train start, completing a $13.5-billion, 15Mtpa facility. Michael Smith owns this plant-terminal near Houston in partnership with Osaka Gas.

Venture Global LNG, founded in 2013 by Bob Bender and Michael Sabel, said on June 19 it started equipment installation in Cameron Parish, Louisiana. This 10Mtpa project will start in 2022.

It has plans to add later 20Mtpa at Plaquemines, Louisiana and 20Mtpa at adjacent Global Delta.

Siemens said in May it will supply three trains at Sabine Pass, on the Texas side, for Golden Pass LNG, owned by Qatar Petroleum (70%) and ExxonMobil (30%). Each train will produce 5.2Mtpa by 2024.

“Everything under construction (Golden Pass), Sabine Pass 6 and Corpus Christi 3, and Calcasieu Pass will almost certainly still be built,” Nolan said.

Driftwood battles uphill

Driftwood LNG plans a 4Bcf/d project in Calcasieu Parish, Louisiana. Project-owner Tellurian Inc. said on Aug.5 it seeks partners.

Tellurian’s owner is Charif Souki, founder and former CEO of Cheniere who left after disagreements with Icahn.

France’s Total, with a 17% stake in Driftwood, said on May 5 its priority is “not to invest more in merchant projects in the U.S.”

Telluride “is raising capital to extend the window of opportunity. They do have a great deal of work yet to do to sell the remaining capacity, and clearly it is an uphill battle, but not completely impossible,” Nolan said.

Kinder Morgan’s 10 liquefaction trains near Savannah, Georgia should be ready for service by the end of summer, Reuters reported on Aug. 10. Each train has 0.3Mtpa capacity. Kinder announced construction in 2013. Shell has a 20-year contract to run it.

Dominion Energy owns Cove Point LNG in Maryland, with1.8 Bcf/d capacity.

U.S. LNG exports disruptive

The U.S. became in 2019 one of the world’s three biggest LNG exporters, with Qatar and Australia.

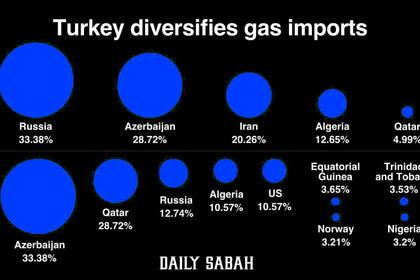

By early 2020 U.S. LNG supplies disrupted Qatar and Russian exports to Europe, the International Energy Agency (IEA) said in June.

Despite plummeting gas demand, European LNG imports rose 20% in January-May from 2019. The U.S. accounted for a fourth of European LNG imports. Traditional pipeline supplies from Russia and North Africa fell 25%, the IEA said.

Henry Hub prices fell to $1.75/MBtu in May, lower than Europe’s TTF at $1.50/MBtu. Asian LNG benchmarks halved to $3/MBtu in January-May from 2019, the EIA said.

“There was likely to be an oversupply irrespective of the pandemic because of start-up schedules in the U.S., Russia, and Australia.

That does typically disrupt pricing until demand can rise to meet supply,” Nolan said.

“Obviously the pandemic didn’t help, but ultimately there will almost certainly be more new projects developed in the U.S. over the next 5 or so years,” he added.

-----

Earlier: