CHINA GDP WILL UP BY 7.9%

IMF - January 8, 2021 - The Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the People’s Republic of China.

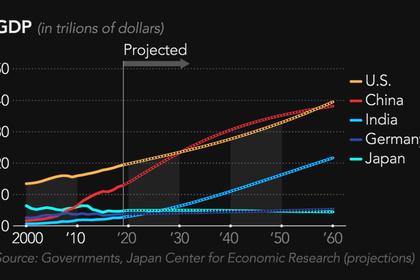

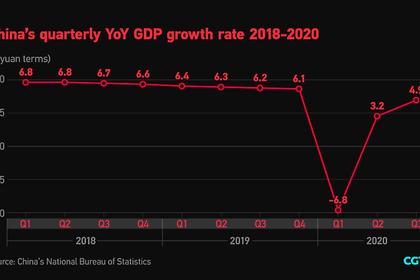

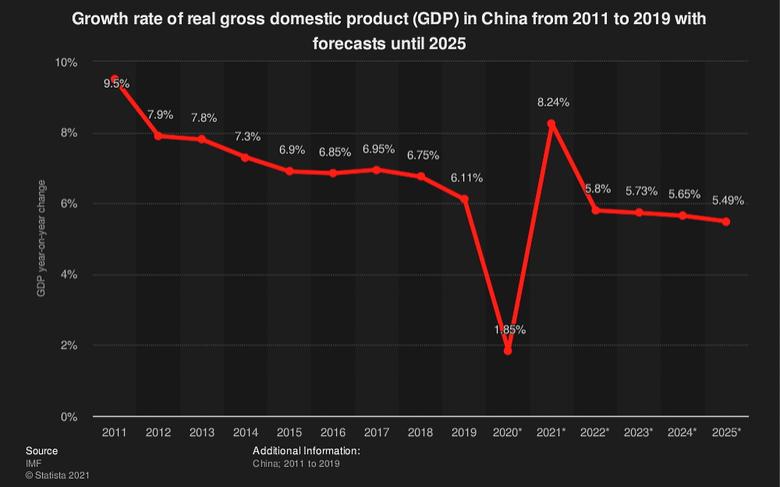

The Chinese economy continues its fast recovery from the pandemic, helped by a strong containment effort and swift policy actions to mitigate the impact of the crisis. GDP growth is projected at 1.9 percent in 2020 and 7.9 percent in 2021, as economic activity continues to normalize and domestic outbreaks remain under control. Core inflation is expected to remain subdued, leaving CPI inflation in 2020-21 below the pre-crisis target of about 3 percent. Corporate leverage is expected to rise by about 10 percentage points of GDP in 2020. The current account surplus is projected to widen to 1.9 percent of GDP in 2020 from 1.0 percent in 2019, before narrowing to below 1 percent in 2021. The projected temporary increase this year reflects lower commodity prices, the collapse in outbound tourism, and a surge in exports of pandemic-related and other goods supported by China’s early recovery of production and higher export prices.

Macroeconomic and financial policies have supported the recovery. Policymakers have provided financial relief and fiscal support to protect the most-affected firms while safeguarding financial stability, including by providing liquidity to the banking system, expanding re-lending facilities to smaller enterprises, and introducing a repayment moratorium until Q1 2021. The authorities have also increased the disbursement and coverage of unemployment insurance to help vulnerable households and provided tax relief and waived social security contributions by employers. Against this backdrop, the general government deficit (including estimated off-budget investment spending) is projected to rise to 18.2 percent of GDP in 2020 from 12.6 percent in 2019.

Structural reforms have progressed despite the pandemic, but not evenly across key areas. The opening of the financial sector has advanced with a further shortening of the negative lists for foreign investment and the removal of restrictions on the investment quota for foreign institutional investors. Labor market reforms, such as hukou reforms, have improved labor mobility, and the patent law was amended to strengthen intellectual property protection and foster innovation. At the same time, progress in real-sector reform has been slow, especially in the area of state-owned enterprises and competitive neutrality between private and state-owned firms.

Executive Directors noted that the COVID-19 crisis has inflicted significant human and economic costs on China and commended the authorities for the effective containment measures and swift macroeconomic and financial policy support to mitigate the economic impact of the pandemic. Directors noted, however, that growth was still unbalanced and that fiscal, monetary, and structural policies should aim at strengthening private demand to allow for more balanced medium‑term growth.

Directors called for a continuation of the moderately supportive fiscal and monetary policies until the recovery is on solid ground, while noting that, in the medium term, fiscal consolidation was necessary to ensure debt sustainability. To maximize the policy space, they saw benefits in further improving the macro-fiscal framework, including intergovernmental coordination and macroeconomic data, and called for a modernization of the monetary policy framework to strengthen the transmission of conventional interest rate policies and enhance financial intermediation. Some Directors encouraged the authorities to focus on broader concepts of the fiscal deficit. Directors also called for enhancements to the social safety net to reduce precautionary savings, which combined with greater progressivity in the tax system would help address income inequality.

Directors stressed the importance of addressing financial vulnerabilities proactively to safeguard financial stability. As the recovery takes hold, the temporary measures supporting the financial sector should be replaced with policies to address problem loans and strengthen regulatory and supervisory frameworks. Directors noted the need for a comprehensive bank restructuring framework in line with international best practices to allow for the orderly exit of weaker banks. While agreeing with the authorities on the potential benefits from digital currencies, Directors considered that more work was needed to assess risks. They also encouraged the authorities to continue improving their AML/CFT framework.

Directors welcomed continued progress on structural reforms, particularly in further opening up of the financial sector and improving labor mobility through hukou reforms. They stressed the need for further reforms of SOEs, including ensuring competitive neutrality between SOEs and private enterprises, and some Directors called for the need to remove remaining implicit guarantees. Structural reform will be key to boosting potential growth, reduce external imbalances, and build a more resilient, green, and inclusive economy.

Directors noted that while the current account surplus in 2020 should widen temporarily, it is expected to narrow over the medium term, reflecting an unwinding of the temporary impact of the pandemic and a rebalancing of economic growth. Directors also stressed that greater exchange rate flexibility would help the economy adjust to the changing external environment. Some Directors called for further improvement in the transparency of foreign exchange interventions and phasing out of capital flow management measures.

Directors welcomed the authorities’ commitment to global cooperation, and noted that China, together with its partners, had an important role to play in supporting an open and rules-based international trade system. Directors also welcomed China’s intention to play an important role in multilateral efforts to address pressing global challenges, including making any approved vaccine developed in China widely available to other countries and in mitigating climate change. They noted that China has a key role to play in the G-20 DSSI and Common Framework to provide debt relief to low-income countries, but noted that further improvements in data transparency were needed for the success of the global debt relief efforts. They welcomed China’s ambitious plans for emissions abatement and increased green investment.

|

China: Selected Economic Indicators |

|||||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

|

Projections |

|||||||||||

|

(Annual percentage change, unless otherwise indicated) |

|||||||||||

|

NATIONAL ACCOUNTS |

|||||||||||

|

Real GDP (base=2015) |

6.9 |

6.8 |

6.9 |

6.7 |

6.1 |

1.9 |

7.9 |

5.7 |

5.6 |

5.5 |

5.4 |

|

Total domestic demand |

7.3 |

7.9 |

6.8 |

7.4 |

5.5 |

1.5 |

8.7 |

5.8 |

5.6 |

5.6 |

5.4 |

|

Consumption |

8.3 |

8.5 |

7.3 |

8.1 |

6.4 |

-0.8 |

11.3 |

6.4 |

6.5 |

6.2 |

6.1 |

|

Investment |

6.1 |

7.2 |

6.1 |

6.5 |

4.5 |

4.6 |

5.4 |

5.1 |

4.6 |

4.8 |

4.5 |

|

Fixed |

7.9 |

7.3 |

5.9 |

7.1 |

5.1 |

4.3 |

6.3 |

4.9 |

4.6 |

4.8 |

4.5 |

|

Inventories (contribution) |

-0.6 |

0.0 |

0.1 |

-0.2 |

-0.2 |

0.2 |

-0.3 |

0.1 |

0.0 |

0.0 |

0.0 |

|

Net exports (contribution) |

-0.1 |

-0.8 |

0.3 |

-0.5 |

0.7 |

0.4 |

-0.5 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Total capital formation (percent of GDP) |

43.0 |

42.7 |

43.2 |

44.0 |

43.1 |

43.1 |

41.8 |

41.2 |

40.4 |

39.6 |

38.8 |

|

Gross national saving (percent of GDP) 1/ |

45.8 |

44.5 |

44.8 |

44.1 |

44.1 |

45.0 |

42.7 |

42.0 |

41.1 |

40.2 |

39.4 |

|

LABOR MARKET |

|||||||||||

|

Unemployment rate (annual average) 2/ |

5.0 |

5.0 |

5.0 |

4.9 |

5.2 |

5.4 |

… |

… |

… |

… |

… |

|

Employment |

0.3 |

0.2 |

0.0 |

-0.1 |

-0.1 |

-0.3 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

|

PRICES |

|||||||||||

|

Consumer prices (average) |

1.4 |

2.0 |

1.6 |

2.1 |

2.9 |

2.4 |

0.5 |

1.9 |

1.9 |

2.0 |

2.0 |

|

GDP Deflator |

0.1 |

0.9 |

3.9 |

3.5 |

2.4 |

2.1 |

1.6 |

2.1 |

2.1 |

2.2 |

2.2 |

|

FINANCIAL |

|||||||||||

|

7-day repo rate (percent) |

2.4 |

2.7 |

5.4 |

3.1 |

3.1 |

… |

… |

… |

… |

… |

… |

|

10 year government bond rate (percent) |

3.7 |

3.0 |

3.9 |

3.3 |

3.2 |

... |

... |

... |

... |

... |

... |

|

Real effective exchange rate (average) |

9.8 |

-4.9 |

-2.9 |

1.4 |

-0.8 |

… |

… |

… |

… |

… |

… |

|

Nominal effective exchange rate (average) |

9.7 |

-5.4 |

-2.5 |

1.5 |

-1.8 |

… |

… |

… |

… |

… |

… |

|

MACRO-FINANCIAL |

|||||||||||

|

Total social financing |

12.5 |

30.5 |

14.1 |

10.3 |

10.7 |

13.8 |

12.2 |

9.4 |

8.8 |

8.4 |

7.9 |

|

In percent of GDP |

200 |

242 |

248 |

248 |

253 |

276 |

283 |

287 |

290 |

291 |

292 |

|

Total nonfinancial sector debt 3/ |

14.5 |

16.8 |

14.3 |

10.8 |

10.7 |

13.9 |

12.4 |

9.8 |

9.2 |

8.7 |

8.2 |

|

In percent of GDP |

222 |

241 |

248 |

248 |

253 |

277 |

284 |

289 |

293 |

295 |

297 |

|

Domestic credit to the private sector |

15.9 |

12.6 |

11.6 |

8.3 |

9.2 |

12.0 |

11.0 |

7.9 |

7.5 |

7.1 |

6.5 |

|

In percent of GDP |

161 |

168 |

169 |

166 |

167 |

179 |

182 |

182 |

181 |

180 |

178 |

|

House price 4/ |

9.1 |

11.3 |

5.7 |

12.3 |

8.6 |

7.0 |

6.5 |

6.2 |

5.9 |

5.8 |

5.7 |

|

Household disposable income (percent of GDP) |

61.1 |

61.6 |

60.1 |

59.3 |

59.1 |

57.6 |

59.2 |

59.1 |

58.9 |

58.6 |

58.3 |

|

Household savings (percent of disposable income) |

38.4 |

37.2 |

35.7 |

34.8 |

34.4 |

37.1 |

33.7 |

31.8 |

29.9 |

27.9 |

25.9 |

|

Household debt (percent of GDP) |

39.1 |

44.7 |

48.9 |

52.3 |

55.6 |

58.3 |

61.3 |

62.4 |

64.0 |

64.9 |

66.0 |

|

Non-financial corporate domestic debt (percent of GDP) |

122 |

124 |

120 |

113 |

111 |

121 |

120 |

119 |

117 |

115 |

112 |

|

BIS credit-to-GDP gap (percent of GDP) |

25.4 |

20.8 |

11.8 |

0.3 |

-2.2 |

… |

… |

… |

… |

… |

… |

|

GENERAL BUDGETARY GOVERNMENT (Percent of GDP) |

|||||||||||

|

Net lending/borrowing 5/ |

-2.8 |

-3.7 |

-3.8 |

-4.7 |

-6.3 |

-11.9 |

-11.0 |

-10.1 |

-9.1 |

-8.3 |

-7.5 |

|

Revenue |

28.8 |

28.2 |

27.8 |

28.3 |

27.7 |

24.5 |

25.0 |

25.3 |

25.8 |

26.5 |

27.1 |

|

Additional financing from land sales |

1.9 |

2.0 |

2.5 |

2.8 |

2.9 |

2.9 |

2.9 |

2.9 |

2.9 |

2.9 |

2.9 |

|

Expenditure |

33.5 |

33.9 |

34.2 |

35.8 |

36.9 |

39.3 |

38.9 |

38.3 |

37.9 |

37.8 |

37.6 |

|

Debt 6/ |

36.7 |

36.7 |

36.2 |

36.5 |

38.1 |

44.7 |

47.2 |

49.5 |

51.2 |

52.6 |

53.8 |

|

Structural balance |

-2.5 |

-3.4 |

-3.6 |

-4.5 |

-6.0 |

-10.6 |

-10.3 |

-9.6 |

-8.8 |

-8.1 |

-7.5 |

|

BALANCE OF PAYMENTS (Percent of GDP) |

|||||||||||

|

Current account balance |

2.7 |

1.8 |

1.6 |

0.2 |

1.0 |

1.9 |

0.9 |

0.8 |

0.8 |

0.6 |

0.5 |

|

Trade balance |

5.2 |

4.4 |

3.9 |

2.9 |

3.0 |

3.5 |

2.6 |

2.8 |

2.6 |

2.5 |

2.4 |

|

Services balance |

-2.0 |

-2.1 |

-2.1 |

-2.1 |

-1.8 |

-1.1 |

-1.3 |

-1.7 |

-1.7 |

-1.7 |

-1.7 |

|

Net international investment position |

15.1 |

17.4 |

17.1 |

15.5 |

14.7 |

16.1 |

15.2 |

14.8 |

14.4 |

13.9 |

13.4 |

|

Gross official reserves (billions of U.S. dollars) |

3,406 |

3,098 |

3,236 |

3,168 |

3,223 |

3,579 |

3,842 |

4,127 |

4,427 |

4,734 |

5,056 |

|

MEMORANDUM ITEMS |

|||||||||||

|

Nominal GDP (billions of RMB) 7/ |

69,209 |

74,598 |

82,898 |

91,577 |

99,493 |

103,462 |

113,377 |

122,286 |

131,750 |

142,072 |

153,020 |

|

Augmented debt (percent of GDP) 8/ |

55.2 |

66.4 |

72.8 |

76.4 |

80.5 |

91.7 |

96.4 |

101.4 |

105.6 |

109.3 |

112.7 |

|

Augmented net lending/borrowing (percent of GDP) 8/ |

-8.7 |

-15.9 |

-13.5 |

-11.8 |

-12.6 |

-18.2 |

-17.2 |

-16.3 |

-15.4 |

-14.6 |

-13.8 |

|

Sources: Bloomberg, CEIC, IMF International Financial Statistics database, and IMF staff estimates and projections. |

|||||||||||

|

1/ IMF staff estimates for 2019. |

|||||||||||

|

2/ Surveyed unemployment rate. |

|||||||||||

|

3/ Includes government funds. |

|||||||||||

|

4/ Average selling prices estimated by IMF staff based on the data of national housing sale values and volumes published by the National Bureau of Statistics |

|||||||||||

|

5/ Adjustments are made to the authorities' fiscal budgetary balances to reflect consolidated general budgetary government balance, including government-managed funds, state-administered SOE funds, adjustment to the stabilization fund, and social security fund. |

|||||||||||

|

6/ The estimation of debt levels after 2015 assumes zero off-budget borrowing from 2015 to 2025. |

|||||||||||

|

7/ Expenditure side nominal GDP. |

|||||||||||

|

8/ The augmented balance expands the perimeter of government to include government-managed funds and the activity of local government financing vehicles (LGFVs). |

|||||||||||

-----

Earlier: