UAE OIL PRODUCTION +103 TBD

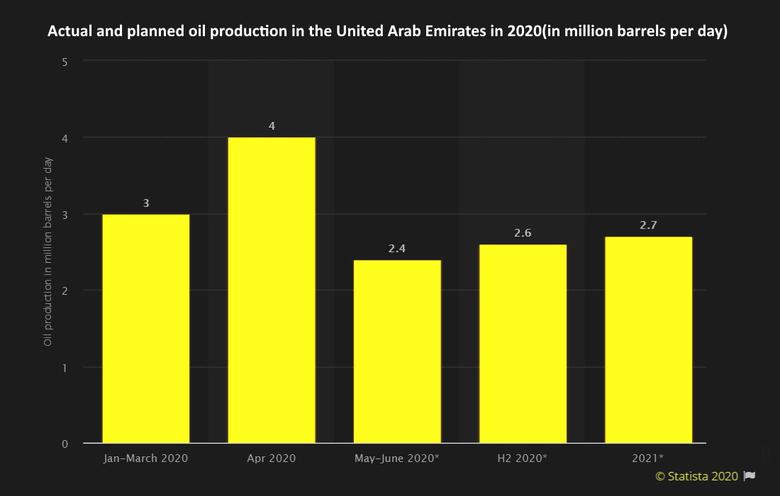

PLATTS - 01 Sep 2020 - The UAE breached its OPEC+ quota in August, pumping 2.693 million b/d, the energy minister tweeted on Sept. 1, as electricity demand powered by natural gas -- produced in concert with crude oil -- surged in the month.

"While the UAE's production increased to 2.693 million b/d in August, measures have been taken to compensate for this temporary increase due to peak summer electricity demand in the UAE, which required an increase in oil production and associated gas," Suhail al-Mazrouei tweeted.

That is 103,000 b/d above its quota of 2.590 million b/d, under the OPEC+ supply accord, and a rise of 293,000 b/d from what the country reported in July, when its cap was 2.446 million b/d.

The significant quota violation is notable for the UAE, a close ally of Saudi Arabia, which chairs a key OPEC+ committee tasked with monitoring compliance with the deal and has heavily pressured other members to adhere to their commitments. The UAE also sits on the committee.

"Obviously, August is the peak summer month in the UAE, so there is increased local energy demand," a source said.

With the UAE's power plants requiring more gas to generate electricity for air-conditioning, the country was forced to pump more crude to meet the demand for associated gas.

ASSOCIATED GAS

Abu Dhabi National Oil Co., which produces the vast majority of the UAE's crude, plans a 30% cut in October term volumes for all of its crude grades, Mazrouei tweeted, which should help the country make up for its August overproduction.

Under the OPEC+ deal, members that exceeded their quotas must make additional so-called compensation cuts in the same quantity as their overproduction.

"The UAE remains fully committed to the OPEC+ agreement, as illustrated in June when we cut an additional 100,000 b/d from our agreed quota," the minister added.

UAE crude exports surged in July and August, according to cargo-tracking firm Kpler, but sources said this was largely due to de-stocking of inventories built up in April, during a short-lived market-share battle after OPEC and its allies failed to agree on production cuts beyond March.

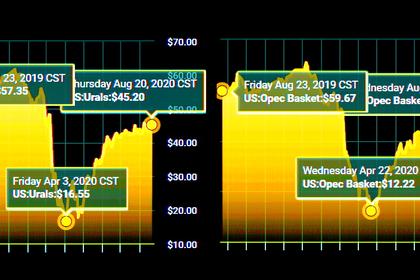

The 23-country OPEC+ alliance eventually resolved its differences and implemented a historic 9.7 million b/d cut pact starting in May, which was rolled back to 7.7 million b/d in August. Crude prices have stabilized at around $45/b over the last several weeks, due in large part to the cuts and a partial recovery in global oil demand as coronavirus lockdown measures eased.

KPLER DATA

Kpler estimates UAE net crude exports averaged 2.748 million b/d in August compared with 2.711 million b/d in July, and 2.263 million b/d in June.

Over the same period, UAE crude inventories stood at 36.8 million barrels as of the end of August, compared with 33.1 million barrels at the end of July and 37.2 million barrels at the end of June.

OPEC announced Sept. 1 that it would be using Kpler data exclusively for cargo-tracking and inventories data.

The OPEC+ monitoring committee is next scheduled to meet online Sept. 17.

-----

Earlier: