BAKER HUGHES NET INCOME $653 MLN

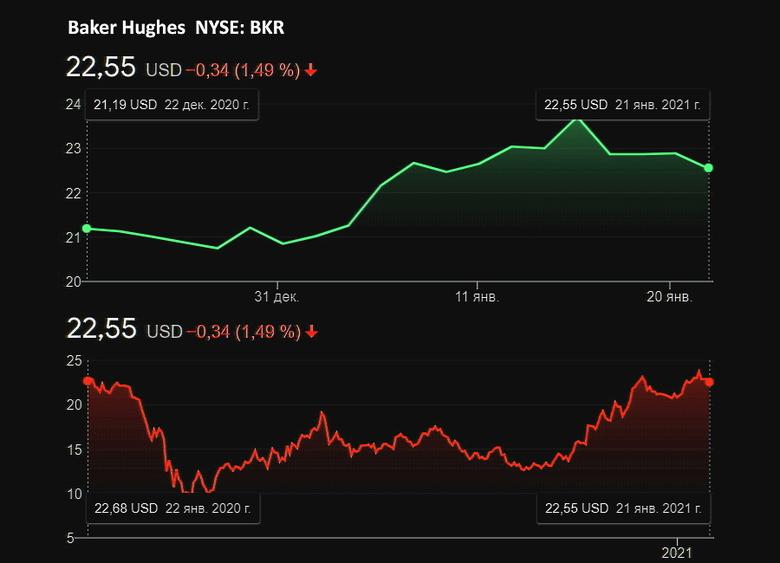

BAKER HUGHES - January 21, 2021 - Baker Hughes Company (NYSE: BKR) ("Baker Hughes" or the "Company") announced results today for the fourth quarter and total year 2020.

- Orders of $5.2 billion for the quarter, up 2% sequentially and down 25% year-over-year.

- Revenue of $5.5 billion for the quarter, up 9% sequentially and down 13% year-over-year.

- GAAP operating income of $182 million for the quarter, up $231 million sequentially and down 45% year-over-year.

- Adjusted operating income (a non-GAAP measure) of $462 million for the quarter, up 98% sequentially and down 15% year-over-year.

- GAAP diluted earnings per share of $0.91 for the quarter which included $(0.98) per share of adjusting items. Adjusted diluted earnings per share (a non-GAAP measure) were $(0.07).

- Cash flows generated from operating activities were $378 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $250 million.

|

|

Three Months Ended |

|

Variance |

|||||||||

|

(in millions except per share amounts) |

December 31, |

September 30, |

December 31, |

|

Sequential |

Year-over- |

||||||

|

Orders |

$ |

5,188 |

|

$ |

5,106 |

|

$ |

6,944 |

|

|

2% |

(25)% |

|

Revenue |

5,495 |

|

5,049 |

|

6,347 |

|

|

9% |

(13)% |

|||

|

Operating income (loss) |

182 |

|

(49) |

|

331 |

|

|

F |

(45)% |

|||

|

Adjusted operating income (non-GAAP) |

462 |

|

234 |

|

546 |

|

|

98% |

(15)% |

|||

|

Net income (loss) attributable to Baker Hughes |

653 |

|

(170) |

|

48 |

|

|

F |

F |

|||

|

Adjusted net income (non-GAAP) attributable to Baker Hughes |

(50) |

|

27 |

|

179 |

|

|

U |

U |

|||

|

Diluted EPS attributable to Class A shareholders |

0.91 |

|

(0.25) |

|

0.07 |

|

|

F |

F |

|||

|

Adjusted diluted EPS (non-GAAP) attributable to Class A shareholders |

(0.07) |

|

0.04 |

|

0.27 |

|

|

U |

U |

|||

|

Cash flow from operating activities |

378 |

|

219 |

|

1,357 |

|

|

73% |

(72)% |

|||

|

Free cash flow (non-GAAP) |

250 |

|

52 |

|

1,053 |

|

|

F |

(76)% |

|||

"F" is used in most instances when variance is above 100%. Additionally, "U" is used in most instances when variance is below (100)%.

“We are pleased with our fourth quarter and full year results while navigating the impacts of the global pandemic and industry downturn. Despite an incredibly challenging year for the industry in 2020, we generated over $500 million in free cash flow, booked $6.4 billion in TPS orders, and executed on our substantial cost-out and restructuring program. We also took several important steps to accelerate our strategy and invest in energy transition technologies, helping to position the company for the future. I cannot thank our employees enough for their hard work and dedication to achieve our goals and move the company forward,” said Lorenzo Simonelli, Baker Hughes chairman and chief executive officer.

“As we look ahead to 2021, we are cautiously optimistic that the global economy and oil demand will begin to recover from the impact of the global pandemic. We believe this macro environment likely translates into a tepid investment environment for oil and gas during the first half of 2021. However, we expect spending and activity levels to gain momentum through the year as the macro environment improves, likely setting up the industry for stronger growth in 2022.

“Baker Hughes is well placed to navigate the current market environment and positioned to lead the energy transition. We remain focused on executing for customers, being disciplined on cost, and delivering for our shareholders,” concluded Simonelli.

-----

Earlier: