CHINA'S GAS DEMAND WILL UP

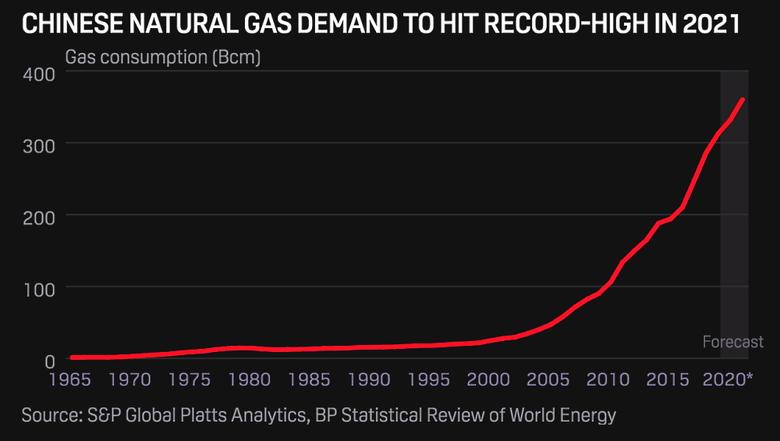

PLATTS - 07 Jan 2021 - China's natural gas demand is expected to set a new record in 2021 as its economy emerges from the pandemic faster than most countries and it remains on track to meet its long-term environment protection targets, data from S&P Global Platts Analytics and state-owned Sinopec's research arm showed Jan. 7.

S&P Global Platts Analytics expects Chinese natural gas demand to reach 360 Bcm in 2021, up 8.4% from an estimated 332 Bcm in 2020. It was at 313 Bcm in 2019.

State-owned Sinopec has a slightly more conservative outlook, and expects gas demand at around 340-345 Bcm in 2021, up 6%-8% from an estimated 320 Bcm in 2020, data from its unit Institute of Economic Research showed.

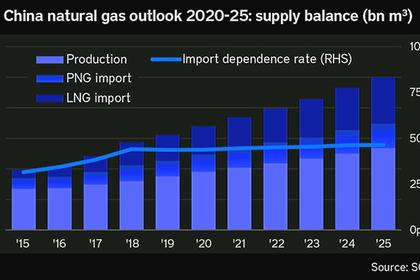

China's average annual increase in natural gas demand is expected to exceed 20 Bcm in the 14th Five Year Plan (2021-2025) and reach 430 Bcm in 2025, which will be slower than the average annual growth of 11.1% seen during the 13th Five Year Plan, according to state-owned CNPC's think tank Economics & Technology Research Institute.

Firm demand trajectory

Strong demand from both residential and industrial users will incentivize more domestic gas production and imports in 2021.

China's domestic gas output is also on track to hit a record high, estimated to grow 7.3% in 2020, and by another 3% in 2021 to reach 200 Bcm, according to Platts Analytics LNG analyst Szehwei Yeo.

CNPC's ETRI expects China's gas output to reach 220-250 Bcm in 2025, up by 35-65 Bcm from 2020, implying an annual growth rate of around 3%-7%, Platts calculations showed.

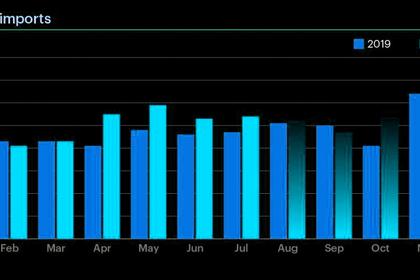

Meanwhile, Platts Analytics forecasts that China's natural gas imports including pipeline gas and LNG will reach 163 Bcm in 2021, up around 18% year on year.

Russian gas imports from the Power of Siberia pipeline have already started and will continue to ramp up this year, increasing pipeline imports further. Power of Siberia gas imports are expected to grow by 32% in 2021 compared to 2020 levels, according to Platts Analytics.

Gazprom is considering increasing gas deliveries via Power of Siberia by an additional 6 Bcm in 2021. It sent a total 3.84 Bcm of gas to China in the first year of operations of the pipeline.

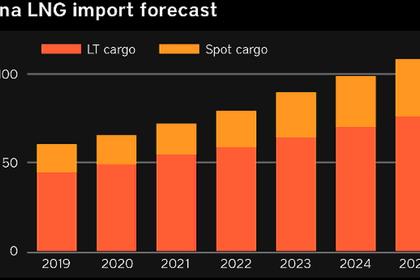

In addition, China is expected to launch five LNG terminal expansion projects and two new terminals in 2021, which will add 17 million mt/year of LNG receiving capacity and 3.16 Mcm of LNG storage capacity.

The expansion projects are PetroChina Tangshan Phase 3, ENN Zhoushan Phase 2, Sinopec Qingdao Phase 2, CNOOC Ningbo Phase 2 and PetroChina Rudong Phase 3, while the new terminals are Pinghu LNG and Wenzhou LNG.

China currently has 22 LNG terminals with a total receiving capacity of around 81 million/year, while its LNG storage capacity built either by state-owned or independent entities totaled around 6.3 Bcm, Platts Analytics data showed.

Total Chinese contracted LNG volumes in 2021 are estimated to reach 55 million mt, up 1.6% from 2020, Platts Analytics said.

CNPC's ETRI expects China's pipeline gas imports to reach around 100 Bcm by 2025, nearly double from the 2019 level, while LNG receiving capacity is expected to exceed 120 million mt/year, up 48% from current levels, making China the world's largest LNG importer.

Market reform promotes trading

Easier access to pipeline and LNG infrastructure, after state-owned PipeChina took over assets from the three state-owned oil and gas giants PetroChina, Sinopec and CNOOC, is expected to stimulate new demand for natural gas.

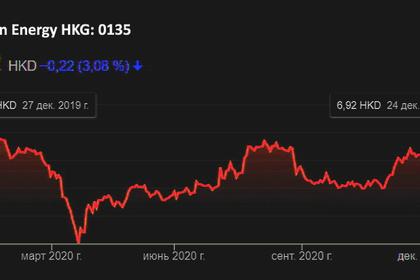

Local players like second-tier private buyers and newer companies have already gained access, with companies like JOVO, Foran Energy, Sinopec and PetroChina being awarded slots at PipeChina's terminals since November 2020.

Lower barriers to entry should result in increased price competitiveness and reduce the monopoly of the national oil companies in upstream and downstream businesses.

Furthermore, the emergence of the Shenzhen spot gas exchange in Southern China and new developments at the Shanghai Petroleum and Natural Gas Exchange in 2020 could facilitate the growth of trading hubs where natural gas products can be transacted.

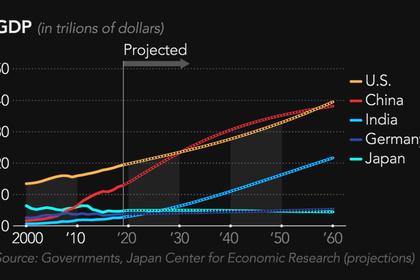

China's economic growth is expected to accelerate in 2021 on the back of successful suppression of the COVID-19 pandemic, industrial and manufacturing growth. The IMF forecasts China's GDP to grow by 8.2% in 2021, from 1.9% in 2020, outpacing global and Asian economic growth of 5.2% and 6.9%, respectively.

"We expect demand from coal-to-gas [switching] to continue to grow in 2021 as some gas pipeline projects, which are scheduled to complete construction by the end of 2020, will be put into operation in 2021 and inevitably add natural gas demand," an analyst with Sinopec Institute of Economic Research said.

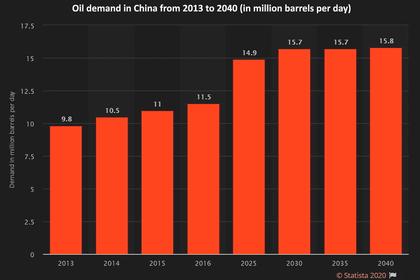

China aims to hit peak emissions before 2030 and carbon neutrality by 2060, which are expected to be the main driver for the longer term development of China's low carbon energy, including natural gas.

-----

Earlier: