EU GAS MARKETS ARE CHANGING

ENERGYPOST.EU - January 15, 2021 - The EU has sought to create a competitive and customer-centred internal energy market, aimed at producing affordable and fair prices for consumers. Continuing to apply these principles as the EU moves away from using fossil gas will be crucial for a successful energy transition. The EU is currently exploring the legislative changes that might be required to align gas market regulation with this transition – we consider this issue and explain why the implementation of effective competition is so important.

The European Commission is planning to issue new proposals for gas legislation in the last quarter of 2021. This package is a once in a decade market reform, which sits at the heart of the European Green Deal and has the potential to build a better future for citizens across Europe. Moreover, with gas consumption increasing in many countries such as China, successful delivery of a gas package by the EU can provide inspiration for a global transition away from fossil gas usage.

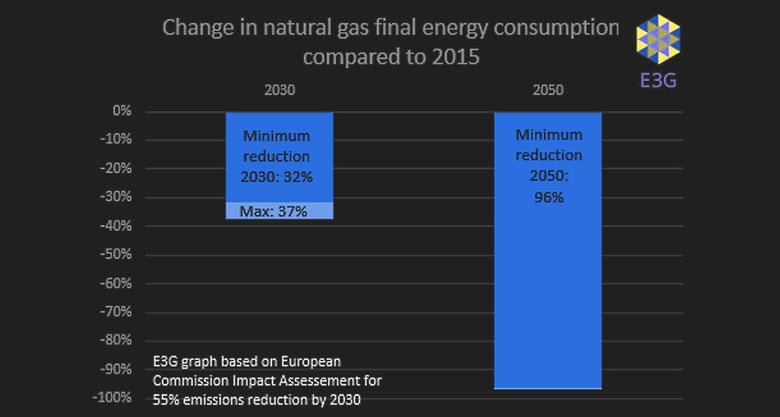

EU gas markets are on the cusp of dramatic changes. The European Commission’s impact assessment in support of a 55% emissions reduction target by 2030 suggested natural gas use would reduce by 32-37% of final energy consumption compared to 2015 and continue to plunge to negligible levels thereafter.

Urgent need of reform

EU gas markets and associated regulations are designed to support steady-state operations, not drive an industrial transformation. A ‘gas package’ of measures, embracing the Renewable Energy Directive, taxation issues and hydrogen regulations, is urgently required to align gas market regulation with the delivery of the European Green Deal and a fast, cost-effective transition away from fossil fuels.

It is important that this package ensures all consumers have fair and equitable access to the products and services that will replace those currently dependent on fossil gas. The EU has some important choices to make about the future of its energy system. These choices will have big social ramifications.

The EU Gas Package

Some have suggested that an EU ‘gas package’ should replicate for gas what the clean energy for all European package did for electricity. Whilst the focus on ensuring people are the beneficiaries of legislative change is the same, this is where the similarity ends.

Electricity is a growth sector – legislation was needed to ensure the market could cope with rapidly growing demand and changes in the way electricity was produced. The key challenge was to open the market to new sources of competition, from small, distributed generation and active engagement of consumers.

It’s not like Electricity

Gas is different – it is a shrinking market. The challenge is to ensure that the services it currently provides are open to competition from zero carbon emissions products. This must lead to the necessary decline in fossil gas usage to achieve a net-zero Europe. The decline must also be managed in a socially sustainable way.

The focus of gas market design should no longer just be about creating gas-on-gas competition. Rather, it should enable fair competition for services currently offered by fossil gas, such as heat or energy system balancing, to be replaced through smart electrification, more efficient usage, and other gases like green hydrogen (produced by electrolysis using renewable electricity) and biomethane (from sustainably produced biomass).

The ‘efficiency first’ principle, enshrined in EU legislation, is often overlooked, but prioritisation of energy efficiency will be an acid test of a successful gas package. Similarly, the role of digitalisation in supporting smart electrification will be critical to ensure energy consumers emerge from the transition better off, with superior products and services. Importantly, the transition must be just, leaving no citizen, community, region, or worker behind. The transition should also help eradicate energy poverty.

Three main issues

There will be three main issues to address in achieving a fair and green transition;

- Market access – Zero carbon products and services will need access to the highest value markets. Scarce and high value resources should not be constrained to low value markets where alternatives products and services exist. Green hydrogen, for example, may be the only credible route to decarbonising some products and services.

- Competition – Competition across the energy sector must be embedded in infrastructure planning decisions to allow consumers access to the best value products.

- Incentives – A careful balance must be struck between maintaining incentives for consumers to move away from fossil gas usage whilst avoiding high penalties for those unable or unwilling to do so.

Pit-falls include dependence on Hydrogen

One of the issues at the heart of the discussion about the future of the gas involves the role that hydrogen may play. However, a narrow focus on hydrogen will not address the issues described above. The EU must not be tempted to avoid complex issues and stick to good news stories about hydrogen, focusing only on setting high-level short-term targets and removing the current regulatory barriers to its use and transportation. This would fail to recognise the urgency of the challenge, slowing the transition and ultimately raising costs for consumers.

Alternatively, and equally damaging, would be to pre-determine the destiny of the EU gas system by deciding there will be a huge future role for hydrogen, regardless of the alternatives, and doing everything to promote production, demand, and transportation in a non-targeted manner. Many cities and regions are already planning the decarbonisation of their heating systems given local conditions. These are often based on electrification, efficiency, and decarbonising heat networks. Developing a large, but eventually underutilised hydrogen network would be damaging to innovation, increase costs for residential and industrial consumers and reduce speed of delivery.

The gas package must focus on creating a better future for EU citizens, and this requires that the difficult issues be tackled. The package is a long-term initiative and should be linked to education and cultural change programmes, recognising the potential of young people to act as the agents of change.

Solutions to the energy transition

The transition to climate neutrality should be a journey to improve the lives of citizens, not a step backwards. The solutions to the energy transition challenge lie in the long-held principles of the internal energy market: consumer choice should be maximised where possible.

A fit-for-purpose gas package should set out proposals for how effective competition will be established. Importantly, it should identify where this can be achieved through market mechanisms and where technically rigorous and independently administered processes are required.

There will inevitably be limits to the extent that consumer choice can drive the long-term infrastructure investments required. Furthermore, there is neither the time nor money available to keep all options open. Long-term investments in infrastructure are required to ensure fair and transparent competition between all zero emissions products that could replace fossil gas. This must create the electricity, hydrogen, and digital networks that open-up the best-value options for consumers.

We cannot rely purely on financial incentives to drive consumer choices since this will create a society of winners and losers. The biggest challenge and ultimate measure of success of the gas package will be the balance that is struck between regulations and standards to drive change and the associated consumer deal that ensures individual citizens will benefit.

-----

Earlier: